Post-COVID Scarcity Drives Unprecedented Industrial Space Demand

- Share via

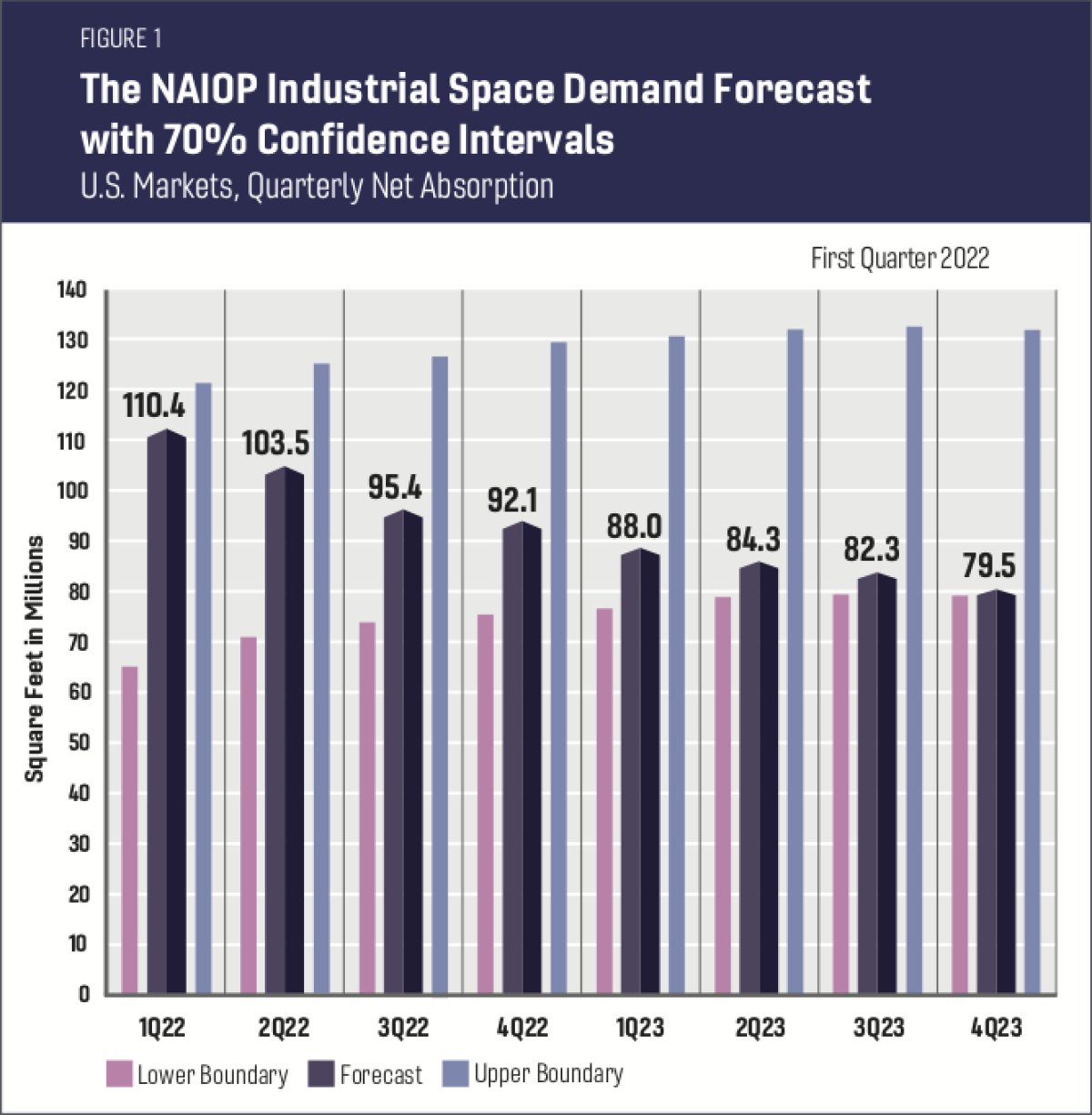

The industrial real estate market will continue to experience record levels of absorption through 2022 and 2023, according to the latest NAIOP Industrial Space Demand Forecast, released recently.

The report’s authors, Dr. Hany Guirguis and Dr. Michael Seiler, forecast that the total net absorption of industrial space in 2022 will be 401.4 million square feet with a quarterly average of 100.4 million square feet. In 2023, the projected net absorption is 334.1 million square feet with a quarterly average of 83.5 million square feet. This is an upward revision of prior forecasts, largely due to retailers and manufacturers expanding inventories to avoid future supply shortages and fulfill increased demand through 2023. This reflects the U.S. economic transition from recovery to expansion, which is expected to support higher employment and a rising GDP.

According to the report, demand for space is currently outpacing the supply of new product. Rents have correspondingly increased rapidly, and many firms simply cannot find space to lease. The scarcity is so great that firms are getting creative by renting properties that can be adapted to serve their purposes, locating facilities further away from their final destinations and building vertically.

“Concerns over access to future space needs have even resulted in larger firms occupying extra space today to avoid problems in the future and signing leases on buildings long before they are built. This lowers current vacancy rates and worsens the problem in the short run. Smaller firms often do not have this ability and are finding it difficult to expand. In more densely populated areas, land is physically constrained and/or zoning prohibits the ability to add supply, leaving a true shortage with no obvious solution,” said the report.

Wage growth has continued, although workers are more concerned about the growth in future real wages. That said, consumer demand for goods remains strong, which supports demand for industrial real estate. The unemployment rate is finally leveling off at around 4% after continuously declining since April 2020. Overall, while many share concerns over the future of the economy, the current state fosters continued growth in demand for industrial real estate.

“Even with inflationary pressures, consumer demand for goods remains strong, unemployment is leveling off and the overall prospects for the economy are positive. These factors are leading to unprecedented levels of demand for industrial real estate,” said Thomas J. Bisacquino, president and CEO of NAIOP.

NAIOP, the Commercial Real Estate Development Association, is the leading organization for developers, owners and related professionals in office, industrial, retail and mixed-use real estate. NAIOP comprises 20,000 members in North America and advances responsible commercial real estate development and advocates for effective public policy. For more information, visit naiop.org.