Gardena Will Study Proposal for City-Owned Liability Firm

- Share via

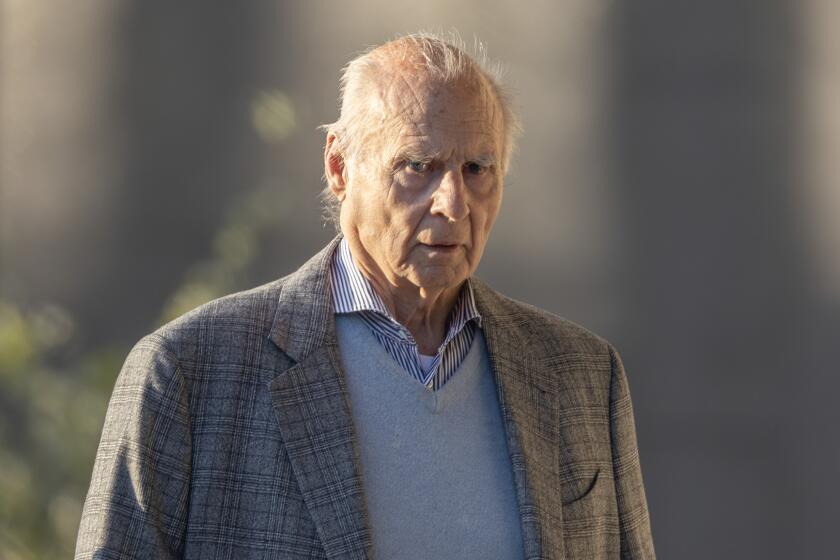

As chief deputy to Los Angeles County Supervisor Kenneth Hahn for the past 12 years, Mas Fukai says that he frequently has found himself on the front line in the supervisor’s long-running war against automobile insurance companies.

Over the years, Fukai, a Gardena city councilman, and Hahn together have assailed the insurance companies’ claim that redlining--the practice of basing insurance rates primarily on where a motorist lives rather than his driving record--is fair. Thus far, success has proved elusive.

Despite the defeats on the county level, Fukai says he now is determined to take on the companies on his home turf in Gardena. And this time, he says, the battle will center not on auto policies, but on homeowners’ and business insurance.

At Fukai’s urging, the Gardena City Council last week voted 4 to 1 to study the feasibility of establishing a nonprofit, city-owned insurance company that presumably would take on the giants of the insurance establishment.

City of Gardena Insurance Co. could offer lower-priced premiums and better service than private firms now offer to the community’s homeowners and merchants, Fukai said. And despite the giant hurdles, legal and otherwise, that city officials admit will have to be overcome before the company could be established, Fukai said he is confident it can be done.

“It’s an idea, but it will work,” Fukai said in an interview last week. “Believe me, it will work.”

One immediate challenge that Fukai, who frequently takes public potshots at insurance companies, must overcome is opposition from Councilwoman Gwen Duffy, who cast the dissenting vote on exploring the issue at last week’s council meeting. Duffy expressed concern that city officials might spend a lot of time and effort on the plan only to find out what she says everyone should have known all along--that such an undertaking would simply be too risky to undertake.

Moreover, the councilwoman, who generally believes government should not interfere with free enterprise, said she fears that the city could find itself entering into a venture better left to others. “I am concerned about crossing the line (into) the private sector, which has the experience in this area,” Duffy said.

Fukai, a four-term councilman, said he decided to push for the plan after he saw what the city was being charged for liability insurance, and came to the conclusion that Gardena was being “gouged.” The city paid $45,000 for $10 million in liability insurance in 1984, and now pays $320,000 for $2 million in coverage.

Additionally, Fukai says his displeasure with insurance companies in Gardena extends to automobile policies. He contends that Gardena drivers, like Hahn’s constituents in South-Central Los Angeles, are victims of redlining, unfairly paying more for automobile insurance than drivers in neighboring communities such as Torrance.

(Recent figures released by the California Insurance Department indicate that Gardena drivers often pay more for a policy with the same company than their counterparts in Torrance and many other South Bay cities. The department cautions that many variables, including the driver’s age and the type of coverage contained in a policy, affect the rates.)

The councilman, along with other city officials, admits that Gardena is entering waters that heretofore have gone largely uncharted. The effort also follows less ambitious efforts by other cities, including Huntington Beach, which have studied proposals to offer some sort of municipal-type insurance to residents, only to later scrap the proposals in the face of adversity.

Victor Slevin, the West Coast spokesman for the American Insurance Assn., a Washington-based trade group, said that he is unaware of any city in California that has been successful in offering homeowner insurance to residents. One reason, he said, is that prices for homeowner policies have not risen as fast or as much as for other types of insurance.

“I would guess the city of Gardena would have a hard time meeting the competition” from insurance companies, Slevin said, adding that “in most cases, there hasn’t been a hue and cry” from the public.

Slevin also noted that companies that have considered setting up such programs typically have “gone about asking for help from a brokerage house or someone familiar with insurance” to assist them. And such a company, if formed, could pose a problem for the city because of the huge liability it would have to assume if a major catastrophe struck, he said.

That view is shared by Richard Roth, assistant commissioner for the state Insurance Department. “If they had a huge fire and the lawsuits piled up, the municipality would be liable,” Roth said. “Say a brush fire swept through Gardena like there was in Baldwin Hills. It would be catastrophic.”

(In the disastrous Baldwin Hills fire in July, 1985. three people were killed, 48 homes were destroyed and 18 others were damaged.)

The biggest stumbling block to Gardena’s effort to establish its own insurance company, however, may be the state insurance code, Roth said. The code has been interpreted by the department to forbid public entities inside or outside the state from being insurers.

But Gardena officials say they disagree with the department’s interpretation of the code. City Atty. Michael Karger said that while the code specifically forbids out-of-state public entities from becoming insurers, it does not refer to in-state public entities.

Gardena officials say that the city’s own insurance company might be formed through the sale of tax-exempt or taxable bonds, a move that would not endanger the city’s general fund. The bonds would be backed by premiums paid by policy holders.

At the same time, the city would purchase additional insurance to cover itself in case of a catastrophe, the officials said. The two moves would enable the city to meet state requirements that require insurance carriers to have sufficient capitalization to cover claims.

The same officials say that another state requirement that requires insurers to demonstrate that they possess sufficient expertise in the insurance field could be met by having the city hire several insurance professionals and by allowing private brokers to sell the policies.

Fukai predicts that public opinion within Gardena “will come alive” on the issue. And whatever the eventual outcome, the city could benefit, he said.

“Right now there is talk within the insurance industry, ‘Look out, Gardena is trying to do something,’ ” Fukai said at the council meeting last week. “And I think just (because of) that we could get some results from all the big insurance companies.”

Times correspondent Kathee Yamamoto also contributed to this story.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.