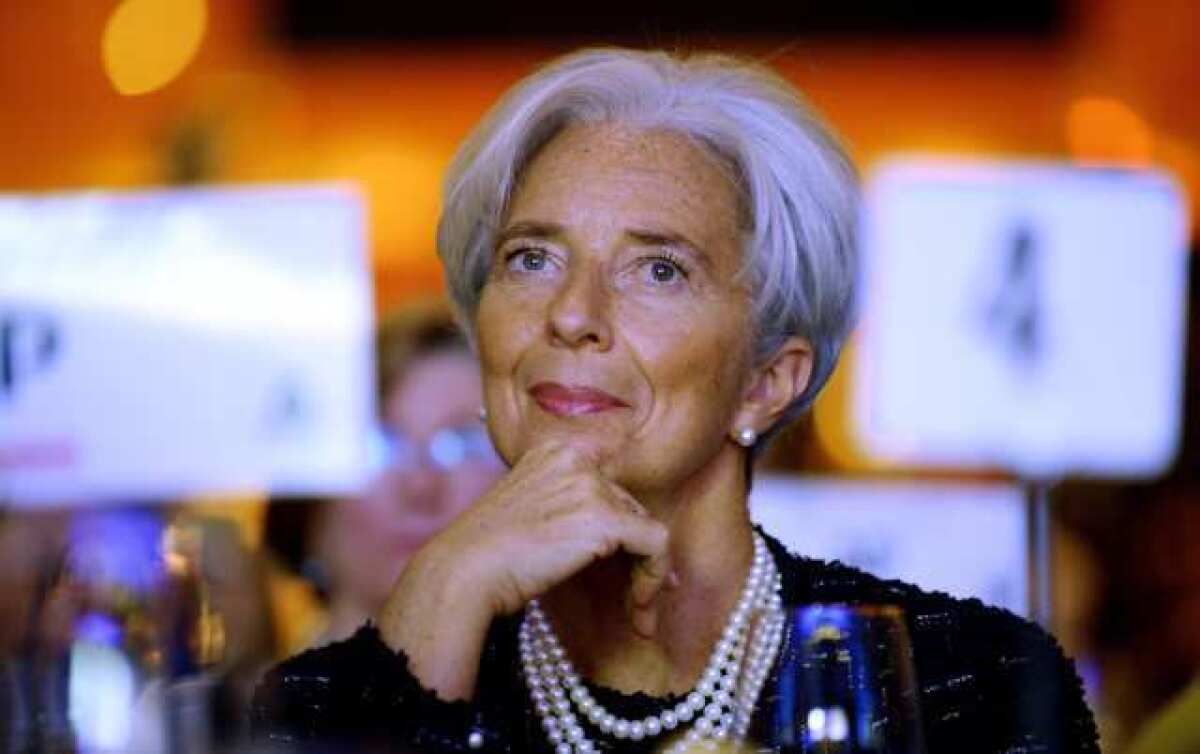

IMF’s Lagarde: All of the focus should be on achieving stability

- Share via

For there to be stability in Europe and around the world, the U.S. needs to get its act together, said Christine Lagarde, managing director of the International Monetary Fund in a speech Tuesday.

“The world is growing smaller and more interconnected by the day, meaning that economic disruption in one country can touch people all across the globe,” Lagarde told journalists at the Associated Press Annual Meeting inWashington, D.C.

The U.S., she said, holds $2.5 trillion in foreign assets while banks abroad have $5.5 trillion in U.S. assets. The country makes up 11% of international trade, she said.

“So America has a large stake in how Europe fares -- and how the world fares,” she said.

Overall, the economic situation has improved over the past few months, with “some signs of thaw – welcome signs after the longest, hardest winter in a generation,” Lagarde said.

But she warned against “a false sense of security,” pointing to high public and private debt in Europe and rising oil prices that “have the potential to do a lot of damage.”

American household debt needs to be tamped down, she said, pointing to the 1.5 million delinquent mortgages in the country. And scaling back unemployment – which now affects nearly 13 million people in the U.S. and more than 200 million workers worldwide – must be a priority, Lagarde said.

Monetary policy will go a long way toward boosting growth, but Largarde also cautioned that “a global undifferentiated rush to austerity will prove self-defeating.”

Other goals: Countries must better coordinate on enforcing cross-border regulations for banks, Lagarde said. The U.S. should curb its entitlement spending, boost mortgage write-downs and ease refinancing.

“In today’s world, we cannot afford the luxury of staying in our own mental backyards,” Lagarde said.

She also made an appeal for the IMF’s 187 member companies to send more financial resources to the organization, which, she said, acts as an “economic club and a giant credit union” to pool resources from its partner nations.

It probably helps that the U.S. is the IMF’s largest shareholder.

“The time has come to increase our firepower,” she said.

RELATED:

Eurozone countries build a bigger financial ‘firewall’

U.S. will grow faster than Europe amid debt crisis: OECD

IMF predicts mild European recession, lower global growth in 2012

Follow Tiffany Hsu on Twitter and Google+

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.