O’Malley’s plan to expand Social Security draws fire from a Wall Street front

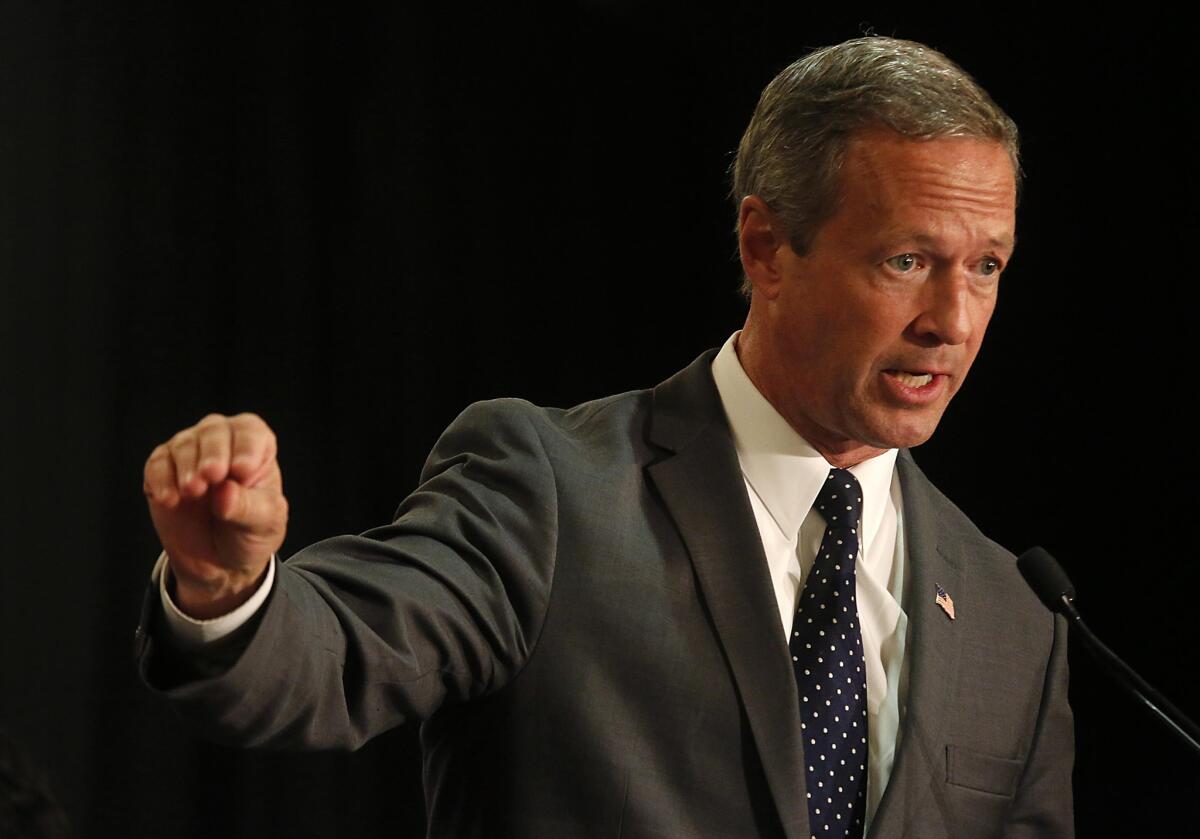

Democratic presidential candidate Martin O’Malley addressed the Young Democrats of America convention in Los Angeles this week.

- Share via

Former Maryland Gov. Martin O’Malley, one of the more overlooked candidates for the Democratic presidential nomination, emerged Friday with an encouraging endorsement of expanding Social Security to make it even more relevant to the lives of working Americans than it is today.

“The economic pressures on millions of families — from stagnant wages and high housing costs, to a lack of affordable childcare and skyrocketing college tuition — have resulted in meager, if any, retirement savings for tomorrow’s retirees,” his statement reads. He’s right about that, and right that Social Security is the one pillar of retirement security that has remained strong, while employer pensions and retirees’ personal nest eggs wither.

O’Malley’s ideas for the program are good, as far as they go. He aligns himself firmly with the progressive camp calling for expanding benefits and requiring wealthier Americans to shoulder their fair share of the program’s cost, which hasn’t been happening. In doing so, he joins his fellow presidential candidate, Sen. Bernie Sanders (I-Vt.), who introduced a proposal to expand Social Security in Congress earlier this year, and Sen. Elizabeth Warren (D-Mass.), who also is pushing to expand the program. The received wisdom on the campaign trail Friday was that O’Malley’s move will increase pressure on Hillary Rodham Clinton, the presumptive favorite in the Democratic race, to endorse Social Security expansion. She’s been silent on the issue.

What’s most significant about O’Malley’s initiative is his foursquare defense of Social Security and opposition to any effort to reduce benefits or privatize the program. He would impose the payroll tax on all earned income over $250,000. Currently, the payroll tax applies only to wages up to an inflation-adjusted $118,500, so O’Malley’s plan creates a window between the lower cap and $250,000. Because the higher figure wouldn’t be indexed to inflation, that window would narrow over time.

O’Malley doesn’t go as far as Sanders, who would impose the tax on all income, including unearned income such as capital gains, over $250,000. Since more than half the income of wealthier Americans comes from unearned sources, that’s a significant difference.

O’Malley would “immediately” boost benefits for all retirees and enhance them especially for lower-income recipients, though he doesn’t provide specifics in his plan. He would award up to five years of “caregiver credits” for those who take time off from work to raise a family or care for elderly family members; this is an important boon particularly for women, whose lifetime earnings for Social Security are often diminished by those years out of the workforce.

If one judges such proposals by its critics, O’Malley’s plan is looking good. An almost immediate broadside came from Third Way, a self-described “moderate,” “centrist” think tank that we’ve described in the past as little more than a Wall Street front. (By my count, of its 32 board members, 25 have had ties to Wall Street firms, the investment industry more broadly, or industry.)

Third Way attacked O’Malley’s plan as “political pandering at its worst” and described it as “heaping superfluous benefits on Lexus-driving retirees in Palm Beach.” Third Way has been consistently and demonstrably wrong about Social Security and the retirement challenges facing America’s working population in the past, so it’s not surprising they’re wrong again here. O’Malley explicitly states that he wants to give minimum-wage and lower-income workers an especially enhanced benefit and raise the special minimum Social Security benefit to 125% of the federal poverty level.

That benefit, which applies to workers with long histories of very low wages, is currently $804 a month, which is about 82% of the poverty level; O’Malley would raise it to about $1,226 a month.

Third Way has been in the forefront of groups sounding unwarranted alarms about Social Security’s future, while proposing retirement programs that wouldn’t do much more than line investment promoters’ pockets. As for its “Lexus-driving retirees in Palm Beach,” this would be unworthy even of a group that wears its Wall Street connections as a badge, much less one that hides them behind the claim of being “centrists.”

The truth is that more than half of all married couples in retirement and about three-quarters of singles get 50% of their income or more from Social Security. For a fifth of married seniors and half of the unmarried, the program accounts for 90% of income.

O’Malley understands that; Third Way doesn’t.

O’Malley’s initiative will be seen as an attempt to remain relevant in a race that appears, at best, to be a two-person dash pitting Clinton against Sanders but looks more realistically to be Clinton’s race. But he and Sanders do serve the purpose of upholding the Democratic party’s progressive principles and thereby keeping Clinton on the left side of the center line. On Social Security, the ball’s in her court. Third Way, or the right way?

Keep up to date with the Economy Hub. Follow @hiltzikm on Twitter, see our Facebook page, or email michael.hiltzik@latimes.com.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.