Anxiety Builds Over AOL Earnings Release

- Share via

NEW YORK — When AOL Time Warner Inc. releases its earnings report today, there will be far more at stake than in the typical quarterly update.

The media giant is struggling through a yearlong stock skid that already has cost two executives their jobs. Investors will scrutinize advertising revenue and subscriber growth at the troubled America Online unit and will look for reassurance that the new management team has answers for lingering strategic problems.

Moreover, AOL Time Warner is one of a few high-profile companies--along with McDonald’s Corp., Anheuser-Busch Cos. Inc., GlaxoSmithKline and a few others--reporting earnings today, at a time when the stock market is desperate for positive news.

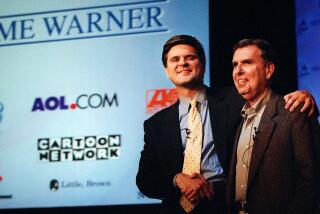

A key issue for Richard D. Parsons, who took over as chief executive in May after the early retirement--under pressure--of Gerald Levin, is reestablishing the company’s credibility with investors, analysts said.

“This has become a show-me stock,” said Ajay Mehra of Columbia Management in Portland, Ore., which holds about 1 million AOL Time Warner shares.

Not only has the company failed to live up to the growth and synergy promises that were the rationale for the record-breaking merger, but it also has been accused of puffing up AOL revenue through questionable accounting.

The company denies wrongdoing, but the questions have helped to pummel the stock. On the New York Stock Exchange on Tuesday, its shares fell 46 cents to $11.55, a new 52-week low.

Last week, Robert W. Pittman, the corporate chief operating officer and head of America Online, announced his resignation. Pittman frequently was criticized for hyping the growth and profit potential of combining Time Warner’s entertainment and news brands with America Online’s Internet reach.

Speculation has centered on Pittman’s mentor, AOL Time Warner Chairman Steve Case, as the next high-level departure, although the company dismisses the idea.

The single most important number in today’s earnings report may be subscriber growth at America Online, said Harold L. Vogel of Vogel Capital in New York.

“That will be a milestone on the way to a decision whether to keep it [the Internet service] or get rid of it,” Vogel said.

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.