Coelho Action Puts Spotlight on Spiegel Role

- Share via

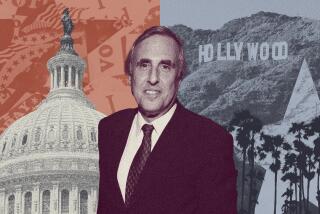

The startling news that House Majority Whip Tony Coelho plans to quit Congress rather than face a House probe into his personal finances has put a spotlight on the business and political activities of Thomas and Abraham Spiegel, majority owners of Columbia Savings & Loan in Beverly Hills.

Thomas Spiegel, Columbia’s chief executive, played a key role in Coelho’s downfall by advising the Democratic congressman from Merced to buy a $100,000 “junk bond” in 1986, financed in part by a $50,000 loan from Columbia Savings. Coelho got into trouble when he failed to disclose the $50,000 loan as required by law.

That Spiegel would assume the role of financial adviser to Coelho, the House’s third-ranking Democrat, was improper and unwise, some thrift industry insiders believe. As an executive in an industry closely regulated by Congress, they argue, Spiegel should not tell lawmakers where to invest their money.

“I’m really angry about this one,” one savings and loan industry veteran said privately on Saturday. “He should have known better.”

Although Spiegel declined to discuss his political activities, he did issue a statement Saturday reiterating that he did nothing improper in recommending the bond purchase to Coelho. He has said previously that he offered the advice during a chance phone call from Coelho at a time when Spiegel thought the bonds would make an excellent investment.

‘Surprised and Saddened’

Saying he was “surprised and saddened” by Coelho’s resignation, Spiegel added that “there was nothing inappropriate that took place between Tony Coelho and myself.” He declined further comment.

After recommending the investment, Spiegel purchased the bond for Coelho, who had not yet arranged financing for the deal. Two months later, Spiegel sold the bond to Coelho at the initial purchase price plus accrued interest despite the bond having appreciated substantially in market value.

Spiegel has raised his political profile sharply in recent years, hosting cocktail parties and fund-raisers for lawmakers such as Sen. Donald W. Riegle Jr. (D-Mich.), now chairman of the Senate Banking Committee, and Sen. Howard M. Metzenbaum (D-Ohio), industry sources said.

Those who know Spiegel believe that he was seeking blue-chip political connections in order to protect Columbia Savings’ own controversial investments in high-risk, high-yield junk bonds, which now total about $4 billion.

Hosts Gala Affair

One particularly gala affair was a cocktail party and fund-raiser held nearly two years ago for Metzenbaum at Spiegel’s home in Beverly Hills. Among the guests were junk-bond guru Michael Milken and television reporter Barbara Walters, according to one person who attended the party.

Spiegel, 43, is the only son of Abraham Spiegel, a Nazi death-camp survivor who founded the savings and loan more than a decade ago but in recent years has handed over operation of the company to his son. The Spiegel family owns about two-thirds of Columbia’s stock.

How the Spiegel family came to own and operate Columbia Savings is a story that mixes personal tragedy with professional controversy. It also is a story of financial success in an industry that has been brought to its knees in recent years by horrific losses.

While the savings and loan industry in general suffered from endless problems, Columbia Savings profited enormously, in part by hitching its star to Milken, whose offices at Drexel Burnham Lambert Inc. were a few blocks away on Wilshire Boulevard.

‘Less Conventional S&L;’

Under Milken’s tutelage, Columbia Savings began amassing a junk-bond portfolio that now totals about 30% of its investments. “It was the relation with Tom and Milken that established a whole new horizon for Columbia,” said Gilbert Fuentes, Columbia Savings’ former treasurer. “It became a much less conventional S&L.;”

But Columbia Savings’ investments sparked cries of foul from industry traditionalists who feel that government-guaranteed deposits at a savings and loan should be invested in housing, not junk bonds. Even so, few would dispute that Spiegel runs his business well.

Today, though, the cloud that hangs over Milken, who was indicted on sweeping securities fraud charges in March, has spread to Columbia Savings and other major customers who regularly bought junk bonds underwritten by Drexel.

Federal investigators are looking into whether Columbia Savings was engaged in an illegal trading scheme with Drexel known as stock parking, which usually involves sham trades designed to hide the true ownership of the securities.

Starts Lucrative Career

The early history of Columbia Savings starts with Abe Spiegel, who came to California in the late 1940s by way of New York and Czechoslovakia to begin what turned out to be highly lucrative career in banking and real estate development.

One of nine children, Abe Spiegel was reared in a town now known as Mukachevo in the Soviet Union, where his father owned a lumber mill, according to Blanca Wintner, Abe’s sister. (Spiegel has been out of the country and unavailable for interviews).

Wintner said Abe and several relatives survived incarceration at Auschwitz on small scraps of bread and potatoes from the kitchen, where Abe worked. He and his family then emigrated to America in 1947 from Czechoslovakia, where Tom was born about a year after the war ended.

An iron-willed, impatient deal maker with little time for finesse or ambiguity, Abe Spiegel has amassed an empire in America that is now worth an estimated $300 million. His early years in California were spent building homes for veterans who swarmed into Orange County and the San Fernando Valley following World War II.

Close Friend of Bradley

Spiegel wields considerable political influence on behalf of the Los Angeles Jewish community. He is a close friend of Mayor Tom Bradley, and one of Bradley’s advisers, William Elkins, is on Columbia Savings’ board of directors.

Abe Spiegel has had major investments in three savings and loans, the first in 1958. That thrift was also known as Columbia Savings and was eventually merged into the banking operations of an insurance company. He bought Aetna Savings & Loan in 1965 and later sold it to a conglomerate that merged the operations into Brentwood Savings.

His final thrust came in 1974, when he bought control in Eastland Savings, a small thrift headquartered in East Los Angeles. In the ensuing years, the elder Spiegel moved the firm’s base of operations to Orange County and later to Beverly Hills. The name was changed to Columbia Savings in 1976.

Tom Spiegel entered the picture that same year, when he went to work for Columbia at age 30 following a year of law school and brief careers in securities trading and real estate development. He became president and chief executive of Columbia Savings in 1977.

Some Stormy Times

By some accounts, the relation between Tom and Abe Spiegel has been stormy at times, punctuated by loud arguments and sharp disagreements, but the two are said to be very close.

Although Tom has made most of the decisions at Columbia in the past five years, Abe has never faded away, even though he is now 82. “He has 82 years of experience, and it’s nice to have him around,” Tom Spiegel said about his father in a recent interview. After pausing, he added, “And he likes to be around.”

Tom’s passion at Columbia Savings is the company’s investment portfolio, which includes nearly $5 billion in corporate securities and $3.8 billion in mortgage-backed securities. Columbia’s assets total nearly $13 billion, making it one of the largest thrifts in the nation.

Under Tom Spiegel’s leadership, Columbia Savings ballooned in size as it invested heavily in junk bonds. He also has received annual compensation packages that have been the highest in the industry.

Ego and Wealth

A workaholic, Spiegel lives privately but elegantly, with personal use of Columbia’s corporate airplanes and a weekend home near Palm Springs. According to one former associate, Spiegel is fired to a large degree by ego and a desire for wealth.

“He’s got a tremendous ego,” the associate said. “He loves to go into restaurants and be recognized. He and his father are a lot alike in that way.”

He added, “Tom’s the kind of guy that if you congratulated him on making his first million dollars, he’d tell you he was already at work on the second million.”

Spiegel’s compensation at Columbia Savings peaked at nearly $9 million in 1985, an amount that drew the ire of banking regulators because it was so large. His pay package fell to $4.1 million in 1988.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox twice per week.

You may occasionally receive promotional content from the Los Angeles Times.