Qintex Chairman Not Planning Any Major Changes at MGM/UA

- Share via

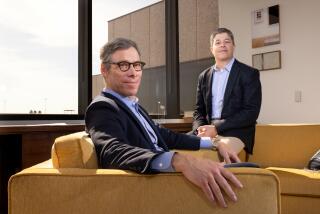

Christopher Skase, the 40-year-old Aussie who is buying MGM/UA Communications for $1 billion, said Friday that his path for resurrecting 70-year-old United Artists as a movie maker calls for “evolution, not revolution.”

UA, founded by Charlie Chaplin, Mary Pickford, Douglas Fairbanks and D. W. Griffith, has been dormant as a producer since MGM/UA folded its two production units into a single operation last fall. During the latter half of 1988, the studio was marked by wholesale departures of film-making talent assembled by Lee Rich, formerly MGM/UA’s chief executive.

Ironically, UA’s “Rain Man” went on to become the top national box-office hit and Academy Award winner.

Interest In Film Industry

Skase, in an interview at the Beverly Hills headquarters of his burgeoning U.S. entity, Qintex Entertainment, said he sees “no need for wholesale changes” in senior management or production chief Richard Berger’s team now at MGM/UA. Smiling, he said he’d settle for more “Rain Man” pictures.

After noting that “what we’re looking to do” is only about 15 films a year, the Qintex chairman paused and added that the 15 will represent a combination of UA-produced films and others to be made by a new MGM (controlled by financier Kirk Kerkorian).

His comment pointed up the fact--likely to be of continuing interest in the film industry--that Kerkorian, 71, who presently owns 82% of MGM/UA, will be Skase’s business associate under the new setup.

For one thing, Kerkorian has pledged to invest $75 million in Skase’s holding company, Qintex Group. Skase and his aides said the details of the investment--including whether it might be equity, debt or a combination--have not yet been determined.

Also, UA will distribute all new MGM movies, as well as those in the 34-title, post-1986 MGM library under a 35-year pact. That library, the MGM name and the MGM/UA television production unit are MGM/UA assets that Kerkorian is buying back from Qintex for $250 million.

Shows No Qualms

Kerkorian is renowned for his deal-making prowess and knack of selling off and replacing publicly traded parts of his movie-casino-airline empire. He is widely considered to have come out on top when he sold MGM in 1986 to Atlanta cable TV entrepreneur Ted Turner, who had to take on a mountain of debt and sell off all of the studio’s assets except its film library.

Skase acknowledged press reports about Kerkorian’s deal-making prowess but showed no qualms about his own deal with Kerkorian.

Commenting that MCA President Sidney Jay Sheinberg called it “a good deal for both parties,” Skase said: “We believe we have paid a fair economic price.” Skase, while skirting details of Kerkorian’s role in the negotiations that led to the deal, said the Los Angeles financier took a personal role at different times--”primarily to deal with the major issues.”

It was only a year ago, he said, that his group discussed various options for “going from the junior league to the main league” in U.S. entertainment. One by one, various possibilities had been eliminated for “a variety of financial reasons.”

Although talks with MGM/UA began last October, Skase said, it was not until he was in the Los Angeles area on vacation at Easter that he became aware that “the matter was going to be crystallized in (Kerkorian’s) mind.” Skase said his own senior aides, including Qintex Entertainment Chief Executive David Evans, were away, so “I was on deck alone” for the accelerated talks.

By the end of that week, the definitive agreement was signed and announced.

‘Significant’ Debt Burden

Skase insists that he sees no problem in financing the MGM/UA deal with a combination of $600 million in cash and borrowings. He shrugged off the fact that Standard & Poor’s announced this week that it may lower its credit ratings on MGM/UA’s $400 million of subordinated debt in high-yield “junk bonds” and Qintex Entertainment’s own senior secured debt.

S&P; noted that debt service requirements of the combined entities will be “significant,” especially with needs to fund film production. It also said “disruptive effects of recent reorganizations may portend gaps in the film release schedule over the next 12-18 months.”

Skase said the debt rating services were “obviously at a disadvantage” at not knowing the capital structure of the new company because it is not yet finalized. Once the structure is made public, he said, the proposed inclusion of “a minimum of $300 million” in new equity will “satisfy every analyst” that both the short- and long-range financial structures are “sound and prudent.”

The Australian said he wants UA to “take bold, well-researched risks” in providing high-quality family entertainment with international appeal, best reflected in the recent hit miniseries “Lonesome Dove,” which Qintex co-produced with Motown.

He said Qintex is acquiring strong assets in the 4,000-title UA library, its “very, very strong domestic and international (film) distribution,” its video business and its licensing and merchandising business, “so the basic ingredients are there.”

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.