Westside Mall Owners Say Bigger Is Better

- Share via

The nation’s mall owners are gobbling up rivals in a race to become the biggest in the land, and two of the landlords with the biggest appetites are headquartered in the Los Angeles area.

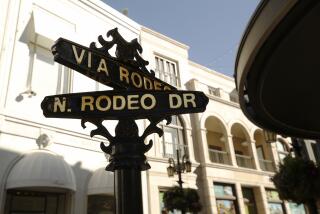

his month, Santa Monica-based Macerich Co. announced the acquisition of Arizona’s largest mall owner, Westcor Realty, for about $662 million, and Monday said that it had agreed to buy The Oaks shopping center in Thousand Oaks in a deal valued at about $150 million.

Meanwhile, Brentwood-based Westfield America Inc. is digesting the 14 malls, including the prestigious Century City Shopping Center, it received in January as part of the $2.2-billion acquisition of Rodamco North America by Westfield and two other mall operators.

While the two Southern California companies are still far smaller than industry leader Simon Property Group, they are among the fastest growing in the rapidly consolidating mall business.

“Everybody eyes everybody else as a potential competitor for any portfolio that comes up [for sale],” said Westfield America Chief Executive Peter Lowy.

Macerich and Westfield are part of an aggressive league of rivals that have increased their shares of the nation’s malls. The number of players with more than $1 billion worth of mall property has shrunk by about half during the last decade and is expected to eventually drop to only a handful, according to industry officials. With most urban areas already saturated with malls, the most viable way for mall companies to grow is to own a larger share of the country’s top 1,000 regional malls.

Recent acquisitions have dramatically expanded the size and scope of Macerich and Westfield, which are among the nation’s 10 largest owners of mall and shopping center space.

Westfield, the wholly owned subsidiary of Westfield Holdings of Australia, is the larger of the two, owning all or part of 61 U.S. malls with about 60 million square feet of shopping space, and has maintained a higher public profile. The firm was in the headlines recently when its effort to rebuild the shopping center that once lay beneath the destroyed World Trade Center in New York ran into opposition.

Only slightly smaller is the Macerich portfolio, which has more than doubled in size since the late 1990s. It will include about 55 properties totaling nearly 60 million square feet once pending acquisitions are completed.

Despite being rivals in some regions, Lowy and his counterpart at Macerich, Chief Executive Arthur Coppola, maintain a friendly relationship. Retail tenants looking for mall space often split their day meeting at both companies, which are headquartered a few miles apart on the Westside.

“It’s not unusual for a tenant to spend the morning over there and the afternoon over here,” said Coppola, 50.

Coppola and Lowy, 43, have become leaders in an industry that was written off in recent years by many who perceived malls as vulnerable to a host of new competition, ranging from discounters such as Wal-Mart to online retailers. Despite the many failed and struggling properties that did not modernize or expand, a regional mall that dominates its market can be a moneymaker that continues to draw huge numbers of customers even during a sluggish economy, say industry observers.

“The death of the mall has been much exaggerated,” Lowy said. “Malls have gotten stronger.”

The two firms differ in some marketing strategies. Most notably, Macerich rejects Westfield’s bid to build consumer loyalty by branding its properties as “Westfield Shoppingtowns.” Some industry analysts said Westfield also stands out in the industry by being more open to new concepts, ranging from adding rooftop parking to including big-box retailers in its mix of tenants.

“Westfield seems to be very visionary in terms of their ideas for their properties,” said John Beaney, a senior vice president for Katz & Associates, a retail real estate consulting firm.

The companies share many strategies and strengths.

Macerich and Westfield are considered experts in buying and turning around second-tier malls after extensive and expensive renovations. After buying the former Buenaventura mall in Ventura County, Macerich spent $89 million to virtually rebuild and expand the property, now known as Pacific View mall.

“That’s been a strength of both companies--take existing centers that have a good market position and remodel, develop and expand them,” said retail industry consultant Rob York at Fransen Co.

Macerich and Westfield also have built concentrations of malls in certain areas that allow them to cut operating costs, raise rents and increase their clout with retailers. Westfield, for example, dominates San Diego County with eight properties. Macerich has a lock on southeast Los Angeles County with control of Lakewood, Stonewood and Los Cerritos malls.

“If a tenant wants to come to that ... area, they need to talk to you,” Coppola said.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.