Drillers Seek New Natural Gas Sites

- Share via

Natural gas drillers are turning up the heat on Uncle Sam to open up more areas for exploration, amid the highest gas prices ever.

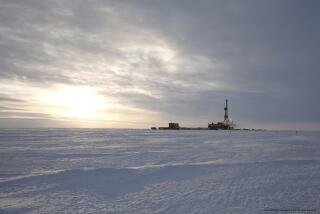

Anadarko Petroleum Corp. said Wednesday it plans to start drilling for natural gas in two parts of the Arctic by early 2002, in hopes that a gas pipeline to the Lower 48 states will be built by 2008.

The company last month bought the right to explore 176,000 acres in the MacKenzie Delta of the Canadian Arctic. It will begin seismic shooting, which maps the geology of potential drilling sites, this winter in both the Delta and Alaska’s North Slope, said John Seitz, president and chief operating officer.

Natural gas prices in the last decade haven’t been high enough to justify the expense of building a gas pipeline from Alaska, major oil companies have said.

But with prices having doubled this year, interest in building a line has been renewed.

Gas futures on the New York Mercantile Exchange fell 4.5 cents to $5.318 per million British thermal units Wednesday, down just slightly from Tuesday’s record.

“The country needs gas from the Arctic,” Seitz said, speaking at the Dain Rauscher Wessels oil and gas conference in Houston.

About a dozen companies have pipeline proposals on the table, Seitz said. He estimated that at least one route could be built by 2008. Some estimates are for as early at 2005, he said.

Drilling on both Anadarko’s MacKenzie and North Slope properties could begin in December 2001 or January 2002, Seitz said.

But chances for construction of a gas pipeline could be threatened if the government intervenes to push down prices, experts say.

“We’ve got an election year, so anything’s up for grabs,” said Lisa Stewart, executive vice president of business development for oil and gas explorer Apache Corp.

Another energy giant, gas producer and energy trader Enron Corp., also warned against government intervention.

“Markets do correct, and this market also will correct,” Enron CEO Kenneth Lay said at the Governors’ Natural Gas Summit in Columbus, Ohio. “As long as the regulators will leave it alone . . . this market will come back into balance in the next two or three years.”

Without government interference, Apache thinks prices will remain appealing enough to spur new drilling. Stewart noted that gas inventories are low nationwide and demand is expected to boom.

The government will probably move or be pressured to open up lands now off limits to explorers, rather than impose price controls, Seitz said. California and the Rocky Mountains are ripe for exploration, he said. “The solution for the prices is more supply, and we need to have more land to explore and exploit,” he said.

Shares of both Anadarko and Apache rose Wednesday, even as many other energy stocks fell. Anadarko (ticker symbol: APC) gained 95 cents to $64; Apache rose 19 cents to $62.69. Both trade on the New York Stock Exchange.

Enron (ENE), one of the hottest energy stocks, fell $2.69 to $82.17 on the New York Stock Exchange.

(BEGIN TEXT OF INFOBOX / INFOGRAPHIC)

Gas Stocks on Fire

Shares of gas and oil exploration and production companies Anadarko Petroleum (ticker symbol: APC) and Apache Corp. (APA) have rocketed this year as gas and oil prices have soared.

*

Monthly closes and latest for Anadarko and Apache on the New York Stock Exchange

Anadarko

Wednesday: $64.00, up 95 cents

*

Apache

Wednesday: $62.69, up 19 cents

Source: Bloomberg News

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.