Since when can’t Ben Bernanke refinance his Washington house?

- Share via

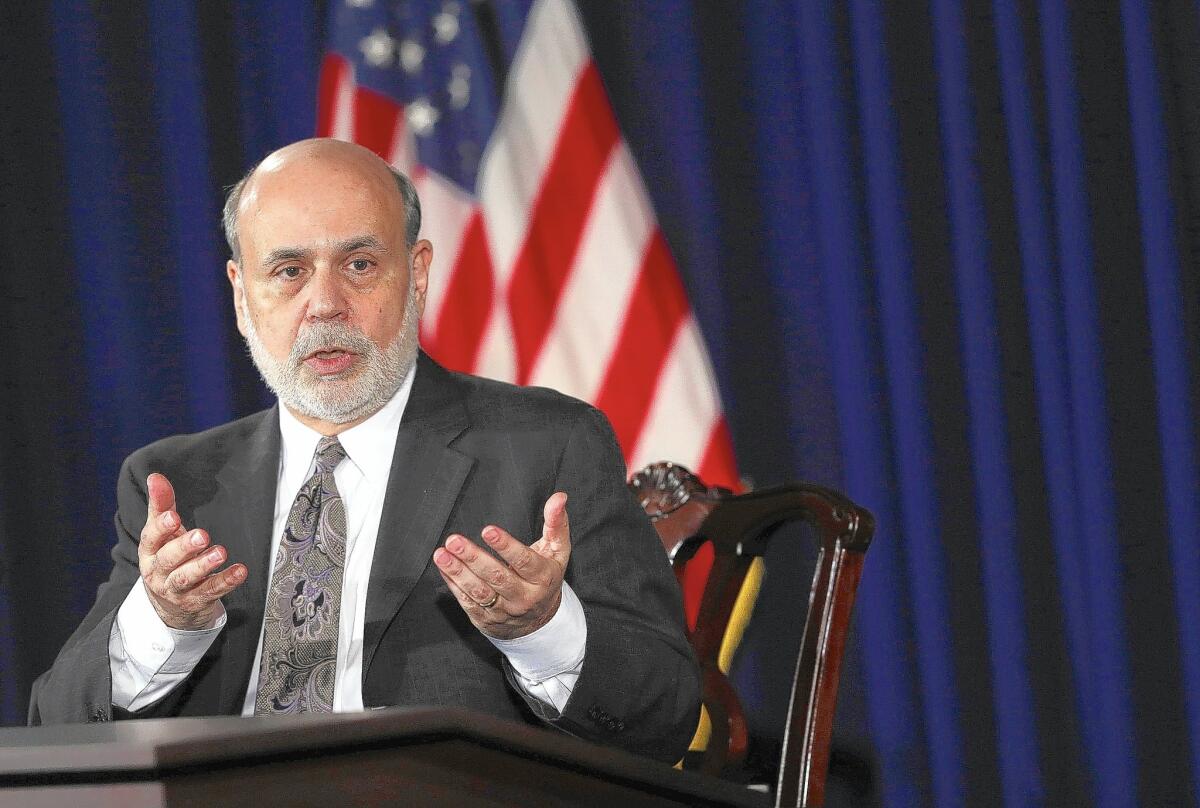

The account by former Federal Reserve Chairman Ben Bernanke of how he couldn’t refinance his Washington townhouse seemed the perfect example of mortgage lending standards that many complain are too tight.

Lending experts, though, said Bernanke’s refinancing woes, which went viral after his remarks at a conference Thursday, could be fixed easily: There are plenty of banks that would replace the $672,000 mortgage the former central banker obtained three years ago.

That was when Bernanke and his wife, Anna, took advantage of historically low interest rates -- driven down by the Fed’s own policies -- to replace a 5.375% loan with another at 4.25%.

Bernanke, who left the Fed in January, has been hiring himself out as a speaker at six figures a pop. The first such appearance, at a forum in Abu Dhabi in March, earned him at least $250,000, according to reports -- more in 40 minutes than he earned all last year at the Fed.

He’s also working on his memoirs, and is a distinguished fellow in residence at Washington’s Brookings Institution, where spokesman D.J. Nordquist said Bernanke “isn’t doing any media” on his efforts to refinance the three-bedroom brick row house, purchased in 2004.

Informed observers said a lender probably ran Bernanke’s request through one of the computerized screening programs common to the industry, which rejected him because he could no longer show two years of stable income from the same source.

That two-year rule, originated by government-supported home finance giants Fannie Mae and Freddie Mac, has become standard for lenders who sell their loans, including jumbo mortgages such as Bernanke’s, which are too large for Fannie and Freddie to handle.

But some credit unions, community banks and major banks don’t sell the home loans. They keep a significant number of them on their books.

That enables them to examine income and assets in alternate ways so long as they obey the master commandment imposed by regulators in the aftermath of the financial crisis: Determine whether the borrower has the ability to repay the debt.

“I’m sure Bernanke’s had at least 30 emails from portfolio lenders who are interested in speaking to him and probably would be able to accommodate him,” said Donovan Ternes, the president of Provident Savings Bank in Riverside.

Provident has about half its $1.1 billion in assets invested in residential first mortgages that it holds on its books. “We could have that conversation” with Bernanke, Ternes said.

Not all the interested lenders would step forward merely because, well, it’s Ben Bernanke, mortgage professionals said.

Some have developed loan programs specifically designed to serve borrowers who fall outside the standard boxes created by Fannie, Freddie and the Consumer Financial Protection Bureau.

One such approach is to look at liquid assets, including earnings on retirement savings, as an alternate way to document that a borrower can afford a loan.

These programs, which require an excellent credit score, would be suitable for an older self-employed person such as Bernanke, who could withdraw 401(k) or individual retirement account savings without penalty.

Bernanke, who reported assets of $1.07 million to $2.28 million back in 2011, would be highly likely to qualify for one of these asset-based programs, said Jeff Seabold, chief lending officer at Banc of California in Irvine.

Banc of California has such a program, designed mainly for self-employed people such as the small-business owners who drive the California economy, Seabold said. It keeps these loans, which require borrowers to have at least 30% down payments or equity in the homes, in its portfolio as investments.

“Frankly, we think there’s a tremendous opportunity to make these loans,” Seabold said.

He said competitors offering similar mortgages to affluent self-employed people include City National Bank in Los Angeles, First Republic Bank and Union Bank in San Francisco, and Wall Street giants JPMorgan Chase & Co. and HSBC Holdings Inc.

If Bernanke were looking for a more down-home approach, he could pick from any number of community banks in the Southeast, where he grew up in the small town of Dillon, S.C., said Christopher Marinac, director of research at investment bank FIG Partners in Atlanta.

Marinac rattled off several banks in South Carolina that would be candidates to finance the native son.

“South State Bank in Columbia could help him out. Or Southcoast [Community Bank] in Charleston, or Southern First in Greenville,” Marinac said. “It’s all about know your customer, and that’s what they do.”

Bernanke purchased the 1,842-square-foot home for $839,000, property records show. Zillow estimates its current market value at $968,486.

Follow @ScottReckard on Twitter for news about banks, home loans and related lovable objects.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.