Three-year prison term recommended for former KPMG auditor

- Share via

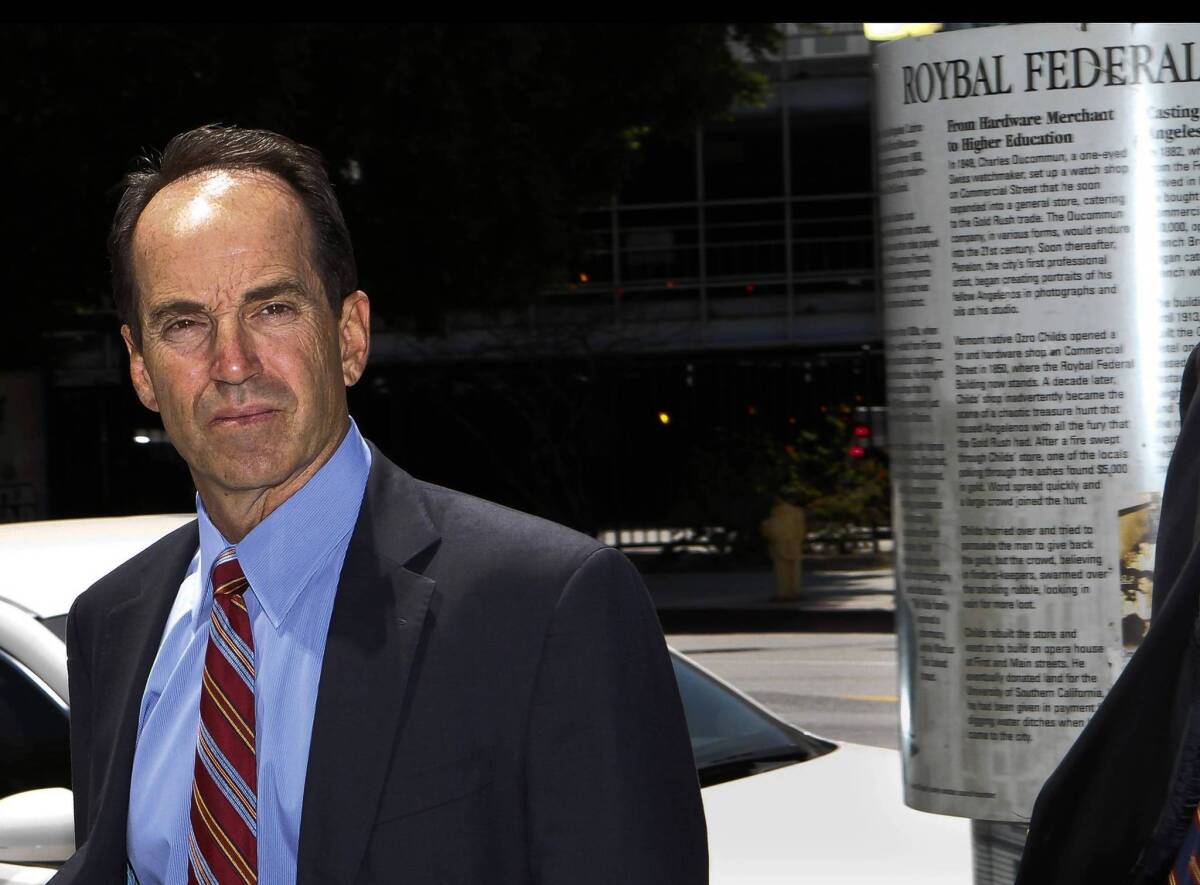

Former KPMG auditing partner Scott London should spend three years in prison on his insider-trading conviction for selling secret information about the accounting firm’s clients to a stock-trading friend, the federal probation office in Los Angeles recommended.

The tips to Encino jeweler Bryan Shaw resulted in nearly $1.3 million in profitable trades, prosecutors alleged.

The probation office, in a confidential report, recommended the prison term, and the information was disclosed in court papers filed recently by London’s attorney, Harland Braun.

London, who supervised a team of auditors at KPMG’s Los Angeles office, was secretly photographed by FBI agents in February accepting cash from Shaw as payment for past tips about the accounting firm’s clients.

Authorities filed charges in April. London later pleaded guilty to insider trading, admitting he gave Shaw sneak previews of earnings reports from companies that included Los Angeles nutritional products firm Herbalife Ltd. and footwear maker Skechers USA Inc.

KPMG fired London after learning of the allegations.

Braun said in court papers that the proposed three-year term and $100,000 fine were excessive. He recommended no more than 18 to 24 months and a fine of $25,000. He argued that London already has paid dearly for his crime, losing his $900,000-a-year job and a host of friends at the company who are banned from talking to him.

“A large number of people, many of whom numbered among Scott’s closest friends, have been permanently removed from his life,” Braun said.

Thom Mrozek, a spokesman for the U.S. Attorney’s office, declined to comment on what prosecutors would seek.

Braun said the probation office has inappropriately calculated the financial loss — a key sentencing factor — as $1.27 million, the amount Shaw made from illegal trades. London had no way of knowing that his friend was making so much money, Braun said.

“Shaw told Mr. London that he would be receiving one-third of the total gains,” Braun said. Because Shaw paid London “around $66,000 in cash and gifts,” London believed that Shaw’s total profits were about $200,000, Braun said.

“Mr. London should not be held responsible for the $1.27 million unless he could have reasonably anticipated that Shaw’s illicit earnings would add up to that amount,” Braun said.

If the sentence were based on a loss of $200,000, London’s potential sentence would be reduced to a range of 18 to 24 months, Braun said.

In his sentencing motion, Braun suggested that London started the scheme to help his friend, who was having financial difficulties.

“When Mr. London made the ill-conceived decision to provide Bryan Shaw with illegal stock tips, beginning in October of 2010, it was largely in response to Shaw telling him that his jewelry business was doing very poorly,” Braun said.

“Mr. London felt very sorry for Shaw and, unfortunately, made the bad decision to provide him with quarterly earnings information as well as acquisition information concerning a few select companies,” the lawyer said.

Citing London’s wrongdoing, KPMG resigned as auditor for Herbalife and Skechers and withdrew its past approval of three years’ worth of the companies’ financial statements, forcing them to hire new accounting firms and to re-audit those statements. Both companies are expected to seek substantial reimbursement from KPMG.

London is scheduled to be sentenced Dec. 9 by U.S. District Judge George H. Wu. Shaw, who also has pleaded guilty, is scheduled to be sentenced Jan. 23.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.