Column: The truth about U.S. taxes is that they aren’t high enough

- Share via

Monday being tax day, it’s only proper to deliver an important home truth to American taxpayers: You don’t pay enough.

That isn’t a reference to the hoary old questions about whether corporations and the rich pay their fair share (they don’t, but more on that in a moment). It’s more about the level of government revenues in the U.S. compared with other developed countries, and compared with what’s needed.

U.S. tax revenues from all levels of government in 2017 were lower as a percentage of gross domestic product than in all but five of the 36 members of the Organization for Economic Co-operation and Development (OECD) — 27.1%. The highest were France and Denmark, at 46.2% and 46%; the lowest Mexico, at 16.2% The OECD average was 34.2%.

These figures put the lie to the claim often heard from anti-tax conservatives — and in grousing around the water cooler — that Americans are taxed at the absolute limit. They’re not, especially in relation to the costs of all the services Americans expect from their government.

The comparatively low tax receipts are the reason that the nation’s infrastructure is crumbling and the educational system is a shambles. They’re the reason that public universities give away faculty-hiring decisions to outfits like the Koch network and make other deals that compromise their principles.

Mark Laret, CEO of the UC San Francisco Medical Center, last week tried to justify UCSF’s appalling proposal to affiliate with the Catholic hospital chain Dignity Health, which discriminates against women and LGBTQ patients, by reminding a UC regents committee that his public institution receives no funding from the state of California.

Internet speeds, consumer product safety oversight, and environmental regulations are all substandard in the United States because the government turns these crucial responsibilities over to the regulated industries, ostensibly to save money. We’re told that Social Security and Medicare benefits will have to shrink in the future because we simply can’t afford them.

One chronically underfunded government service is tax collection itself. The consistent diminishment of the enforcement capabilities of the IRS creates the “tax gap,” the shortfall of revenues compared with expectations, because of tax evasion. Estimates of the size of the tax gap this year run to as high as $600 billion. The U.S. budget deficit is currently $779 billion, as William Gale and Aaren Krupkin of the Brookings Institution report. That means “the tax gap could plausibly have been 70-80 percent as large as the entire budget deficit in 2018,” they observe. Who benefits here? The wealthy, of course — they’re the source of most of the evasion.

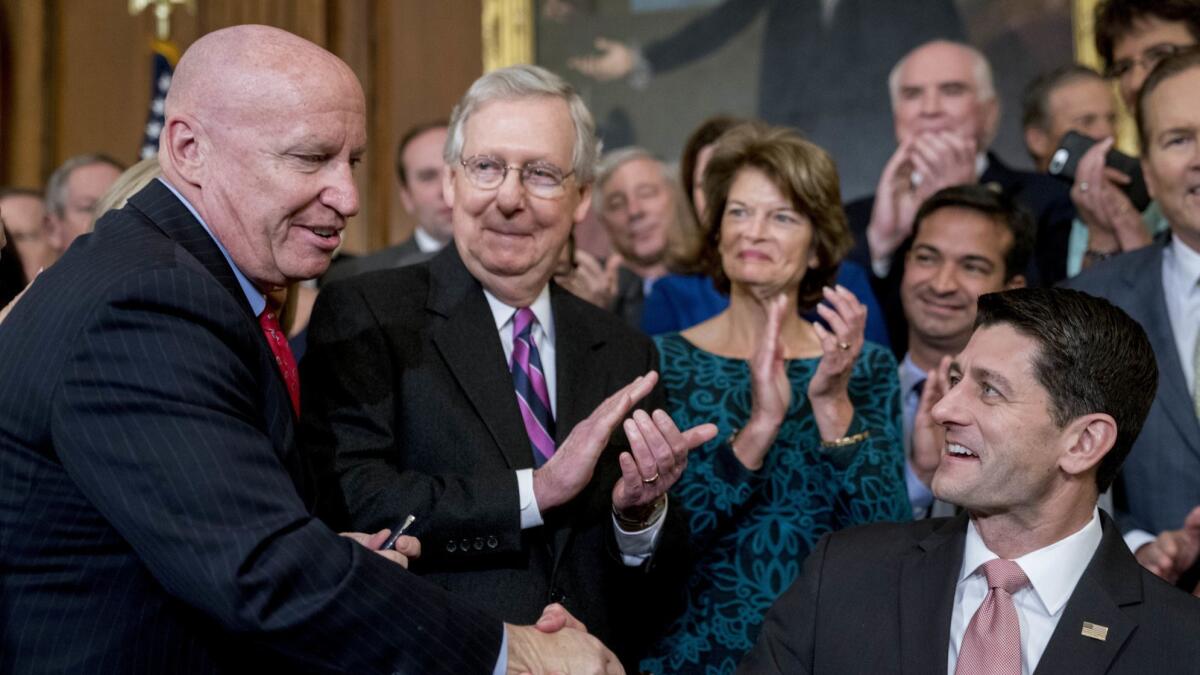

U.S. tax revenues as a share of GDP are certain to be even lower in 2018 than the year before thanks to the Republican tax cut of December 2017. Republicans have claimed that the tax cuts are paying for themselves in heightened economic activity, and therefore higher tax collections, but that’s simply untrue.

In fiscal 2018 (ended September 2018) federal revenues fell to 16.4% of GDP; prior to the tax cut enactment, the Congressional Budget Office had projected they would come in at 18.1%. The tax cuts have exploded the federal deficit, which the CBO expects to top $1 trillion in 2020. According to the Tax Policy Center, the economic growth traceable to the tax cuts will offset only about a quarter of the 10-year revenue loss from the cuts.

The sponsors of the tax cut have struggled to convince Americans that pretty much everyone has received a cut. The raw numbers suggest that overall, about two-thirds of taxpayers will pay lower taxes. But that conceals the greater truth that the overwhelming majority of the cuts are going to corporations and the wealthy.

About a third of middle-class taxpayers will face a bigger bill. Overall, about 6% of households will pay higher taxes, the Tax Policy Center says. That group may be concentrated in states with high state and local taxes, the deduction for which was capped by the tax cut legislation. They’re mostly in states such as California and New York.

There are two main reasons most Americans believe their taxes have gone up, thanks to the Republicans. One is that the cuts for working class Americans were meager to begin with: Taxpayers with earnings below $48,000 got a cut averaging $380, middle-income taxpayers with income between $86,000 and $150,000 got an average cut of $930 — and those with income above about $730,000 (the proverbial 1%) got more than $51,000. The top 0.1%, with incomes of $3.4 million and above, saw their average tax bill cut by more than $193,000.

Adding to the middle- and working-class doubts, the tax cut sponsors chose to deliver their benefits via changes in the withholding tables, reasoning that Americans would be chuffed to see higher take-home totals in their paychecks every week or two. But that cut a small loaf into almost undetectable pieces.

GOP legislators were blind to how average Americans would perceive the results. Then-House Speaker Paul D. Ryan (R-Wis.) drew horselaughs in February 2018 when he tweeted about a secretary at a public high school in Pennsylvania supposedly saying she was “pleasantly surprised” at her increase in take-home pay of $1.50 a week. (The ridicule prompted him subsequently to delete the tweet.) Because of the withholding confusion, as most Americans file their tax returns this tax day, middle-income taxpayers are either writing larger checks to the IRS or claiming lower refunds than they anticipated.

The rationale behind the tax cuts underscores the fundamental conflict between what Americans want from their government and the Republican mantra, dating back to Ronald Reagan and even before, that they can have all those things without paying for them. The harvest has been shrinking public services and soaring income inequality, as the rich get more and the bill falls on everyone else.

Keep up to date with Michael Hiltzik. Follow @hiltzikm on Twitter, see his Facebook page, or email michael.hiltzik@latimes.com.

Return to Michael Hiltzik’s blog.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.