MCA Buys Out Last Major Independent Record Label : Entertainment: In a much anticipated deal, the giant conglomerate will get Geffen Records for stock worth $545 million.

- Share via

The music industry saw its last major independent record label absorbed into a giant media company when MCA Inc. said Wednesday that it had agreed to buy Geffen Records for MCA stock valued at about $545 million.

The acquisition of Geffen would continue the rapid consolidation of the multibillion-dollar music industry and follows MCA’s purchase of GRP Records earlier this month for about $40 million in MCA common stock. In recent years, MCA has revamped its once-flagging roster of musicians and built a strong black and country music presence with artists such as Bobby Brown, Fine Young Cannibals and Tom Petty.

Announcement of the deal capped a marathon negotiating session that began last weekend after West Hollywood-based Geffen decided not to renew its distribution pact with Time Warner Inc.’s record subsidiary and also spurned a reported $700-million cash offer from Thorn EMI, the British media conglomerate.

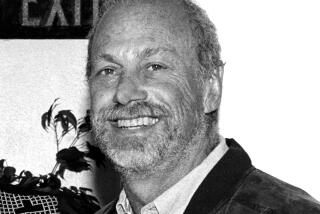

David Geffen, the 47-year-old founder and sole stockholder of Geffen Co., said “in my heart of hearts, I wanted to stay” with Warner Bros. Records Chairman Mo Ostin and Time Warner Co-Chairman Steven J. Ross. “Steve Ross always told me that at the end of the distribution agreement he would buy (Geffen Records). But (Time Warner) is $12 billion in debt. I finally decided I could not spend any more time in the ‘deal’ business; I had to get on with running my businesses.”

Wednesday’s deal calls for MCA to issue Geffen 1 million shares of a new convertible stock that pays a $6.80 annual dividend and can be converted into 10 million shares of MCA common stock worth about $545 million, based on Wednesday’s closing price of $54.50 for MCA shares. In exchange, MCA would get Geffen Records, whose artists include Guns N’ Roses, Don Henley, Aerosmith, Whitesnake and Cher, and its related Geffen Music publishing unit. Geffen Records has 143 employees and said Wednesday that it had sales of more than $225 million last year.

David Geffen would retain ownership of a 90,000-square-foot Geffen office building now under construction in Beverly Hills. He would also keep his Geffen Theatrical stage subsidiary as well as his Geffen Film unit, which he said may be made part of his deal with MCA at a later date. However, other industry sources said that Geffen is negotiating with Walt Disney Co. over his film division.

Disney declined to comment.

However, in an arrangement apparently aimed at limiting Geffen’s control over MCA, Geffen’s new MCA shares would be held under tightly restricted conditions.

Geffen could convert only a limited number of the shares each year for the next four years and only if he sells the shares--an option that Geffen said he does not plan to exercise. Geffen also agreed not to increase his MCA stake for 20 years.

“David Geffen may never own them,” MCA President Sidney J. Sheinberg said of the common shares that may eventually be issued. Sheinberg said there was no plan for Geffen to join the MCA board.

The long-rumored Geffen sale is considered a huge blow to Warner Music, the Time Warner subsidiary that for the last decade has distributed Geffen Records products both internationally and domestically and also distributes MCA Records in most foreign markets except Canada and Britain. Warner’s distribution agreement with Geffen expires Dec. 31, while MCA’s distribution accord with Warner runs out in March, 1991.

Geffen said the two distribution pacts represent about $150 million in business for Warner, which is said to be still regrouping financially following last year’s purchase of Warner Communications by Time Inc.

Geffen had developed a close relationship with Warner after he first merged, then managed, the Elektra and Asylum labels for the company. Warner had owned 50% of Geffen, but Geffen acquired the remainder of the company in the mid-1980s.

Although the expiring distribution agreement with Warner had put Geffen under pressure to reach an accord on the future of his company, industry observers say he shrewdly orchestrated suitors into a bidding frenzy. Geffen said he settled for less than Thorn EMI’s $700 million in cash because of the adverse tax consequences of such a deal. He said a stock swap would insulate him from immediately paying taxes.

Yet although many industry observers praised Geffen’s negotiating savvy, some were less impressed by the financial soundness of the deal.

“I don’t know how the hell MCA is going to recoup its investment,” said one official at Warner/Chappell Music, one of the largest music publishing companies in the world. “That (sales) multiple seems mighty high to me. Even if David doubles the size of the company . . . I don’t see where it makes sense.”

Some big MCA shareholders agree that the acquisition was overpriced.

“I think most large holders, including ourselves, are not very happy with it,” said one major investor who declined to be identified.

Wall Street also reacted negatively. In trading Wednesday on the New York Stock Exchange, MCA shares fell $1.875 to close at $54.50. But analysts attributed the mostly to the dilution of existing share values that will be caused by the issuance of new stock.

“I don’t think it was a reaction to Geffen,” said David Londoner, an analyst for the New York-based investment house Wertheim Schroder. “It was the street saying, if they’re putting out 10 million shares, that means (MCA) isn’t for sale.”

Wednesday’s announcement has fueled speculation that MCA may move to strengthen its international record distribution, perhaps by leaving the Warner fold and reaching some new combination with Thorn EMI, which owns Capitol Records, or Bertelsmann AG, which owns RCA Records.

“We have for some time been exploring a variety of possibilities for our future internationally,” said Al Teller, chairman of MCA Music Entertainment Group. “With this deal, all of our options will be looked at again.”

MUSIC MATCHUP

MCA Inc. gets:

Geffen Co.’s record and music publishing operations, but not its film division.

David Geffen’s promise not to buy MCA stock for 20 years.

Geffen gets 1 million new MCA preferred shares that:

Are valued at about $545 million.

May convert to 10 million common shares.

May not convert unless Geffen sells them.

May be sold only in controlled amounts over four years.

Carry a special $6.80 per share dividend.

BIG RECORD-INDUSTRY DEALS

The record industry has been hit by an unprecedented wave of consolidation in recent years:

1985: Pop singer Michael Jackson pays about $50 million for ATV Music, the British music publishing concern that controls copyrights to nearly all the songs written by the Beatles.

1986: West German media conglomerate Bertelsmann, which already owns 25% of RCA Records, buys the remaining 75% from General Electric for $300 million.

1987: Warner Communications pays an estimated $125 million for Chappell & Co., one of the world’s largest music publishers.

1988: Japanese giant Sony, in its first foray into the U.S. entertainment business, pays $2 billion for industry leader CBS Records.

1988: MCA and the investment group Boston Ventures buy Motown Records, once the nation’s largest black business, from founder Berry Gordy Jr. for $61 million.

1989: Polygram Records, a unit of the Dutch electronics conglomerate N.V. Philips, buys independent Island Records for about $300 million.

1989: British media firm Thorn EMI, which already owns Capitol Records, pays $104.1 million for 50% of independent Chrysalis Records.

1989: Polygram buys independent A&M; Records for about $450 million.

1990: MCA buys independent GRP Records for common stock valued at about $40 million.

1990: MCA agrees to buy Geffen Records and Geffen Music for convertible preferred stock worth about $545 million.

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.