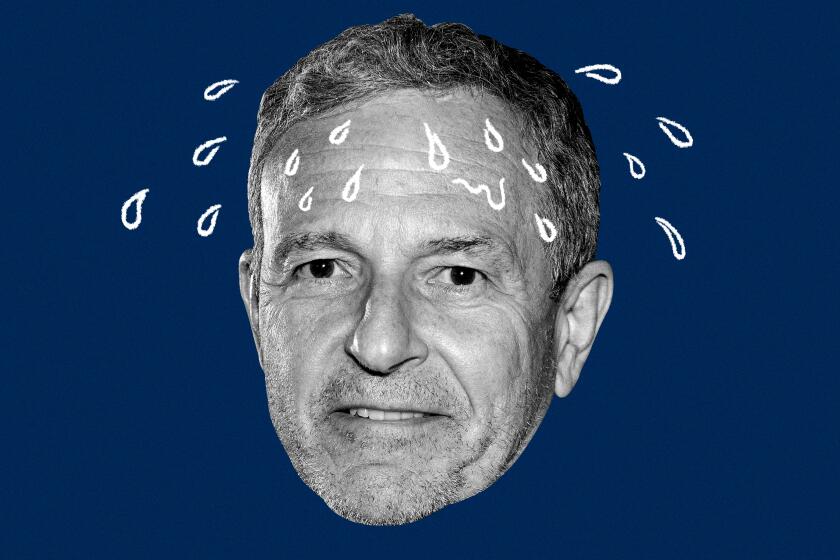

Disney’s Bob Iger triumphs over Nelson Peltz in bitter shareholder vote. But big challenges remain

- Share via

Walt Disney Co. on Wednesday fought off a bruising challenge from billionaire investor Nelson Peltz as shareholders delivered their overwhelming support for chief executive Bob Iger and the company’s nominated board members, ending a costly campaign against the Burbank entertainment giant’s leadership and strategy.

In Disney’s most consequential board election in 20 years — and one of corporate America’s most closely watched proxy contests in recent memory — Peltz fell short in his long-shot bid to wrangle a seat on the board. Preliminary results showed that Peltz mustered about 31% of the vote, according to a person close to the election but not authorized to comment.

In contrast, Iger received a resounding 94% of shareholders’ support — a decisive victory that reinforces his popularity among large institutional investors as well as small shareholders who are nostalgic for the company, its characters and theme parks. Three-quarters of “retail” shareholders (as opposed to larger institutional investors, such as mutual funds) voted in support of Disney’s slate of 12 nominees, including Iger, for the board.

Peltz’s ally, former Disney executive Jay Rasulo, also was snubbed by shareholders, along with three candidates offered by the smaller activist investor Blackwells Capital.

Vote totals were preliminary; final results must be certified and filed with the Securities & Exchange Commission.

Despite prevailing in the proxy contest, Disney must reckon with colossal business challenges and simmering discontent in corners of its shareholder base. This year’s proxy challenge revealed divisions not seen since the end of the Michael Eisner era.

If Peltz had succeeded, it would have been seen as a stunning rebuke of the Disney board and Iger, who returned to the company in late 2022 to reverse its flagging fortunes. Peltz could have used his perch on the board to influence the company’s streaming strategy and executive compensation plans.

Even with Peltz vanquished, Iger and his management team remain under pressure to accelerate the company’s turnaround plans, including efforts to make its streaming business profitable. Disney needs to find ways to preserve the power of its ESPN sports empire, and other TV channels, while also reinvigorating its movie pipeline and expanding its theme parks and resorts business.

And board members have been tasked to quickly find a capable successor for Iger — a duty that has eluded the company for years.

Disney’s shareholder vote has become a contentious referendum on CEO Bob Iger, who has struggled to tame enormous problems that prompted his return in late 2022.

Disney’s dominant showing sent a strong message, analysts said.

“There’s really only one way to read this: It’s a clear mandate for Iger,” said Corey Martin, Beverly Hills-based managing partner at law firm Granderson Des Rochers and chair of its entertainment finance practice. “He’s going to... cement his legacy upon his departure, including picking his successor.”

Iger thanked shareholders for their support during Disney’s annual meeting, which was held virtually.

“Now that this distracting proxy contest is behind us, we are eager to focus 100% of our attention on our most important priorities,” Iger said, adding that Disney would concentrate on “value creation for our shareholders and creative excellence for our consumers.”

Peltz, founder and CEO of New York-based Trian Fund Management, conceded the result.

“While we are disappointed with the outcome of this proxy contest, Trian greatly appreciates all of the support and dialogue we have had with Disney stakeholders,” Peltz’s firm said in a statement Wednesday. “We are proud of the impact we have had in refocusing this Company on value creation and good governance.”

Although Peltz had previously waged successful activist campaigns at other companies, including Heinz, Procter & Gamble and DuPont, he appeared outgunned and outmaneuvered by Disney, analysts said.

“The Disney company is probably ... one of the toughest targets you’d want to take on,” said Keith Meyer, global practice leader with the board services practice at Major, Lindsey & Africa, who has led hundreds of board, chief executive and C-suite searches.

Meyer noted the company’s skills in managing marketing and public relations campaigns appeared to give it the upper hand, particularly as the battle grew increasingly contentious.

“It did get personal,” Meyer said. “Just like you’re going to market a film or a movie, this is about their own future.”

Peltz’s campaign was likely also doomed by its lack of a clear plan for the future.

“Trian was better at diagnosing problems at Disney than it was in providing specific, tangible, logical solutions or cures,” Raymond James media analyst Ric Prentiss wrote in a note to clients. “We are glad this long, not to mention expensive, distraction is over (for now).”

Beating Peltz wasn’t cheap, though, despite the company’s advantages. Disney had said in its proxy report that it planned to spend up to $40 million defending its board nominees and fending off the incursions.

For the second time in a year, activist investor Nelson Peltz is battling Bob Iger and Disney to shake up the company and nab two board seats.

The proxy campaign had homed in on Disney’s subpar stock performance over the last five years, uneven box-office results and the company’s bungled succession efforts. But it wasn’t enough.

“Iger was able to demonstrate and articulate to shareholders that he has a plan for being fiscally responsible while also investing in future growth,” Martin said. “I don’t think Peltz was able to articulate anything close to what the future necessarily holds beyond just cost cutting.”

Under the microscope was Disney’s board’s disastrous decision to hire Bob Chapek as CEO four years ago and extending his contract less than six months before directors forced him out. Chapek, who was Iger’s handpicked replacement, made several costly missteps, including allowing Disney to become fodder for the culture war campaign of Florida Gov. Ron DeSantis. Disney also racked up billions of dollars in losses on streaming.

Iger returned as CEO in November 2022 but, despite his earlier successful tenure, has struggled amid last year’s Hollywood labor unrest and the industry’s shift to streaming and Netflix’s television takeover.

The influential proxy advisor, Institutional Shareholder Services Inc., recommended putting Peltz on the board. The California Public Employees’ Retirement System, or CalPERS, voted its more than 6 million shares in favor of Peltz and Rasulo, saying the pair were “qualified and capable of leading needed change in corporate governance” at Disney.

Peltz unveiled Trian’s proxy fight last fall. It was his second stab at winning a board seat, but he withdrew his initial effort after Iger announced a deep cost-cutting, which ultimately resulted in the elimination of 8,000 jobs.

Trian spent months pounding Disney with position papers and pointed critiques over financial struggles and questionable calls, such as Disney’s 2019 acquisition of much of Rupert Murdoch’s 21st Century Fox entertainment assets. Another sore point among critics was Disney’s promotion of social messages through its films and shows.

“Despite its many advantages, Disney has lost its way,” Trian said in its letter to Disney shareholders.

Disney punched back, warning shareholders in a political campaign-styled video that it would be “disruptive and destructive” to add Peltz and Rasulo to the company’s board. Much of the company’s messaging was aimed at shareholders with small holdings, including families fond of the century-old company’s history.

The Disney shareholder meeting also showcased how the company, known for its squeaky clean and family friendly image, has been thrust into the so-called culture wars and been accused of espousing political and social agendas.

One group that spoke at the meeting proposed curbing Disney’s support of diverse communities. The conservative National Center for Public Policy Research, apparently riled by Disney’s support of the LGBTQ groups, proposed a mandate that Disney disclose donations of more than $5,000 to nonprofits.

During the meeting, Scott Shepard, the center’s general counsel, accused Iger of using Disney to advance the CEO’s alleged “extreme niche worldview” by trying to make “Disney synonymous with force-feeding radical gender ideology,” which Shepard said was alienating the company’s core fan base. His measure failed.

Shareholders were allowed to submit questions before the 53-minute meeting, and one asked whether it was “possible for Disney to stay out of political and social agendas and just provide entertainment?”

Iger said the company has “a responsibility to be in the room, but we know our job is not to advance any kind of agenda.”

“We continue to have a positive impact on the world and inspire future generations just as we have done for over 100 years,” he said. “ So as long as I’m in the job, I’m going to continue to be guided by a sense of decency and respect and we will always trust our instincts.”

Blackwells Capital weighed in earlier this year by nominating a trio of candidates to Disney’s board. But Blackwells efforts were overshadowed by the presence of Peltz, whose campaign was buoyed by the support and significant stock holdings of former Marvel Entertainment Chairman Isaac “Ike” Perlmutter, who was ousted from Disney a year ago.

Disney alleged that Perlmutter had a grudge against the company and Iger, and that it was fueling the bitter and personal attacks and the campaign to shake up the board.

The opposition campaigns did not pose a direct threat to Iger’s continued tenure; his reelection to the board was uncontested. Still, the company fought to avoid divisions that could weaken the celebrated chief’s standing.

The Burbank company has a hangover from its big streaming push. The stock has struggled, investors are restive and its key studios have been stretched.

Last summer, Disney extended Iger’s contract through 2026 to give him the runway to carry out his turnaround plan. The board also needed time to select and become comfortable with his eventual replacement.

In the closing weeks of the campaign, Disney rolled out big names in support, including Eisner, Laurene Powell Jobs, founder of the Emerson Collective; “Star Wars” creator George Lucas and the heirs of company founders Walt and Roy Disney.

Long before the vote, Wall Street had expressed confidence in Iger and his team.

Disney’s stock has gained 30% this year, fueled in large part, by Disney’s strong first-quarter earnings. Shares soared after Disney topped expectations with first-quarter net income of $2.15 billion — a 58% increase over the year earlier period. The strong earnings coincided with headline-making moves, including bringing Taylor Swift’s Eras Tour movie to Disney+ and a $1.5-billion investment in Epic Games, maker of “Fortnite.”

On Wednesday, shares fell 3% to $118.98.

“We wish the best for all of the Company’s stakeholders, including Disney’s Board and management team,” Trian said in its statement. “We will be watching the Company’s performance and be focusing on its continued success.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.