Mortgage Broker Gets 20 Years in Fraud Case

- Share via

In one of the stiffest sentences handed down to a white-collar criminal in Southern California, a former Orange County mortgage broker was sentenced Monday to 20 years in prison on federal racketeering and extortion charges.

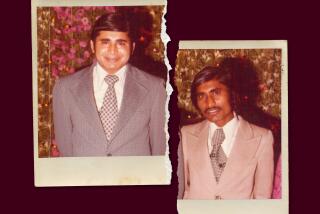

John Fred Parrish of Anaheim, described by one investigator as an “articulate swindler” with a down-home demeanor, was also ordered to pay $4.4 million to those he defrauded and fined $10,000.

U.S. District Judge Terry J. Hatter Jr. said he wanted Parrish’s sentence to send a message that while white-collar offenses “are not crimes of violence, there are victims (just) as tragically affected.”

Hatter also ordered Parrish to pay $4.4 million to two pension funds, a savings and loan and a physician taken in by Parrish’s loan fraud schemes.

Parrish, 55, was president and chairman of Barclays Mortgage Corp. in Irvine, which has no connection to London-based Barclays Bank.

“I apologize to the court and the government and to all those who have been harmed,” the tall, gray-haired Parrish told Hatter before the sentence was imposed. “I have made some stupid mistakes.”

Visibly shaken, Parrish declined to comment after the sentencing hearing. He pleaded guilty to the charges in January, but his sentencing had been delayed several times.

Parrish was indicted by a federal grand jury in December, 1986, on mail fraud and racketeering charges stemming from the alleged issuance of about $11 million of phony mortgage bonds. The indictment also charged Parrish with defrauding an Alhambra savings and loan out of $5.7 million and bilking a Studio City-based pension fund out of $5 million.

In February, 1986, Parrish was indicted on extortion charges for allegedly hiring a man to threaten a Laguna Niguel businessman who owed him $500,000.

Sentence Called Excessive

Hatter sentenced Parrish to two years on the extortion charges, but said the sentence could be served concurrently with the 20-year racketeering sentence. He also ordered Parrish to pay a $10,000 fine on the extortion charges. Additionally, Parrish faces $28 million to $35 million in court-ordered judgments stemming from civil lawsuits, Hatter said.

The judge dismissed two mail fraud counts.

Hatter ordered Parrish to surrender to federal authorities on Jan. 4. Marc B. Geller, Parrish’s attorney, said he thought the sentence was excessive because it was twice as long as the one recommended by both the U.S. Attorney’s office and the federal pretrial services unit.

Geller said he was surprised at its severity since Parrish has been providing information about his activities to numerous state and federal agencies, including the FBI and the Federal Savings and Loan Insurance Corp., which insures the nation’s savings and loans.

“I’m really pleased,” said Guy Ormes, an Orange County deputy district attorney who served as an assistant U.S. attorney in the Parrish case. “I think it’s a very just sentence.”

Ormes said he believed that the sentence was one of the longest imposed in a white-collar crime case. In August, 1986, another Orange County businessman, Victor Bagha, was sentenced to 18 years in federal prison on bank fraud charges.

At their peak in 1985, Parrish’s insurance and mortgage companies employed 120 people to manage millions of dollars of real estate development deals around the country.

In 1985, Barclays claimed to have a net worth of $16 million and a network of 60 affiliated companies “managed and staffed by top professionals in their fields,” according to a promotional brochure filed in court.

When Barclays Mortgage filed for federal bankruptcy protection in March, 1986, it listed $70 million in assets and $70 million in liabilities.

“Parrish is representative of a number of Orange County individuals who took advantage of the real estate market and the deregulation of the savings and loan industry,” said Assistant U.S. Atty. Terree A. Bowers, chief of the U.S. Attorney’s white-collar crime unit, in a previous interview.

“To my knowledge, this is the first time in the history of this office that a white-collar defendant agreed to plead guilty to a racketeering charge before he was even charged,” Bowers said in that interview.

He was out of town Monday.

In an earlier interview two months ago, Parrish acknowledged that his business career was all but finished.

“I’m doing some consulting work for people, but I’m basically retired--involuntarily,” Parrish said. “It isn’t pleasant not knowing (what will happen), but I just take it one day at a time.”

One state investigator said he has spent years untangling a web of Parrish business deals, focusing on the two transactions that prompted the federal charges.

“He seems to be a down-home country boy when, in fact, he is an articulate swindler,” said Whit Murray, a special agent for the California Attorney General’s special prosecution unit in San Diego.

“He is very intelligent,” Murray said.

“He knows the insurance business and has a substantial law library in his home.”

A sentencing memo filed by Parrish’s attorney in federal court paints a colorful picture of the man who graduated from Cedar Grove High School in Dublin, Ga., in 1948.

“My family was dirt poor,” Parrish wrote in the memo. “We grew what we ate and dad’s chronic illness drained what little resources we had.”

A native of Dublin, Parrish worked 15 years for the Georgia International Finance Co. and later served as vice president of operations for United Family Life Insurance Co. in Atlanta. He moved to Huntington Beach in 1980 and started Barclays Mortgage in 1982.

Parrish, who frequently officiated at high school football and basketball games in Georgia, has six grown children, including a daughter who lives in Costa Mesa.

He married his second and current wife, Phyllis Atkinson, in 1971. In the sentencing memo, she described her husband as a “workaholic” but added that his “kids are very important to him.”

“He’s the type who will bring a stray cat in from the rain,” wrote Mrs. Parrish. “Sometimes he’s too nice. People take advantage of that. Mark Wood sure did.”

Wood, of Laguna Niguel, was target of Parrish’s extortion attempt. Wood was president of Meadow Valley Corp., a Nevada development company that filed for bankruptcy in January, 1986. Wood owed Parrish $500,000. In 1985, Parrish allegedly hired a thug to pressure Wood into repaying the debt, plus $100,000.

FBI Taped Calls

A man told Wood that he “could be found on the side of the road in a sack” and that Wood’s wife might turn up missing if the money was not repaid immediately, according to an indictment filed in February, 1986.

After he began receiving the threatening phone calls, Wood contacted the FBI, which taped several calls. Wood later filed his own $10-million lawsuit against Parrish, claiming emotional distress.

In January, Parrish pleaded guilty to mail fraud involving the defrauding of Progressive Savings & Loan of nearly $6 million. Progressive was one of the purchasers of about $9.4 million worth of mortgage bonds that Barclays sold to develop 40 acres of Laguna Beach property. However, the project, Canyon Acres Ltd., was never built.

In court, Parrish admitted that he failed to inform the bank that the land was virtually unbuildable and that “development would require construction of a private water system.”

“I gave the false impression that Canyon Acres Ltd. was an independent and separate entity, not associated with Barclays or myself,” Parrish told Judge Hatter.

“In fact, Canyon Acres Ltd. was comprised of Barclays Mortgage as general partner and myself as a limited partner.”

The second mail fraud count involved the Motion Picture Industry Pension Plan. In August, 1984, Parrish solicited the pension plan to invest $5 million in a $25 million offering of mortgage guarantee bonds. The pension plan’s investment was backed up by 11 deeds of trust for various pieces of property, Parrish said in court.

After making one interest payment on the pension fund’s investment Barclays defaulted on the rest of the notes, court records showed.

Didn’t Receive Payment

The Studio City-based fund, which represents 36,000 employees in the entertainment industry, won civil judgments totaling approximately $27 million against Barclays in federal court, according to James vs. Selna, the fund’s Newport Beach attorney.

Despite all the judgments won against Parrish, “we haven’t got a dime,” Selna said in a previous interview.

He said the pension fund is moving to foreclose on some of the property securing the notes offered by Parrish.

“He was cordial and gracious,” Selna said. “There were no signs to suggest, just looking at him, that he was a crook.” Selna said he met with Parrish in Barclays’ comfortable, two-story office building in Irvine. “There was nothing really to tip you off that this was a giant scam.”

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.