IRS Seeks $1 Million From Gehry in Fines, Taxes

- Share via

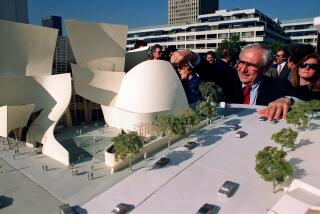

WASHINGTON — Frank O. Gehry is among the most acclaimed and sought-after architects in the world, but the Internal Revenue Service is seeking the Los Angeles luminary’s firm for other reasons--about $1 million in back taxes and penalties.

The IRS slapped Frank O. Gehry & Associates Inc. with a tax-deficiency notice earlier this year, asserting that Gehry had awarded himself “unreasonable compensation” in 1992 and ‘93, according to U.S. Tax Court records.

The dispute involves an interpretation of complex IRS regulations, not an allegation of criminal tax evasion. Nonetheless, the IRS levied a big fine against the architect, who was named just this week by Time magazine as one of the 25 most influential Americans.

Gehry is the designer of the Disney Concert Hall, a $265-million project whose construction has stalled for lack of money. If Gehry’s firm falls into financial peril, it is not clear whether it might hamper his role in the project. Although the design has been completed, Gehry’s firm continues to be heavily involved.

Contacted at his Santa Monica offices late this week, Gehry said he is baffled by the whole matter and had delegated responsibility for his financial affairs.

“I don’t know anything about it,” he said. “My accountant handles this stuff. If I owe them money, we’ll figure it out. But I don’t have $1 million to pay them.”

Steve Collett, Gehry’s accountant, insisted that the architect does have the money to satisfy the IRS’ demand and that his architecture practice is in no jeopardy. Collett predicted that Gehry will ultimately win his case in Tax Court. He called the IRS’ actions ridiculous.

“Frank Gehry paid enormous taxes in each of those years,” Collett said. “I don’t think the IRS can prevail. But if it did, Frank has sufficient liquid assets that he could pay off the whole thing. Frank could pay this several times over, but he won’t have to.”

Gehry’s attorney, Roger Olsen, declined to comment.

Harry Hufford, chief executive of Walt Disney Concert Hall Corp., downplayed the possible impact Gehry’s tax problems could have on the project and said he continues to support the architect.

“It looks like a dispute between Frank and the IRS that should have no effect on the concert hall,” Hufford said. “His business is viable.”

The architect’s dispute went to court June 6, when his representatives filed a petition to overturn the IRS tax-deficiency notice issued in March. The petition disclosed that the agency had found Gehry deficient by $491,655 for 1992 and $393,951 for 1993. It also assesses fines of $90,331 for 1992 and $78,590 for 1993. The deficiency notice was signed by IRS regional director Richard R. Orosco and IRS Commissioner Margaret Milner Richardson.

According to tax experts, such cases are not unusual among highly paid professionals. By asserting that Gehry deserved less direct compensation, the IRS is intending to force the architect to take a portion of income in dividends, which are then subject to taxation both as corporate profit and as personal income, said Bruce Hochman, a Los Angeles tax attorney.

Hochman said the IRS should be using its scarce resources to round up tax outlaws rather than attempting to impose double taxation on individuals like Gehry, whom he called a genius. The IRS often loses in these types of cases, he said.

Collett said the IRS examiners based their conclusion about Gehry’s compensation on a table that compares average salaries of architects. Such a formula fails to recognize Gehry’s talent and international reputation, he said.

“It’s an outrage,” Collett said.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.