Tenet’s Problems Fixable, CEO Says

- Share via

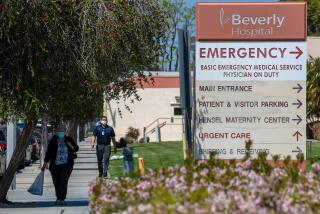

Tenet Healthcare Corp. Chief Executive Trevor Fetter on Tuesday sought to dispel any idea that the nation’s second-largest hospital chain faced a liquidity crunch and said its financial problems could be repaired.

Tenet’s stock has slid significantly in the last week after it cut a new deal with lenders that required the Santa Barbara-based company to pledge capital stock in its hospital subsidiaries and slashed its credit line to $500 million in cash loans. On Monday Tenet also posted a $954-million loss for the fourth quarter and forecast negative cash flow for this year of $500 million to $600 million, again raising concerns about its finances.

“I don’t want to give you the impression that Tenet’s problems are behind it,” Fetter told Wall Street analysts on a conference call to discuss the quarterly results. “We have done a lot of work over the past 16 months, and have a good sense of the challenges we face. They are significant, but I believe they are fixable.”

Since the start of the year, the company has announced plans to sell 28 of its 100 hospitals, including 19 in California, to focus on more profitable operations.

Tenet hopes to get about $600 million from the sale of the hospitals and from tax refunds, Tenet Chief Financial Officer Stephen Farber said.

Tenet is also shedding layers of management and taking other steps to make up for steep reductions in Medicare revenues.

Tenet faces numerous government investigations, including over its Medicare billings and financial arrangements between its hospitals and physicians, as well as scores of lawsuits related to allegedly unnecessary heart surgeries at its Redding hospital.

Some analysts have estimated that Tenet would have to pay more than $1 billion to resolve the government investigations and to settle the lawsuits.

Despite the scope of the company’s legal problems, Fetter stressed that they would have little effect this year. None of the Redding malpractice cases are likely to go to trial before fall, and the company would have the opportunity to appeal any adverse verdict, he said.

Tenet is also pursuing a global settlement of the government investigations, a process the company said would preclude any sudden resolution. In addition, executives said Tenet would not agree to any settlement with the government that it could not finance.

“The bottom line is that I don’t agree with the bear arguments around a liquidity squeeze,” Fetter said.

Premila Peters, a bond analyst with KDP Investment Advisors, said Fetter did a good job of answering questions about Tenet’s legal matters. But she still is concerned about Tenet’s cash-flow problems.

“The fact that negative cash-flow number was as big as it was did come as a big surprise,” she said. “I think the risk level at this company has increased” and that Tenet was operating with little margin for error.

Advest Inc. analyst Robert M. Mains said after the conference call that he remained neutral on Tenet stock.

“I have not been one of the people saying there’s a liquidity risk,” he said. But given that Tenet is still losing money, any longer-term forecast about the company is loaded with uncertainties, Mains said.

Tenet’s shares dropped to $9.15, their lowest price since 1995, before closing at $10.29, up 48 cents for the day, on the New York Stock Exchange.

The stock has fallen 36% this year.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.