For Macerich, Success in Mall Market Comes in Threes

- Share via

Over the last five years, a majority of the nation’s regional shopping malls have been taken over by half a dozen or so publicly traded companies. One of those giants, Santa Monica’s Macerich Co., has set out to create virtual monopolies in certain markets--beginning with the Southland’s so-called “mid-county” area and most recently the Westside of Los Angeles.

With the May acquisition of the Los Cerritos Center in Cerritos, the real estate investment trust known in retail circles as the Mall Doctor owns three regional malls in a market area serving more than 1.8 million residents.

Macerich already owned Stonewood Center in nearby Downey and the company’s flagship property, Lakewood Center Mall in Lakewood--a dominant regional magnet undergoing a major expansion. Collectively, the three malls carrying the Macerich banner feature 4.1 million square feet of store space, including 14 department stores, and generate about $900 million in annual sales.

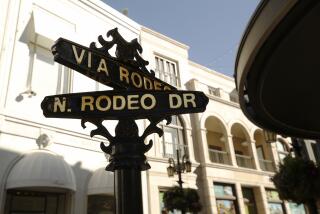

Last week, Macerich, which already owns the Westside Pavilion and Villa Marina Marketplace, added Santa Monica Place to its 41-million-square-foot portfolio--another move reflecting its “clustering” strategy. Macerich’s three Westside malls serve a lucrative market area of about 1 million residents with an average household income of about $84,000.

That $130-million deal is the culmination of nearly $1.6 billion in mall acquisitions the company has completed in less than 24 months.

In addition to operational synergies and efficiencies, its dominance in those densely populated areas let Macerich go on the offense with its marketing budgets, said Art Coppola, the company’s 47-year-old chief executive.

“Under separate ownership, the aim of your marketing is to increase your market share relative to the competition,” he said. “If you can combine the marketing [under common ownership], you’re spending for the benefit of all three.

“There are substantial synergies that come with [clustered] ownership and we expect to gain tremendous marketing, leasing and operating efficiencies from combining these properties,” he added.

Macerich executives have already started tearing up contracts that prohibited certain Los Cerritos tenants from opening shops at the once-competing Macerich properties such as Lakewood.

“It’s a unique opportunity to have three centers controlling a huge market area,” added Macerich’s 74-year-old founder and chairman, Mace Siegel, who’s also well known in the horse-racing community.

And Macerich’s ability to approach the clustered properties essentially as one unit has significant financial implications at a time when Wall Street remains cool to REIT stocks, Siegel said.

Rather than trying to sell new stock amid a continued REIT slump--NYSE-traded Macerich shares hit a 52-week low of $19.69 on Oct. 27--the company set out to raise additional expansion capital by bringing in a financial partner that would invest specifically in the three mid-county properties, the chairman specified.

And Macerich did just that. On the day it announced the Santa Monica Place acquisition, the company also announced the sale of 49% of the three mid-county malls to Canada’s biggest public pension fund, the Ontario Teachers’ Pension Plan. The deal valued the three properties at about $550 million.

Coppola said Macerich also anticipates similar benefits from the acquisition of the Village at Corte Madera. That property provides something of a dominant position in Northern California’s wealthy Marin County in combination with Macerich’s Mall at Northgate--although not quite on the massive scale of the mid-county or Westside trios.

While Coppola and Siegel noted that the company plans to pursue additional acquisitions with potential market monopolies in mind, some observers question the long-term benefits of that strategy.

“It’s certainly an interesting theory and there may be some competitive advantage if you really own a lot of real estate in one market,” said Ned Fox, chairman and chief executive of another locally based shopping center REIT, Center Trust. But while noting his admiration for Macerich management, Fox concluded that any such advantage would likely be short-lived.

One reason: It’s difficult to really control a market area even with ownership of some key malls because not all shopping takes place in the regional centers. Another is that if such control really does reduce competition--presumably leading to higher rents and perhaps prices--shoppers and merchants will opt for more competitive and efficient marketplaces, Fox said.

But veteran retail real estate broker Ted Lawson said Macerich’s ownership of major mall clusters might enable it to create profitable efficiencies without making mall rents less competitive.

“I think it’s a smart move. All three [mid-county] malls are outstanding properties, and there’s an element of cost savings that could come from advertising all three in local papers,” said Lawson, a senior vice president with CB Richard Ellis.

Another factor in their favor is the rapidly changing demographic makeup of the area also sometimes known as Mid-Cities. Macerich’s ownership of the three high-traffic malls should also bring “a better read on the marketplace,” Lawson said.

And because so many apparel retailers only want to be in fashion-oriented regional malls, Macerich could potentially take a hard line on rents for those types of shops, Lawson speculated. But he agreed with Fox that the potential impact is limited by competition from smaller, fashion-oriented shopping centers as well as “value” retailers that are increasingly going upscale.

Predictions about possible monopolies aside, Macerich’s purchases of Los Cerritos Center and Santa Monica Place seem to demonstrate the company’s abilities as a consolidator.

Coppola said the $550-million combined value of the three mid-county centers roughly equates to Macerich’s total market capitalization when it went public five years ago. The company’s market cap today is close to $3.3 billion, and its mall portfolio has quadrupled since the IPO to more than 41 million square feet at more than 50 properties around the country, about a third of them in California.

And even after Wall Street retreated from real estate stocks last year--sharply reducing property acquisitions by most REITs--the group of longtime colleagues comprising Macerich’s senior management team continued to build the company’s portfolio, despite the higher cost of public capital.

Including the Santa Monica Place deal, Macerich has accumulated nearly half of that portfolio in a frantic 20-month period. Though REITs specializing in almost every property type slowed their buying considerably, Macerich purchased interests in 24 malls containing almost 20 million square feet of shopping space. The company’s investment: nearly $1.65 billion.

How did it manage to acquire so much? At least part of the answer lies with the company’s pre-public roots, when it worked with major institutional investors. As Siegel noted, “We’re going back into the partnership business.”

Among the first REITs to cement major alliances with private capital partners--Ontario Teachers in particular--Macerich continued to grow rapidly even after its stock dropped precipitously with the REIT retreat that began early last year.

After Ontario Teachers made a $150-million equity investment in Macerich, the partners hooked up on the $570-million purchase of Seattle insurer Safeco Corp.’s 5.3-million-square-foot mall portfolio, most of it in the Pacific Northwest. Meanwhile, it also purchased the 750,000-square-foot Westside Pavilion for more than $170 million and continued its $90-million redevelopment of the dominant Pacific View (formerly Buenaventura) Mall in Ventura.

Macerich even hooked up with one of its biggest competitors, Indianapolis-based Simon Property Group, to jointly buy a dozen malls from IBM’s pension fund.

Since the bulk of the Safeco sale closed in February, the focus at Macerich has been on digesting the newly acquired properties. That’s the part of the business that earned Macerich the Mall Doctor moniker over its 34-year history.

The company is known for its ability to make malls more productive, primarily by refining the tenant mix. Across the portfolio, sales per square foot have grown from about $253 at the March 1994 IPO to nearly $325 today, not including the properties owned with Simon.

But Wall Street doesn’t seem to be impressed. Just as Macerich was preparing to announce that it had beaten analysts’ funds-from-operations estimates for this year’s first quarter, the company’s common shares hit a then 52-week low of $21.25 on April 7. They had reached $28.50 the previous November.

The stock rebounded over the summer and approached $27, but slipped back amid a general REIT decline to about $20 in recent weeks--even though Macerich announced 64 cents in FFO per share for the second quarter, an 8.1% increase compared with the year-earlier period. The stock closed Monday at $20.06, down 19 cents.

“When the market seems to be saying, ‘We don’t like your company’ and your stock is down 25%, you have to think maybe you’re doing a lot of things wrong,” lamented Siegel, who says he probably takes Wall Street’s swings in sentiment more personally than his colleagues. “So you have to work at being more productive, take a hard look at your portfolio, the competitive picture, every damn thing.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.