Reorganization Jeopardized : Judge Finds Flaw in Care’s Hearing Notice

- Share via

Care Enterprises Inc.’s effort to design its own plan to emerge from bankruptcy was stalled Thursday when a judge ruled that the company had failed to notify creditors properly of a hearing to air complaints about the reorganization.

The ruling in U.S. Bankruptcy Court in Los Angeles, while procedural, could affect the ultimate outcome for the Tustin firm’s reorganization because creditors are preparing an alternative plan to restructure Care, one of the nation’s largest nursing home chains.

With a $180.4-million debt, Care filed a petition in March to reorganize its debts under Chapter 11 of the federal bankruptcy laws. In the last 5 months, it has sold 10 facilities or leases to raise cash and now has 94 nursing homes.

A month ago, it filed a reorganization plan that calls for the sale of 25 more facilities and for repayment of all creditors by 1995.

‘Speculative Objections’

A committee of Care’s unsecured creditors, along with other creditors, filed court papers objecting to Care’s reorganization, to the disclosure statement that explains the plan and to the notice that the company gave about Thursday’s hearing in Los Angeles.

The committee claims that the reorganization plan is “an elaborate set of speculative projections about dramatically improved future earnings” with no data to support them.

But Bankruptcy Court Judge Arthur M. Greenwald did not allow the several dozen lawyers at Thursday’s hearing to discuss the merits of the plan.

He decided that Care had not done enough to notify all creditors and bondholders about the hearing, so he postponed the hearing until Jan. 12 and ordered the firm to go through the notice procedures again.

The court had given Care’s management the exclusive right to get its reorganization plan approved by Jan. 4. If it isn’t approved by then, creditors or other interested parties can propose competing reorganization plans. Such plans could call for the ouster of current management, led by twins Lee and Dee Bangerter.

Dragging Out Procedures

Care attorney Irving Sulmeyer said creditors and bondholders were dragging out court procedures with needless objections so the deadline would pass before Care’s plan could be approved.

The creditors committee does intend to prepare a reorganization plan of its own, Perry L. Landsberg, one of the committee’s attorneys, said after the hearing.

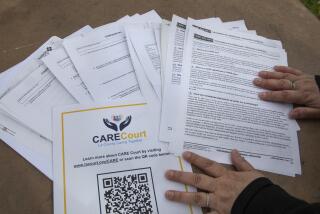

As part of the process to win court approval of the reorganization plan, Care had to explain the plan in a disclosure statement and notify creditors that it was seeking court approval of that statement at Thursday’s hearing.

The disclosure statement is crucial, Landsberg said, because most of the creditors who must vote on whether to accept the plan will base their decision on what they read in the statement.

Most will never even get copies of the plan itself to review, he said.

Disclosure Found Inadequate

The creditors committee also found the disclosure statement inadequate, citing many failures to back up projections, explain inconsistencies and include vital facts, such as why bylaws have been changed to hinder two-thirds of Care’s shareholders from making such decisions as changing board members.

The disclosure statement reflects the failure of the plan itself, the committee said in court documents.

“Because the debtors’ plan leaves no margin for error in any item of projected revenue, cost reductions or debt service, the importance of every assumption underlying the plan is greatly magnified,” the documents stated.

“The failure of any one assumption dooms the plan, making the adequacy of the information contained in the disclosure statement all the more critical.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.