The 2022 In-House Counsel Awards: Photos and Insights from the Event

- Share via

The In-House Counsel Leadership Awards was held at The Beverly Hilton Hotel in Beverly Hills on May 12, 2022. The evening kicked off with a cocktail reception followed by an illuminating panel discussion and concluded with the awards presentation and dinner. The in-person event honored many of the area’s top legal professionals who are currently practicing in California.

Prior to the In-House Counsel Awards presentation, Nicholas Sanchez, a partner at Miller Kaplan, led an engaging panel discussion that covered several trending issues in the field of law. The esteemed panelists presented their insights on a range of topics – from Diversity, Equity and Inclusion initiatives at their law firms to predictions of tax implications in 2023 and beyond.

Our thanks go out to Qiva Dinuri, Partner & Tax Attorney at Miller Kaplan; Alan Wayne Lindeke, General Counsel at Change Home Mortgage; and Chalak Richards, Associate Dean for Student Life, Diversity and Belonging at Pepperdine University, for graciously offering their time and expertise.

Moderator: Nicholas Sanchez Partner, Miller Kaplan

Nicholas Sanchez started his career nearly 15 years ago with Damasco & Associates, which became part of Miller Kaplan in 2016.

In addition to offering general tax advisory and consulting services, Sanchez advises his clients regarding the tax implications of settlements and judgments arising out of class action litigation, administrative enforcement actions, bankruptcies, and receiverships. He is a trusted expert in all tax aspects of Qualified Settlement Funds, including the tax characterization of distributions, taxation of attorney’s fee awards, and information reporting and withholding compliance.

Sanchez’s practice also includes extensive tax controversy services, and he seeks letter rulings on behalf of his clients, which include administration firms, law firms, litigants, and administrative agencies, such as the U.S. Securities and Exchange Commission’s Sarbanes-Oxley Fair Funds. Sanchez is licensed to practice law in California as well as before the United States Tax Court and Internal

Qiva Dinuri, Partner & Tax Attorney, Miller Kaplan

Qiva Dinuri specializes in tax compliance, controversy, and consulting services - assisting her clients with tax research, gift taxes, the taxation of trusts, estates, and Qualified Settlement Funds (QSFs), and information reporting and withholding. Dinuri is a licensed attorney in California (Bar number 299837) and Washington (Bar number 58957), and is currently finalizing her law license in Idaho.

Prior to joining Miller Kaplan in 2018, Dinuri worked as a staff attorney at a financial advisory firm, as a tax associate at EY, and as a claims examiner with GEICO Insurance.

Alan Wayne Lindeke, General Counsel, Change Home Mortgage

Alan Wayne Lindeke is a tenured General Counsel for Change Home Mortgage with a demonstrated history of working in the banking industry and skilled in operations management, management, legal compliance, sales management, and customer service. He has a strong legal professional with a Doctor of Law (J.D.) from Washburn University School of Law, a Master of Laws (LL.M) in taxation from University of San Diego School of Law, and a Certified Regulatory Compliance Manager (CRCM) designation from the American Bankers Association.

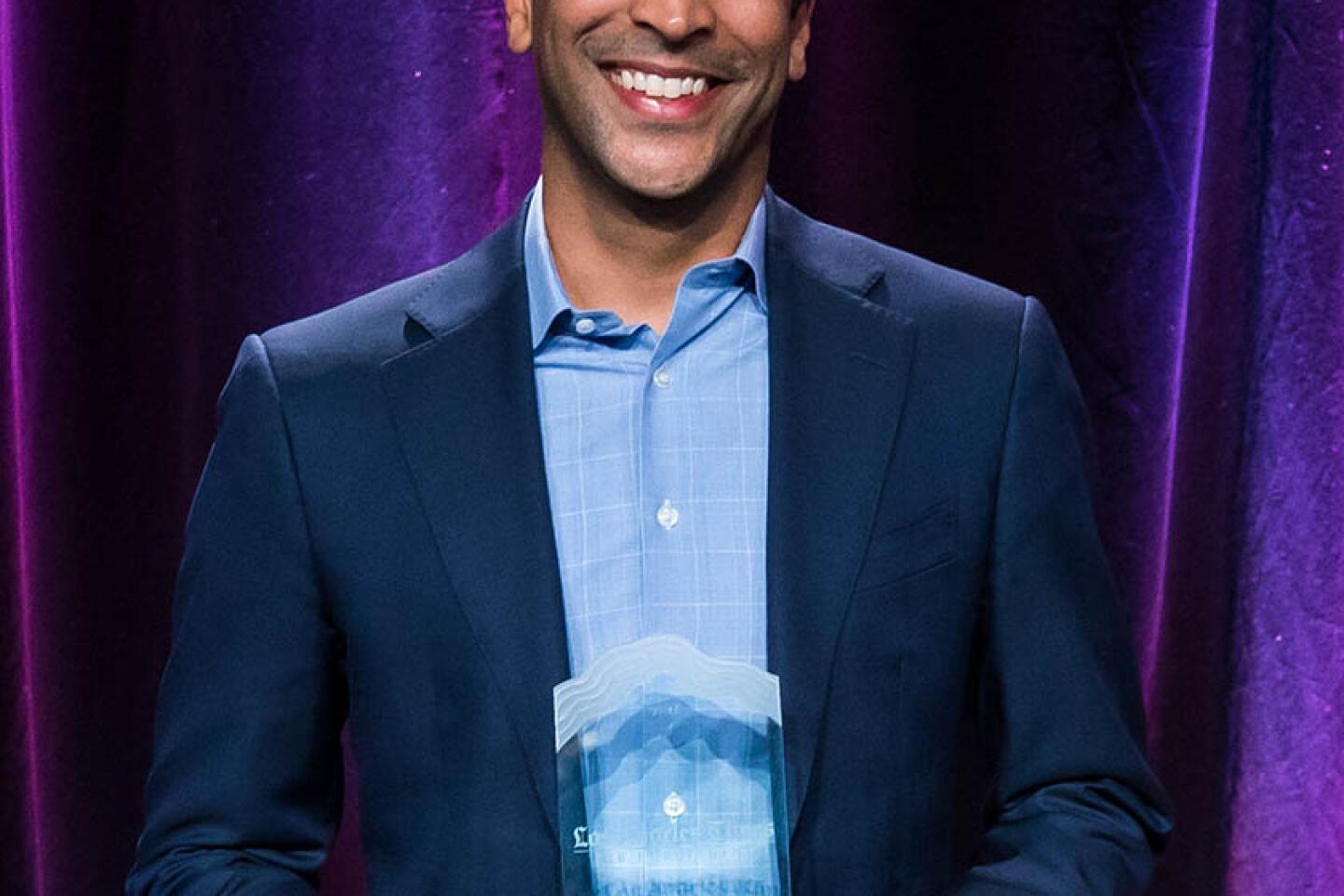

Chalak Richards, Associate Dean for Student Life, Diversity and Belonging, Pepperdine University

Chalak Richards is a justice advocate who is dedicated to bringing diversity, equity, inclusion and a true sense of ownership and belonging to the law. She earned her J.D. at Pepperdine University School of Law, a B.A. from Spelman College, and currently serves as Associate Dean for Student Life, Diversity and Belonging and as Executive Director of the Parris Institute for Professional Excellence at Pepperdine Caruso School of Law. She previously served as Assistant Dean of Career Development.

Before working at Pepperdine Law, Dean Richards worked as an immigration attorney for several years. In 2016 and 2017, she was named a “Top 100 Lawyer in Las Vegas” for her outstanding work and has won numerous Advocacy and Trial awards.

Prior to law school, Dean Richards worked with Urban Promise, a nonprofit organization supporting the academic and spiritual development of five- to tenyear- old children and mentoring teenagers in high-risk communities.

Shared Insights from the Event

Q: How is your organization addressing Diversity, Equity, and Inclusion (“DEI”)? What initiatives does your organization have in place or is planning to put in place to increase DEI? According to the more than 400 law practitioners who responded to the Bloomberg Law 2021 Legal Operations survey, fewer than two-thirds of organizations have metrics in place to track employee diversity and nearly one-third have no plans to put such metrics in place. What metrics, if any, has your organization put into place to track DEI? Are there any overarching legal considerations against putting such metrics in place?

RICHARDS: It is essential for organizations to address DEI through thoughtful, strategic action plans. These plans should consider recruitment of talent from various backgrounds and experiences, consideration of the organizational culture and whether the historically underrepresented individuals want to remain in the organization, and then the areas in which there needs to be institutional transformation. The metrics for this should include both quantitative data - what are representative numbers? How does this compare to the availability and what can be done to utilize availability appropriately? - and qualitative data (i.e., focus groups, climate surveys, and other ways to determine whether culture is shifting). If the measures put in place are narrowly tailored, specifically correlated to the organization’s needs, and go beyond simple quotas, they are more likely to be legally permissible.

LINDEKE: In recognition of my organization’s mission of banking the underbanked fairly and responsibly, DEI is imbedded in our cultural foundation. We consistently strive to identify initiatives to increase DEI; however, we have found that the only real solution is being mindful of the issue in your organization’s everyday business practices. Our organization has engaged an outside, third-party service to assist in measuring DEI. The pernicious effects of systemic racism are real, including - but not limited to - the creation of a wealth gap, clear distinctions in educational opportunities, and real-life work experience. A historically low unemployment rate has made finding qualified candidates extremely difficult, which is compounded when an organization also seeks to fill that position with a diverse candidate. In many instances, employers end up hiring unqualified candidates to be mindful of DEI, which increases legal risk in the event such employees are unable to fulfill their essential job functions, resulting in termination.

Q: What do you forecast will be the top legal issues in 2023 from a tax perspective?

DINURI: As more companies consider allowing remote or hybrid work to continue post-COVID pandemic, companies and their in-house counsel need to be aware of the tax consequences that may arise in allowing such a policy. At the end of 2020, Deloitte conducted a survey of companies with a range of sizes and in a variety of industries regarding the impact of remote work. Companies were asked whether they were proactively tracking employees’ current work locations, and 54% of respondents stated that their company is not actively tracking employees’ remote work locations. Furthermore,, 34% said that they did not have plans to track it in the future. This is concerning since companies need to be aware of where their employees are working as it could affect tax withholding and whether a company has nexus with a state based on the presence of employees in that state. If a state has nexus over a company, that state may now have the ability to impose taxes. What about unemployment taxes and whether the company needs to make contributions to a state unemployment insurance fund? Another consideration is whether a company needs to register its business in states where remote employees are working. Does the company need to obtain state business licenses? As states try to increase revenue, this will be one of the primary areas in which they will increase enforcement efforts. Companies and their in-house and external counsel will need to be prepared to both comply and defend in context where the facts are paramount.