City National deal began with a Canadian banker going undercover

- Share via

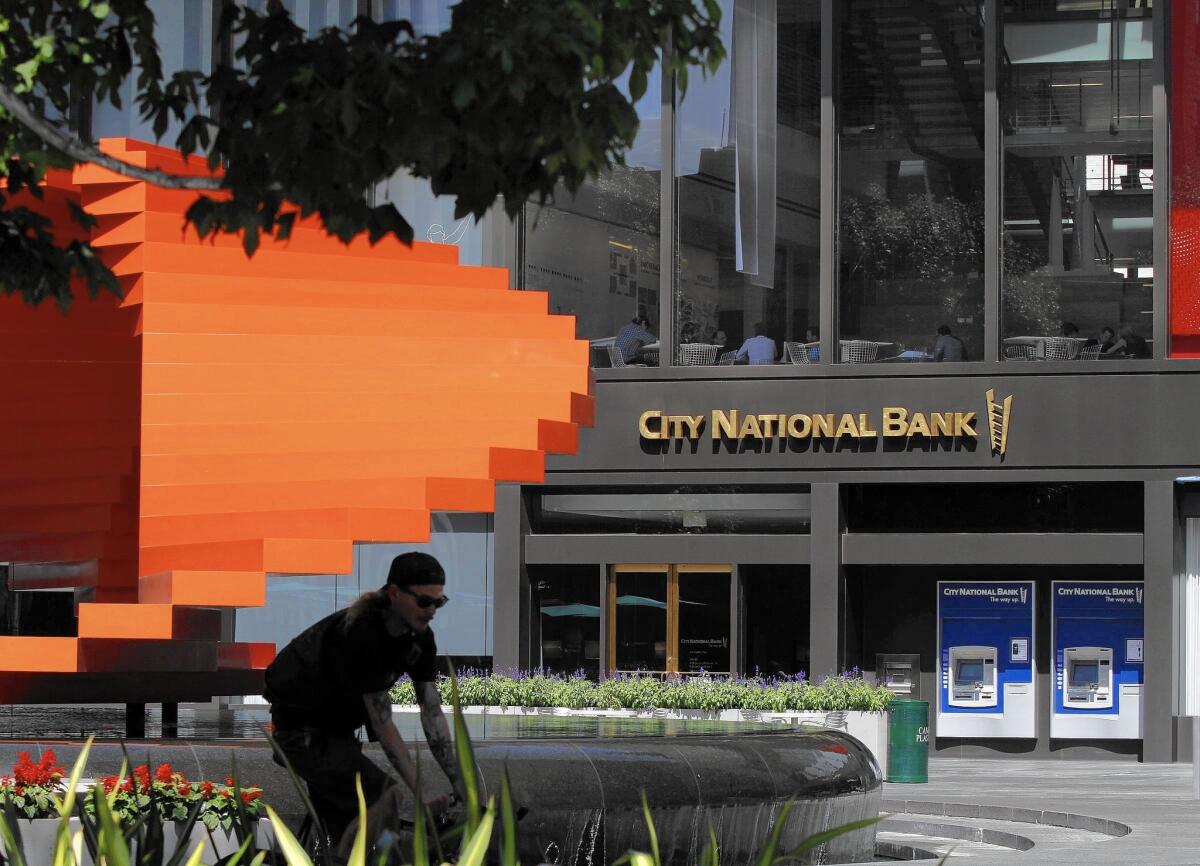

Before spending $5.4 billion to buy City National, the Los Angeles “bank to the stars,” Royal Bank of Canada Chief Executive Dave McKay wanted to see firsthand what he would be getting.

McKay personally went to branches in L.A. and New York, posing as one of the wealthy clients that City National specializes in serving — the kind of customer that made RBC want to buy the bank.

“I actually mystery-shopped New York and L.A. branches and found the experience was very, very consistent,” McKay told The Times.

City National Bank has long been known for its Hollywood clientele and deep ties to the entertainment industry. But the way the firm caters to the walk-in customer helped persuade McKay to buy the bank for a sizable premium over its current stock price.

The surprise deal was announced Wednesday by the parent of City National and RBC, which was eager to expand its U.S. presence, especially in wealthy markets such as Southern California, the San Francisco Bay Area and New York. RBC pursued City National for more than two years, even though the bank was not for sale.

The acquisition is the latest in a series of high-profile mergers involving California regional banks. PacWest Bancorp and CapitalSource Inc., both based in Los Angeles, struck a $2.3-billion deal to combine in 2013. Last year, OneWest Bank in Pasadena agreed to sell itself for $3.4 billion to CIT Group Inc. in New York.

City National has $32.6 billion in assets and 75 offices in five states. It will remain a separate brand under RBC, with headquarters in Los Angeles.

Being part of RBC, which has $760 billion in assets, strengthens City National’s ability to provide financial services to Hollywood and enables it to expand into the entertainment industries in Vancouver, Toronto and London, said City National Chief Executive Russell Goldsmith.

“It was just such a golden opportunity,” he told The Times. “The bank never was for sale. But sometimes when opportunity knocks you’ve got to seize it.”

City National opened in 1954 with a small office in Beverly Hills, billing itself as an alternative to the big banks in downtown L.A. Among the founders were Goldsmith’s grandfather, Ben Maltz, and Alfred Hart, partners in a wholesale liquor business.

Hart also was a board member at Columbia Pictures, and the bank began catering to accountants and business managers in nearby Hollywood.

Actress Donna Reed cut the ribbon at a branch opening. Canine movie star Rin Tin Tin promoted the bank, photographed holding a canvas City National moneybag in his teeth.

But City National’s reputation as the “bank to the stars” really took off in 1963 when it advanced Frank Sinatra the cash he needed to pay a ransom after his son was kidnapped from Harrah’s Lake Tahoe.

Sinatra repaid that and other favors from Hart in 1975 by performing at a benefit that raised $3.5 million from hundreds of Hollywood A-listers to help build the Alfred and Viola Hart Tower at Cedars-Sinai Medical Center. At the event, Sinatra thanked the bank.

Hart was good friends with Sinatra and had helped finance the film that marked his comeback, 1953’s “From Here to Eternity.”

City National carved out a business providing bridge financing for Hollywood films, including “Silence of the Lambs” and “Driving Miss Daisy.”

It has branched out into the broader entertainment industry, offering financial services to hip-hop artists in Atlanta and country music singers in Nashville. City National is the banker for many Broadway shows, including the recent hit “The Book of Mormon” and is the official bank of the Tony Awards.

The bank’s entertainment industry expertise was a major attraction, McKay said.

“City National’s clients are largely high-net-worth individuals and commercial enterprises, two of the fastest-growing client segments in the U.S.,” McKay said.

Bram Goldsmith, who was Maltz’s son-in-law and later became the bank’s longtime chief executive and chairman, said the transaction was a “win-win deal.”

“Apparently they had been looking to expand and decided that we were the only bank they could find that had the same direction and desires that they have,” he told The Times. “They’re not bringing people in. They wanted an organization and our management, so we’ll continue to do what we do, with greater support from the 12th-largest bank in the world.”

RBC will buy City National for $2.7 billion in cash and 44 million RBC shares, the firms said. City National shareholders will get $47.25 in cash and 0.7489 share of RBC common stock for each share of City National common stock.

The deal values City National stock at $93.80 a share, a 26% premium above Wednesday’s closing stock price of $74.57.

The Goldsmith family owns a 13% stake in City National, valuing their holdings at about $700 million.

In a vote of confidence for Royal Bank, the family will take its share of the sale entirely in stock and has agreed to sell no more than half the shares until at least three years after the deal closes. Russell Goldsmith will also remain at City National for at least three years.

News of the deal sent the stock soaring Thursday. Shares of City National rose $14.11, or 19%, to $88.68, on the New York Stock Exchange.

RBC shares fell $1.90, or 2.5%, to $74.71 on the Toronto exchange. The deal could lead to greater regulatory oversight by Washington because RBC’s U.S. assets will rise above $50 billion.

RBC emerged as a heroic campaigner against predatory high-speed stock trading with the publication last year of “Flash Boys,” Michael Lewis’ book exposing the industry’s obsession with trading speed. The book described how the bank’s corporate culture became known as “RBC Nice,” in contrast with the cutthroat norms of Wall Street.

The City National deal comes at a time when banks that survived the Great Recession are being pinched by low interest rates, which cut into their profit on lending.

Shares have declined over the last year at publicly traded California regional banks, including East West, Cathay, Pacific Western and Citizens Business in Southern California, and Silicon Valley and First Republic in Northern California.

City National stock had fared worse than most, falling 8% in the 12 months that ended Wednesday.

McKay said RBC identified City National as a prime target for its U.S. expansion.

RBC was attracted by what it called City National’s “market-leading position in the entertainment industry and an emerging presence in the rapidly growing technology and healthcare segments.”

After buying other regional banks more than a decade ago in secondary market positions, McKay said RBC learned that it had to start with a “tier one” product — another reason why he personally helped research City National.

McKay said he first approached Russell Goldsmith about two years ago. The two had never met.

“We talked about how the two companies together could do something special in the U.S. market,” McKay said. “He said, ‘But I’m not for sale.’”

McKay said he asked Russell Goldsmith to consider it.

Goldsmith will remain as chairman and chief executive of City National and oversee RBC’s U.S. wealth-management unit. Meanwhile, the Goldsmith family and City National will continue to support Los Angeles, Russell Goldsmith said.

“As the bank grows and prospers, we’ll be able to expand, hiring more people in California,” he said.

Bram Goldsmith, 91, said City National started six decades ago with just three employees. Now it will be a key part of a multinational financial firm.

“It’s a very bright future,” he said.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.