Ex-CEO of WorldCom Indicted

- Share via

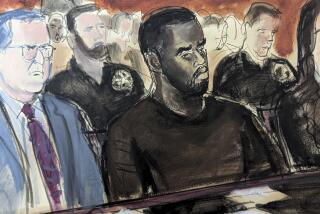

NEW YORK — Bernard J. Ebbers, the onetime milkman and basketball coach who built a global communications empire out of WorldCom Inc., was indicted Tuesday on charges of masterminding the nation’s biggest corporate accounting fraud.

The federal indictment came as WorldCom’s former chief financial officer, Scott D. Sullivan, 42, pleaded guilty to the same three fraud counts and agreed to testify against his former boss.

Prosecutors allege that the pair inflated revenue, hid expenses and failed to disclose the worsening financial condition of the No. 2 long-distance company, which filed for Chapter 11 bankruptcy in July 2002.

WorldCom, poised to emerge from bankruptcy next month as MCI Inc., has admitted it overstated profit by $11 billion under Ebbers and Sullivan.

Ebbers’ lawyer, Reid H. Weingarten, said he and his client were “deeply disappointed” and predicted a jury would clear Ebbers, who resigned as WorldCom chief executive in April 2002.

Tuesday’s indictment of Ebbers, 62, joins the plethora of prosecutions stemming from corporate scandals that have bilked investors and lenders out of billions of dollars and prompted stronger corporate governance rules.

“This is the beginning of the end of the big corporate cases,” said Jacob Frenkel, a Washington lawyer and former Securities and Exchange Commission enforcement officer.

Sullivan entered his plea 10 floors above the Manhattan courtroom where lawyers on Tuesday presented closing arguments in the trial of Martha Stewart on charges of obstruction of justice. Across the street, the criminal trial of John Rigas, former head of cable company Adelphia Communications Corp., was in progress in another federal courtroom.

In a nearby state court, a fraud trial is winding up against former Tyco International Ltd. Chairman L. Dennis Kozlowski, who is accused of pocketing hundreds of millions in unauthorized compensation and profits on inflated stock.

Meanwhile, former HealthSouth Corp. Chief Executive Richard Scrushy is awaiting trial on charges of orchestrating a $2.7-billion accounting fraud.

Last month, former Enron Corp. CEO Jeffrey K. Skilling was indicted, the latest of nearly 30 indictments of Enron energy traders, accountants and finance executives. The only high-profile executive left uncharged is former Enron Chairman Kenneth L. Lay.

Prosecutors build major corporate fraud cases one indictment at a time. Defendants facing long jail terms -- Sullivan is looking at up to 25 years in prison -- are encouraged to turn on their bosses.

Ebbers built WorldCom from a small, Mississippi-based long-distance company through ever larger acquisitions culminating in the 1998 purchase of MCI for $47 billion. WorldCom developed a global network second only to that of AT&T; Corp. and included such customers as the Department of Defense and other federal agencies.

In the late ‘90s, changes in the telecommunications industry hit WorldCom hard. A glut of fiber-optic cable laid by new competitors such as Global Crossing Ltd. led to sharp price drops.

Sullivan said during his 25-minute court appearance Tuesday that he knew he shouldn’t have falsified WorldCom’s books but did so to help the company through what he thought was a temporary strain. He sounded a contrite tone, but seemed to go out of his way to stress that he was not seeking financial gain.

“I do not seek in any way to justify these actions,” Sullivan said in prepared remarks. “I took these actions knowing they were wrong in an attempt to preserve the company.”

Sullivan added that he feels “sincere remorse and a deep sense of contrition.”

Ebbers and Sullivan were charged with one count each of securities fraud, conspiracy to commit securities fraud and filing false information to the SEC. In addition to prison, both face millions in fines. Sullivan’s punishment could be reduced significantly, depending on his cooperation with the government.

The indictment, handed up in U.S. District Court in Manhattan, charges that Ebbers “insisted that WorldCom publicly report financial results that met analysts’ expectations.” Sullivan made adjustments to the books each quarter to keep revenue and expenses in line, according to the indictment, which alleges that the two officers knew what they were doing was fraudulent.

Through the scheme, the co-conspirators “inflated and maintained artificially the price of WorldCom common stock,” the document alleges. Once an internal audit turned up improper accounting, the company’s stock plummeted more than 90%, resulting in shareholders losing $2 billion of stock value.

When WorldCom filed for Bankruptcy Court protection, it listed assets of $107 billion -- about $40 billion more than Enron’s -- making it the largest bankruptcy in U.S. history.

Ebbers is expected to turn himself in to authorities in New York today and to be arraigned before U.S. District Judge Barbara S. Jones.

“America’s economic strength depends on the integrity of the marketplace,” said U.S. Atty. Gen. John Ashcroft, who appeared at a New York news conference. “No one stands above the law regardless of power, position or privilege.”

Ashcroft refused to answer questions about the Ebbers investigation or to divulge what information Sullivan has given to prosecutors.

Ebbers’ lawyer, Weingarten, insisted that the government’s case had no merit.

“We know the evidence in this case, we know our client, and we know that Bernie Ebbers never sought to mislead investors, never sought to improperly manipulate WorldCom’s numbers, never improperly took any money and never sought to hurt the company he built,” he said.

Outside of court, Sullivan’s attorney, Irwin Nathan, told reporters that his client had “accepted responsibility” and taken “courageous and honorable actions” in admitting his guilt.

Sullivan has put his $13-million home in Boca Raton, Fla., up for sale to help reimburse shareholders, Nathan said.

Sullivan and four other WorldCom executives also have partially settled an SEC lawsuit. WorldCom must pay $750 million into a fund to reimburse those who lost money in the collapse.

The Canadian-born Ebbers, whose fortune in the heady days of 1999 and 2000 was estimated at $1.4 billion and included yachts and real estate, has been spending much of his time helping his lawyers from his home in Brookhaven, Miss.

In late August, Ebbers was indicted in Oklahoma state court, but the charges were dropped in December.

He has turned over to WorldCom much of his holdings, including the sprawling Douglas Ranch in British Columbia, Canada’s largest working cattle ranch. The company recently sold the ranch for about $68.5 million to U.S. sports mogul E. Stanley Kroenke and applied the proceeds to pay off some of the more than $400 million Ebbers borrowed from the company.

In a rare interview in September, Ebbers told an NBC television crew that WorldCom’s biggest problem was that sales to existing customers turned from quarterly gains of $165 million to revenue drops of $100 million every three months.

“When you put your life into something like that and something like that happens, there’s really not a lot to say except it’s just terribly sad, terribly sad,” he said. “A lot of people got hurt in the thing. It didn’t have to happen.”

*

(BEGIN TEXT OF INFOBOX)

Timeline of the WorldCom scandal

Events leading to the indictment of Bernard J. Ebbers:

September 1983: On the eve of the breakup of the AT&T; Corp. long-distance monopoly, Murray Waldron and William Rector meet at a coffee shop in Hattiesburg, Miss., to discuss a business plan for reselling long-distance service

April 1985: Ebbers, an early investor in the company founded by Waldron and Rector, LDDS Communications Inc., is named chief executive.

May 1995: Ebbers changes the company’s name to WorldCom.

April 1998: WorldCom, based in Clinton, Miss., acquires MCI Communications Corp. for $47 billion to become the second-largest U.S. long-distance company.

March 11, 2002: The company says regulators are investigating accounting reports and loans to top executives.

April 25, 2002: The company reports a 78% drop in first-quarter profit amid sliding long-distance sales.

April 29, 2002: Ebbers quits after 17 years as chief executive, resigning under pressure from the company’s stock plunge and a federal investigation of WorldCom’s accounting.

June 25, 2002: WorldCom says it fabricated profit by misreporting $3.85 billion in expenses in 2001 and the first quarter of 2002. Chief Financial Officer Scott D. Sullivan is fired.

July 21, 2002: WorldCom files for bankruptcy protection from creditors.

Aug. 8, 2002: WorldCom finds an additional $3.3 billion in misreported financial results since 1999, bringing the total to more than $7 billion.

Aug. 28, 2002: Sullivan is indicted on charges of securities fraud related to the accounting scandal. He also is accused of making false filings to the SEC. The government eventually negotiates plea bargains with former WorldCom accounting chief Buford Yates, former Controller David Myers and former accounting executives Betty Vinson and Troy Normand, all of whom plead guilty to securities fraud charges and agree to cooperate with investigators.

Nov. 5, 2002: The SEC says WorldCom misstated $9 billion in income, almost $2 billion more than previously disclosed, as the agency adds two fraud charges to its complaint against the company.

March 31, 2003: WorldCom uncovers $11 billion in overstated profit.

Oct. 31, 2003: WorldCom wins approval from U.S. Bankruptcy Court Judge Arthur Gonzalez to exit bankruptcy protection with a fraction of its original debt. The restructuring plan erases $36 billion of WorldCom’s $41 billion in debt, pays some creditors about 36 cents on the dollar and wipes out existing shareholders.

March 2, 2004: U.S. prosecutors charge Ebbers with masterminding one of the biggest accounting frauds in U.S. history, while Sullivan pleads guilty.

Source: Bloomberg NewsLos Angeles Times

Hamilton reported from New York and Granelli from Costa Mesa.