Man Indicted in $7-Million Scam Allegedly Had Defense Mapped Out

- Share via

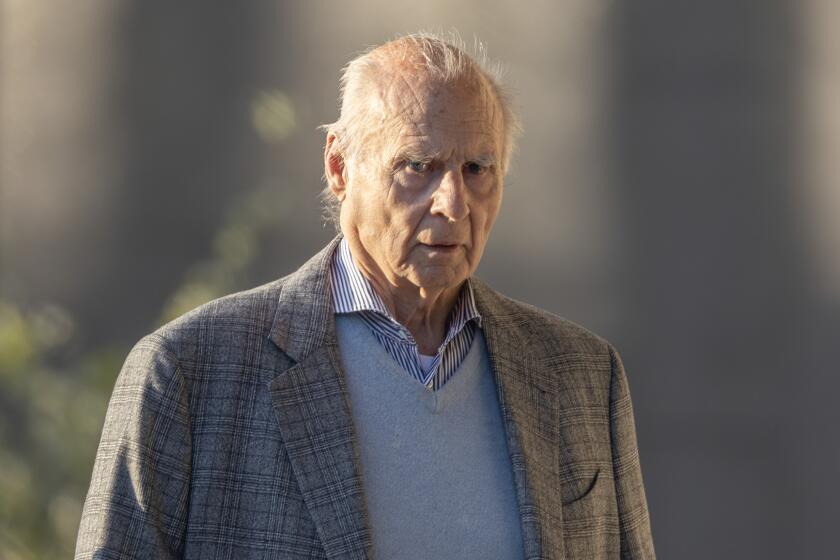

A San Clemente man has been accused of taking a total of $7 million from hundreds of investors in a precious-metals swindle and using the proceeds to buy a boat, a Cadillac and two Porsches and to plan a legal defense before he was even charged with a crime.

A federal indictment disclosed Monday charged Michael L. Maddox, 40, president of the now defunct Goldex International Inc., with 22 counts of mail and wire fraud.

Maddox, working from offices on Pacific Coast Highway in Seal Beach and in Long Beach, used a sales staff he schooled in high-pressure tactics to focus on unsophisticated investors in 1982-83, according to the indictment returned in U.S. District Court in Los Angeles.

Maddox was hospitalized Sunday for what authorities said was a suspected ulcer. He was arraigned in Hoag Memorial Hospital in Newport Beach.

Maddox could not be reached for comment.

Client Beaten

Assistant U.S. Atty. Terree A. Bowers said his office is seeking to have Maddox held without bail because he poses a danger to the public.

The indictment, dated March 1, charges Maddox with ordering an unhappy client, identified as Melvin Bailey, “to be severely beaten” to prevent him from complaining to authorities.

Bowers said another victim told FBI agents that when he talked to Maddox at his Seal Beach office he was with a bodyguard and “had a shotgun leaning against the desk and another handgun on top.”

Maddox lives in a $400,000 home in San Clemente and maintains a large gun collection, according to Kacy R. McClelland, a federal postal inspector assigned to the case.

McClelland said there were about 2,000 Goldex customers in all, and about 500 are suspected of having been defrauded.

Customers allegedly were induced to transfer cash and valuables to Goldex, which claimed to invest in silver and gold bullion and coins, platinum, gems and foreign currencies.

Maddox created a paper world in which investors regularly received detailed “transaction statements” and monthly account summaries, according to the indictment. In fact, the grand jury charged, Maddox kept only two accounts: “a private, speculative account used for his own benefit,” and a second to support the first.

FBI agents first raided Goldex in March, 1983. The firm closed its doors a short time later, Bowers said.

Goldex business was built in part on an extensive advertising campaign warning readers that precious metals are “the only available protection you have against the onslaught of inflation,” the indictment said.

Maddox indicated his staff was highly trained, but in fact employees had no special knowledge and often would sell directly from written sales pitches he provided, according to the indictment.

Goldex was a typical boiler-room operation, in which numerous high-pressure calls were made to prospective clients, prosecutors say. When customers attempted to withdraw funds or close accounts, Maddox and his employees would delay with excuses ranging from difficulties in getting money transferred from the East Coast to a claim that the firm had been burglarized, snarling records, according to the indictment.

Goldex filed for bankruptcy April 15, 1983, a move Maddox allegedly used as a ploy to ward off clients seeking to withdraw funds or close accounts, according to the indictment.

The indictment was returned shortly before the legal time limit for filing criminal charges ran out, McClelland said. Federal law allows prosecutors five years to file mail and wire fraud charges.

The approaching deadline--April 1--was well known to Maddox, McClelland said.

When he was taken into custody, he told the FBI that he had “a special bottle of champagne” that he had planned to open if no charges were filed by April 1, McClelland said.

Before Goldex, Maddox was a partner of Keith Grimes in a precious metals business called Grimes/Maddox Rare Coin Co., based in Long Beach. Grimes is serving a 12-year prison sentence stemming from fraudulent operations, but Maddox was not charged, according to McClelland.

Under scrutiny this week are Maddox’s current businesses, Sentry Financial Network Inc. and Sentry Funding Group Inc., investment firms specializing in retirement plans, Bowers said.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.