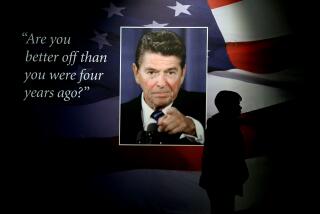

Reagan Leaves Pure Greed Riding High in the Saddle

- Share via

As President Reagan rides off into the California sunset, he can be proud that in many respects the Republic is in better shape than when he took office eight years ago. There is one thing on his record, however, that should cause him personal pain and regret. That is the enshrinement, with his amiable toleration, of greed and sleaze as operating norms in the American business and financial communities.

Surprisingly, given his lack of relevant background or personal interest, Reagan’s greatest successes came in foreign affairs. Critics can argue that Reagan was the lucky beneficiary of a Soviet economic crisis that finally drove the Kremlin to adopt a more accommodating, less threatening posture toward the West.

Even if that is true, the deal-from-strength President deserves credit for having the wisdom and flexibility to take advantage of the historic opportunity, when it came, to put U.S.-Soviet relations on a new, more constructive path.

Unfortunately, the President never appreciated the contradiction between his determination to make America more militarily secure and his insensitivity to the moral decay that is corroding the foundations of the U.S. economic system.

Reagan’s personal honesty has not been seriously questioned. But he proved remarkably relaxed about the transgressions of some subordinates--and many, many businessmen.

The President came into office with an abiding faith in the workings of free markets and a conviction that the best thing government could do was get out of the way and let business do its thing.

No doubt federal regulation had gone too far in some areas; a certain correction was called for in the interest of consumers and a more competitive economy. But regulation of banks and other financial institutions came about in the first place because of the irresponsible, anti-public behavior of the wheelers and dealers of yesteryear. The same is true of antitrust laws.

Common sense tells you that, to the degree that federal regulation was removed, there was a need for self-restraint in corporate board rooms. That restraint has not been forthcoming. Pure greed, unattached to any visible social benefit, is increasingly the name of the game.

One obvious example is the fraud in defense contracting. But a more glaring example is the savings-and-loan industry, which responded to a loosening of regulatory laws and controls by going on a reckless binge of speculative lending and outright corruption. Federal officials say that of the hundreds of S&L; insolvencies, 75% involved fraud or criminal conduct. The American taxpayer is going to be stuck with the bill--up to $70 billion or more--for this particular exercise in deregulation.

Then there are leveraged buyouts, or LBOs. Mergers, including hostile takeovers, can result in stronger, more productive companies. But in most of today’s takeovers the main idea is not to improve the acquired firms but to loot them. American capitalism is threatened with major harm as a result.

Typically the raiding group puts up little money of its own. The takeover is financed by great amounts of borrowing, including the issuance of junk bonds. To cope with repayment, the acquired corporations often raid employee pension funds, slash the work force, cut investment in research and new product development, and sell off whole divisions or subsidiaries--frequently to foreign buyers.

Greed-driven LBOs hurt the American economy in all sorts of ways. But the most debilitating effect is the obsession with short-term profits at the expense of long-term competitiveness--not only in companies that have been acquired but in firms that fear they will be.

The best business brains in Europe and Japan are dedicated to doing whatever it takes to conquer world markets--including ours. Too many American managers spend their time scheming to get rich, then richer still, through financial manipulations that do nothing to enhance U.S. economic strength and a great deal to damage it.

If that situation continues, U.S. living standards will erode and America will soon be unable to afford the military strength that Reagan rightly considers essential to peace and security.

A lot of factors, including warped tax codes and a value-deficient system of business education, are involved.

But Reagan, with his gift for communicating with the American people, could have made a difference. He could have used the power of the presidency as a “bully pulpit” to sound the alarm--to make sleazy business behavior socially unacceptable and to energize the watchdog agencies of the federal government.

Unfortunately, the President didn’t do that. He just looked the other way and, by doing so, became an accomplice.

George Bush’s economic team is making some encouraging noises that suggest a desire to deal with the destructive emphasis of American business on short-term profits. Whether the new President will also confront the moral degeneration in the business community remains to be seen.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox twice per week.

You may occasionally receive promotional content from the Los Angeles Times.