THE ULTRA RICHHow Much Is Too Much?...

- Share via

THE ULTRA RICH

How Much Is Too Much? by Vance Packard (Little, Brown: $22.95)

While America was founded on the principle that “all men are created equal,” differences in achievement in our country have become too dramatic merely to be explained by varying ability, enterprise and persistence. According to Financial World magazine, the top five moneymakers in the financial community in 1986 made 6,542 times the salary of the average full-time American worker, $13,451 compared to $88 million. We’ve been slow to mitigate these inequities through government legislation because we have faith that free enterprise remains the most successful method of stimulating economic growth, but in this timely book, author Vance Packard (“The Hidden Persuaders”) convincingly argues that free enterprise does not “require a reward system that creates and sustains increasingly grotesque accumulations of family wealth.”

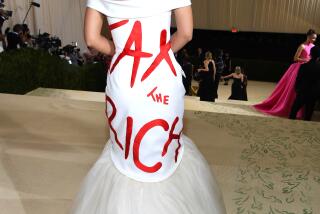

Packard begins “The Ultra Rich” by illustrating how rapidly the gap between rich and poor is widening: The wealth of the 400 wealthiest individuals cited by Forbes, for instance, now equals the savings that all Americans have in commercial banks. He concludes by suggesting reforms that are not new but not outmoded either: Tax net worth when a person’s salary becomes more than 100 times than that of the U.S. President; limit the amount wealth-holders can transfer to individuals to $25 million; create tax loopholes for those who wish to invest large sums in the government for “socially useful economic activity.”

Packard’s reforms are unlikely to stir serious debate in Washington, however, for rather than using his middle chapters to build an argument for his reforms, he devotes most of these pages to voyeuristic profiles of extremely rich people that are seldom surprising. Real estate mogul Sarah Korein’s “secret”: “I always look for good location and good quality building.” Packard is trying to play to reader interest, of course, but in so doing he sells short what could have been his own best appeal to the public interest.

More to Read

Sign up for our Book Club newsletter

Get the latest news, events and more from the Los Angeles Times Book Club, and help us get L.A. reading and talking.

You may occasionally receive promotional content from the Los Angeles Times.