Bankruptcy May Compound Your College Loan Problem

- Share via

Question: My daughter went to an expensive college that had a good program in her area of interest: teaching learning- disabled students. Now, four years later, she has had one job that paid $24,000 and lasted a little more than two years.

With incurred interest, she’s facing student loan debts of more than $45,000.

I’m divorced and receive no financial help from my daughter’s father. I helped with tuition and living expenses as much as I could on my small salary, and even now, I’m able to help very little.

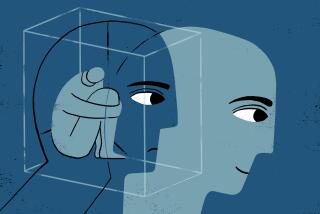

My daughter feels she can’t go to graduate school to become a psychologist as she had hoped because of her financial situation.

She feels defeated. Obviously, we didn’t realize the amount of debt she was accumulating, much less the interest she would face.

Is there any way she could get rid of this debt by filing for bankruptcy?

Answer: Typically, no. Student loans are among the few unsecured debts that normally can’t be erased in Bankruptcy Court.

Your daughter may be able to make an argument to the bankruptcy judge that repaying the loans would pose an extreme financial hardship for her.

However, judges usually define “extreme financial hardship” pretty narrowly. Your daughter probably will want to talk to an experienced bankruptcy attorney about whether this gambit could work.

Even if she could get the loans wiped out, the bankruptcy would stay on her credit report for 10 years, compromising her ability to get credit in the future.

If any of the loans your daughter received were Perkins loans -- low-interest loans typically given to low-income students -- she may be able to get that part of her debt canceled over time if she can get a job in her field. Teachers of disabled children, along with certain professionals in health care and law enforcement, can qualify for cancellation of Perkins loans.

For more information, she should refer to attorney Robin Leonard’s book “Take Control of Your Student Loan Debt” (2002, Nolo Press). Otherwise, her options are limited.

Your daughter got sucked into the trap faced by many students these days: borrowing more than she could afford to repay.

Student loans are easy to get, and few people really think about the payments they’ll face once they get out of school.

In general, undergraduates should use the salary they expect to make in their first year out of college as a guide for how much they can safely borrow. Rarely should you take out loans if the payments will exceed 10% of your gross pay once you graduate.

Knowing how much the payments will be can be tricky, because student loan rates usually are variable.

To be conservative, you can figure on an 8% rate, which would require a $12 monthly payment for each $1,000 you borrow, assuming a 10-year repayment period.

If that’s too much math, then just figure you shouldn’t borrow more than two-thirds of your projected pay.

Because schoolteachers typically make less than $30,000 to start, the most your daughter should have borrowed is about $20,000.

If that amount wasn’t enough to pay for the college she wanted, then she needed to find an alternative, such as a cheaper college or working part time while she was in school.

Her goal now should be to find a job -- any job -- and start hammering away at those loan payments. The longer she puts it off, the more interest will accrue.

There is one silver lining: If she hasn’t consolidated her loans, she has a chance to lock in a super-low 4% rate on any federal student loans she has. She should talk to her lender or visit www.salliemae.com for more details.

*

There’s No Harm in Checking Your Credit

Q: If I request my credit report every so often, will that affect my credit score?

A: Your request for your own report doesn’t hurt your score. What can hurt is applying for new credit accounts. When a lender pulls your report as part of the credit-granting process, that typically knocks your score down a bit.

*

Liz Pulliam Weston is a contributor to The Times, a columnist for MSN.com and a graduate of the personal financial planning certificate program at UC Irvine. Questions can be sent to her at asklizweston@hotmail.com or mailed to her in care of Money Talk, Business Section, Los Angeles Times, 202 W. 1st St., Los Angeles, CA 90012. She regrets that she cannot respond personally to queries. For past Money Talk questions and answers online, visit www.latimes.com/moneytalk.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.