Oil Price Boom a Mixed Blessing for Venezuela

- Share via

CARACAS, Venezuela — It feels like a time warp: The two-tone brown 1975 Ford LTD V-8 glides into the gas station and the attendant fills the tank--18 gallons for about $7.50.

Cheap gasoline is one of the payoffs from this year’s crude-oil price boom for the Western Hemisphere’s largest oil-exporting nation. While the rest of the world groans at the pump, soaring crude oil revenue helps subsidize gas prices at home; a gallon of regular costs 35 cents.

There are other benefits too: Today’s high prices are enabling Venezuela’s populist president, Hugo Chavez, to pour oil revenue into schools and social programs to attack this country’s numbing poverty.

“I’ve never seen the spigot turned as wide open as it is now,” said Eric Ekvall, a political consultant here.

Yet there is not much cheering over the return of oil prices to 1970s levels. Many Venezuelans fear the current crude-oil price spike is no different from those that have evaporated many times before, each one leaving them worse off.

If past boom-bust cycles are any guide, once crude prices fall, government largess built on the oil bonanza will be slashed and debt will rise; economic growth will sputter and jobs will disappear.

“I hope as a Venezuelan that oil prices stabilize, because it is a double-edged sword for us,” said Luis A. Machado, a 47-year-old musician who drives a taxi to make ends meet. “These high prices are something we may have to pay for in spades later on.”

Said political scientist Anibal Romero, who teaches at Simon Bolivar University: “Oil for us is a curse. It destroys the spirit of work. It makes poverty worse. It converts us into fantasy beings.”

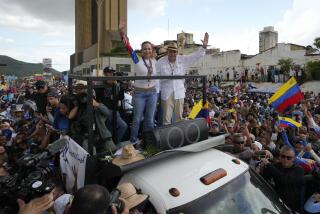

Even Chavez, who has ridden oil to global prominence as a tough-talking principal in the Organization of Petroleum Exporting Countries, conceded at last week’s OPEC summit here that oil is a two-edged sword.

“It is terrible trying to do estimates: If oil drops to $10 per barrel, what do we do? And if it rises to $40? And if it drops back to $8? How will we pay salaries, meet our commitments to farmers?” Chavez said. “It is a very great uncertainty, a vulnerability that no country can withstand. What kind of planning can you do in such a situation?”

Low gasoline prices have always been a symbol for Venezuelans of the bounty of their petroleum wealth. With crude production capacity of 3.7 million barrels a day, Venezuela is the world’s No. 5 oil producer.

When the government tried in 1989 to decontrol gasoline prices, deadly riots broke out in the streets, killing more than 300. Chavez has vowed not to raise gasoline prices this year, even though crude oil has skyrocketed from less than $10 in 1998 to above $30.

Taxi driver Machado calculated it simply: “To raise gasoline prices would mean the guillotine for Chavez.”

Cheap gas prices are one reason so many huge, rusting American gas guzzlers from the 1970s still lumber through the streets of Caracas, polluting the air and clogging traffic in this city of 5 million.

“In Venezuela, the price of gasoline is sacred, like the tortilla in Mexico,” said Caracas economist Maxim Ross.

At the same time, the nation’s overwhelming dependence on crude-oil revenue makes it extremely vulnerable to swings in world prices. Oil accounts for more than 50% of government tax revenue and more than 70% of export earnings.

Thus in 1999, with oil prices plummeting, Venezuela’s economy contracted 7.2% and unemployment soared. This year, growth has returned and revenue from oil is expected to nearly double, to $13 billion this year.

“Venezuela has a classic cycle of fat cows and thin cows,” Ross said. “Public spending rises with high oil prices, and then when prices fall the deficit rises. . . . Yet the country hasn’t created policies to amortize these ups and downs. The solution must come through structural reforms to make the economy more competitive and less dependent on oil.”

For the moment, though, Chavez has a revenue stream to finance his ambitious program. And the government has put $3 billion in excess oil revenue into its oil stabilization fund to help in future hard times.

Chavez’s economic team says it is focusing its spending on a blend of infrastructure programs and basic social spending to assist the 80% of Venezuela’s 23 million people who are regarded as poor.

One key target: education.

Chavez has pledged to transform all schools into “Bolivarian schools,” in honor of visionary South American independence leader Simon Bolivar, for whom Venezuela also named its currency. Though the Bolivarian school project is fraught with political controversy, no one denies that education is sorely inadequate and needs heavy investment.

At the Armando Zuloaga Blanco primary school in a working-class district of central Caracas, 850 schoolchildren are indirect beneficiaries of the oil-backed spending that Chavez is devoting to what he calls his Bolivarian revolution.

Principal Maria Velez said students used to attend a half-day session. This Bolivarian pilot school offers a single session from 7 a.m. to 3:30 p.m. and includes a full lunch to improve nutrition. Teachers chosen for the program get a 60% bonus because of the longer hours. The curriculum emphasizes community involvement and parental support.

Political analyst Ekvall worries that the Bolivarian schools are “window dressing, instead of addressing the structural problems.”

The government insists it is using its oil bonanza cautiously and for structural reforms rather than recurrent spending. Planning and Development Minister Jorge Giordani recently told reporters that infrastructure projects and education would be priorities in 2001. Projects include a $225-million renovation of the nation’s airports.

Venezuela has one of South America’s most impressive transportation networks, with superhighways and tunnels under its slums. But the system is aged and rundown.

Economists agree that oil revenue was used soundly in the 1960s and 1970s, when the first real petro-boom hit, and some internal industries were created to try to reduce dependence on oil. But other possible export industries were neglected, and little infrastructure has been built since 1980.

“The citizens are exhausted by the decline, and they are incredulous that such high oil prices don’t translate into better living standards,” said prominent Caracas economist Francisco Vivancos. Vivancos said Venezuelan babies’ height and weight at birth have fallen since the 1970s.

Therefore, Chavez’s preoccupation with attacking poverty “is absolutely legitimate,” Vivancos said. “It is and should be the first priority. The issue is how and where to attack it. The emphasis on education and health is appropriate, and as a symbol, the Bolivarian school program could be transformed into a mass-based project to refocus education in Venezuela.”

But he finds the low gasoline prices a bizarre holdover because only 20% of Venezuelans have cars, and “it is a subsidy that flows to private car owners, not the poorest people.”

In percentage terms, total government revenue will rise from 16.4% of gross domestic product to 24.6% this year, a massive increase in spending power. The entire increase comes from higher oil revenue.

For the state-owned oil company, Petroleos de Venezuela, the turnaround has been equally dramatic. The average price for Venezuela’s basket of crude oils has risen from $10.57 in 1999 to $25.40 this year. Thanks to that jump, revenue nearly doubled. And taxes and royalties paid by the oil company to the government rose from $2.1 billion in the first half of last year to $5.2 billion for the first six months of 2000.

But even state oil company President Hector Ciavaldini wants more stable prices and a more diverse economy. “Oil carries too heavy a weight in the national economy,” he told the company’s in-house magazine. “Under this unstable prices panorama, there can be no worthwhile planning.”

Said Romero, “To launch new financial resources at this petroleum economy, with all its distortions, far from solving problems actually makes them worse.”

(BEGIN TEXT OF INFOBOX / INFOGRAPHIC)

Fickle Fortunes?

Venezuela’s economy is riding high because of the rise in oil prices. But if past boom-bust cycles are any guide, the prosperity will evaporate when prices fall. Here’s a look at the change in Venezuela’s quarterly gross domestic product and the price of Texas crude:

Venezuela’s GDP has risen...

2nd quarter 2000: +2.6%

(Percent change in quarterly GDP)

... along with oil prices.

2nd quarter 2000: $33.05 per barrel

(Prices for Texas intermediate crude)

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.