Roche Steps Up Competition in Anemia Drugs

- Share via

SAN DIEGO — What is now a contest between Amgen Inc. and Johnson & Johnson over the lucrative anemia drug business could soon become a three-way race.

At a medical meeting here this weekend, Swiss drug maker Roche said it was ready to begin the final round of human tests needed for government approval of Cera, its investigational anemia drug. Cera appears to be able to last at least three times as long as Amgen’s Aranesp, according to Roche -- an improvement that would mean fewer shots and office visits for patients.

“This is an exciting drug,” said Dr. Steven Fishbane, a kidney specialist at Winthrop University Hospital in Mineola, N.Y., and an investigator for Roche. “It is what we have been looking for.”

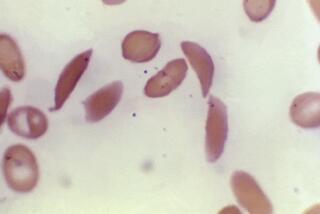

Roche is testing Cera in patients on kidney dialysis and patients with chronic kidney disease, two important markets for Thousand Oaks-based Amgen. Patients with impaired kidneys cannot produce erythropoietin, a hormone that spurs red blood cell production. The anemia drugs are synthetic versions of the hormone, also called EPO.

The stakes are high for Amgen, which discovered the erythropoietin gene and this year will generate $4 billion in revenue from anemia drugs. The company sells Epogen to kidney dialysis patients in the U.S. and has a monopoly in that segment. Amgen sells Aranesp, its long-acting version of Epogen, to other kidney disease patients and to cancer patients with anemia from chemotherapy treatments.

Roche on Saturday presented data to a standing-room-only crowd of physicians that showed Cera worked in anemic patients who received a shot every three weeks. In the company’s upcoming clinical trial, patients would receive Cera once a month. That compares with twice-monthly shots for Aranesp.

Physicians said the difference was significant because kidney disease patients not yet on dialysis see their doctors monthly. Many patients avoid anemia treatments because they do not want to make additional office visits, Fishbane said.

“These patients are pretty sick and are already taking heart medications and are being treated for diabetes and see multiple doctors,” Fishbane said. “It’s a terrible lifestyle for them.”

If Roche’s clinical trial succeeds, Cera “could be a formidable threat to Aranesp,” said Dr. Geoffrey Porges, senior biotechnology analyst for Sanford C. Bernstein & Co. According to Porges, the drug could receive approval in the U.S. and Europe by 2006. Roche said it expected a 2007 launch.

If all goes as planned, Roche could have close to $1 billion in worldwide Cera sales by the end of the drug’s second year in circulation, in 2008, according to a Sanford C. Bernstein research report.

Amgen representatives attending the American Society of Nephrology meeting last weekend wouldn’t comment on the Roche drug. Nonetheless, it was clear Amgen had no intention of ceding its business to Roche.

“We’re very confident of the benefits of Aranesp,” said Dr. Robert Brenner, director of global development for Aranesp in kidney disease.

On Sunday, Amgen presented research showing that patients improved on a monthly shot of Aranesp that contained twice the regular dose. Amgen said a larger clinical trial was planned to confirm the result.

“I think the feeling among physicians is that Aranesp is stretching to get to four weeks and Cera can do that comfortably,” Porges said.

Amgen launched Aranesp in 2001 to compete with Procrit, an anemia drug marketed by Johnson & Johnson under a license from Amgen. Aranesp has allowed Amgen to narrow J&J;’s once formidable lead in the worldwide anemia drug business.

Roche markets a drug similar to Epogen in Europe, but Amgen’s strong patents on erythropoietin have kept Roche and other rivals from the U.S. market. Amgen Chief Executive Kevin Sharer has said the company would defend its patents, and analysts expect Amgen to sue Roche. However, some Wall Street analysts think Amgen’s patents don’t apply to Cera.

Porges said Roche had obtained patents on Cera in the U.S. and Europe, a sign Cera might not infringe on Amgen’s intellectual property. No patents on Aranesp have been issued in the U.S. or in Europe, where Roche and Amgen already are in a patent fight over Aranesp.

“We’re confident Cera does not infringe Amgen’s U.S. patents for erythropoietin,” Roche spokeswoman Shelly Rosenstock said.

Also at the medical meeting Saturday, Medgenics Corp., an Israeli company backed by Silicon Valley venture funds, reported on an experimental gene therapy treatment that would make shots unnecessary.

UCLA professor of medicine Dr. Allen R. Nissenson, a consultant to Medgenics, said the treatment allowed pieces of the patient’s skin to function as small drug factories. First, a 1-inch-square piece of the patient’s skin is removed and then a virus is used to insert the erythropoietin gene into the skin cells. After about a week, with the virus fully removed, the skin is grafted to the patient’s arm or leg, where it should pump out the hormone for several months, until the grafted skin cells die.

Nissenson said a clinical trial of less than a dozen patients is underway in Israel and should be completed in three months. If successful, Medgenics would launch large human tests and seek Food and Drug Administration approval in 2006.

Medgenics plans to market the therapy to kidney doctors as an economic alternative to current anemia drugs, Nissenson said. “They are trying to position this as something that will save a lot of money. Medicare already spends $1 billion on EPO. The pricing on this will be cost effective.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.