Pawnbroker Disputes Myths, Defends Reputation of Business

- Share via

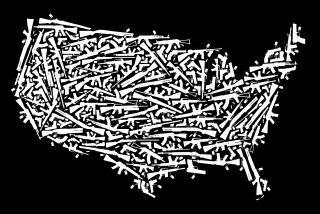

It is the era of the pawnshop as pariah. Throughout the San Fernando Valley, communities are passing legislation to limit the spread of such businesses as a way to fight crime. The argument goes something like this: Pawnshops breed bad neighborhoods. Like graffiti, they are seen as a sign of an urban sickness, attracting a bad element that a community is better off without. Sam Gonen, a local pawnbroker since 1985, has heard all the arguments. The president of Collateral Lenders Inc., with two outlets in the San Fernando Valley and another in Beverly Hills, also is a governor of the Assn. of Pawn Brokers in California, which has about 400 members. Recently, Gonen took time to talk with Times staff writer John M. Glionna about the idea of the pawnshop as a legitimate business.

*

Question: In many communities, pawnshops are seen as a litmus test of a bad neighborhood. Why does your business get such a bad rap?

Answer: The first problem is that we inherited a bad reputation that was created 100 years ago. I think we’re the most misunderstood industry in the world. I would say that my business is a simple business filling up the vacuum created by the world’s changes. Credit cards, instant credit, these are all wonderful things. But when a person falls in the crack and loses his credit, he is still a person. He still has needs and he is not necessarily a criminal. . . . The notion is that criminals walk in here. This is what’s crazy. For the last five years, we have fingerprinted every person who comes in here to pawn an item. Still, the notion is that thieves are coming here. You know what? We have (fewer) thieves here than they do in the banks. I’m serious. Thieves are intimidated to get fingerprinted. But the stereotype still exists. It’s absurd. It’s irritating to know that people still have this notion.

Q: Where did pawnshops get their start?

A: If I am correct, pawnshops were the first banking industry. If you look at the history of Wells Fargo, you’re looking at a pawnshop. A person walks in with a bag of gold. I don’t know if you’ve seen the commercial. He leaves the bag of gold and gets an advance, a loan. You leave something of value, we’ll give you a loan in exchange. You give us back the money. Here’s your item back. That’s the way it works. You borrowed against trust, your reputation was at stake. The process evolved into what we now know as banking. The rumor is that Queen Isabella in Spain, she had to hock her jewelry so she could borrow money to finance the trip of Columbus. This is pawnbrokering in action.

Q: How did you get into the pawnshop business?

A: I got into the business because I was on the downhill working with electronics items. The imports killed my business. I had to find another field, and this was the closest field I had at the time. It’s a very old business. Many in this country have existed for 200 years and have been passed down from father to son, father to son. They were started . . . by the Medici family in Italy. And in China, they’ve been around for 1,000 years. I’m one of the unusual ones who came to the industry from the outside.

Q: So, where did pawnshops pick up their bad associations?

A: Listen, pawnshops used to be disreputable. People had a way of cheating the public and doing bad things. No ifs, ands or buts. Yes, it did happen. But that was 100 years ago when there were no regulations. . . . Just like with the savings and loans. There are good people and then there are bad ones. The bad ones give us all a bad reputation. We now have legislation that is going to solve a lot of our problems. It used to be too easy to be a pawnbroker. Anyone who had $3,000 could suddenly call himself a lender. It was a joke. They didn’t open shop to lend money. They came to steal people’s merchandise, basically.

Q: How can immoral pawnbrokers rip people off?

A: They’re usually the small ones. They don’t have the money. And they’re entering a business that requires lots of money. You cannot be a lender if you have $10,000 or $100,000. It’s not enough, because you loan money. In 10 days, you don’t have any more money. What are you going to do then? So, technically, they’re forced to take shortcuts. The first thing they do is try to talk people into selling their family heirloom instead of just borrowing against it. And it’s possible that they charge incredible interest rates. But there are laws against this kind of thing. And they are very strict. A crooked pawnbroker should not survive more than one year. If you are convicted of any crime, you lose your license to do business. I punch somebody on the street, I’m out of business. My license is the most important thing I own. I have to be clean. But, unfortunately, there are some bad apples that just don’t care. Why? Because there just isn’t enough enforcement. Ten years ago, there were only eight pawnshops in the Valley. And they were clean like a whistle. Now there are more pawnbrokers. What we need is more enforcement. We don’t need any new zoning laws. But let’s talk about the honest pawnshops. The honest ones are actually preventing crime. Every time they give a loan to someone, they help solve his problem so he doesn’t have to go out and commit a crime to pay his mortgage or electricity.

Q: What message would you like to deliver to politicians and others who have spoken out against pawnshops that they might not already know?

A: What these councilmen are trying to do is good. But in their approach, I think they are misinformed. Their misinformation is that pawnshops are a sign of crime. This is absolutely nonsense. If we bring crime to a community, then so do banks. We loan people money who need money. The difference between us and banks is that we do loan the money, the banks don’t. The banks have a big sign: “We give loans.” But it’s only to the people who really don’t need the money, people who are refinancing loans. They don’t need to refinance. They’ll survive anyway. I loan to people who really need the money, and now. I am filling up a vacuum.

We are completely a viable service to the community. If anyone doesn’t believe so, they should open up a charity and give his own money to people who need it. And let him face people without taking possession of anything. If you take pawnshops away, maybe these same councilmen would have to stand on the street corner, giving away money to convince people not to go out and commit that crime in order to pay their bills. And he’d have to take their valuables as collateral, just like me. If anything, pawnshops are crime-prevention tools. I go to meetings and tell people I’m a pawnbroker and they all look at me like I’m a cheat and a crook. And I say to these people, these doctors and lawyers, “You know, you never know if you’re an honest person, you’ve never been tested. But I’m being tested daily. People trust me with something valuable to which I have complete access. I could take their valuables and run. But I don’t. Because I am a businessman. And it’s not good business.”

Q: In the end, what can pawnshops do to battle their negative image?

A: It’s very hard. In our association, we spend 80% of our time trying to improve our name. We have new legislation to clean up the industry. Right now, new, small-time pawnbrokers are almost forced to take shortcuts because they don’t have enough money to do business the right way. The new regulations require that pawnbrokers have $100,000 in liquidatable assets, other than real estate, showing that you are a lender. And they want an unrevokable bond of $20,000, something that will help the consumer. And, guess what? Pawnshops owners were behind this legislation. The last thing we need is another blow to affect our reputation, a reputation we inherited. We defend our reputation daily. That’s the way it is. We have a long way to go. What we do know is that the pawnbrokers who are breaking the rules are injuring all of us.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.