Barnes & Noble Investors Choose Founder Riggio Over Ron Burkle

- Share via

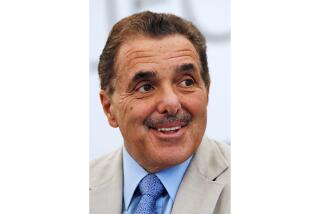

Barnes & Noble Inc.’s shareholders voted to keep Chairman Leonard Riggio on the board of the company he founded, rejecting an attempt at his ouster by Ron Burkle’s Yucaipa Cos. to shake up the largest U.S. bookstore chain.

Riggio, the biggest shareholder, was re-elected to the nine-member board with less than 50 percent of votes cast, Yucaipa said in a statement. The slate from Yucaipa, the second- largest holder, included Burkle.

The vote caps more than a year of Burkle and Riggio clashing over the company’s direction as the chain tries to keep its 700 superstores profitable amid growing popularity of digital books and online sales.

“Anyone who says anything about this board is making it up,” Riggio said at the meeting. “I’ve never met a finer group of individuals.”

Riggio remained on the board as it contemplates a possible sale of the company. Riggio may be part of a group that bids, the company has said. Yucaipa, based in Los Angeles, isn’t planning to acquire the company, Burkle said in a statement on Sept. 24.

David Wilson, CEO of the Graduate Management Admission Council, will join Riggio on the board, according to the statement.

Barnes & Noble overcame Yucaipa receiving the support of Institutional Shareholder Services, often considered the most influential proxy adviser, last week. Adviser firms Glass Lewis & Co., Proxy Governance Inc. and Egan-Jones Ratings Co. backed the company last week and advised voting against amending the pill.

“The dissident has given insufficient reason to support its contest,” Glass Lewis said in its report. “We fail to see by what measure the dissident’s limited plans offer greater value to shareholders.”

Burkle started to buy Barnes & Noble shares in November 2008 and by January 2009 owned 8.3 percent of the company. After Barnes & Noble agreed to purchase Barnes & Noble College Booksellers Inc. from Riggio in August 2009, Burkle criticized the deal in a letter to Riggio.

The stock dropped after the college deal and Yucaipa bought more shares and said in a filing on Nov. 13 that its stake increased to more than 17 percent. The board adopted the pill four days later that capped shares acquired by a single shareholder at 20 percent. Riggio owned about 27 percent at the time the pill was adopted and was prohibited from purchasing more shares.

Burkle, who owned about 19 percent of shares as of May 5, asked the board in January to increase the amount that can be owned under the pill to 37 percent. The board declined. Yucaipa filed a lawsuit in May to have the pill overturned. A Delaware judge upheld it on Aug. 12 and a few hours later Yucaipa filed a proxy to get board seats and increase the pill’s share limit to 30 percent.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.