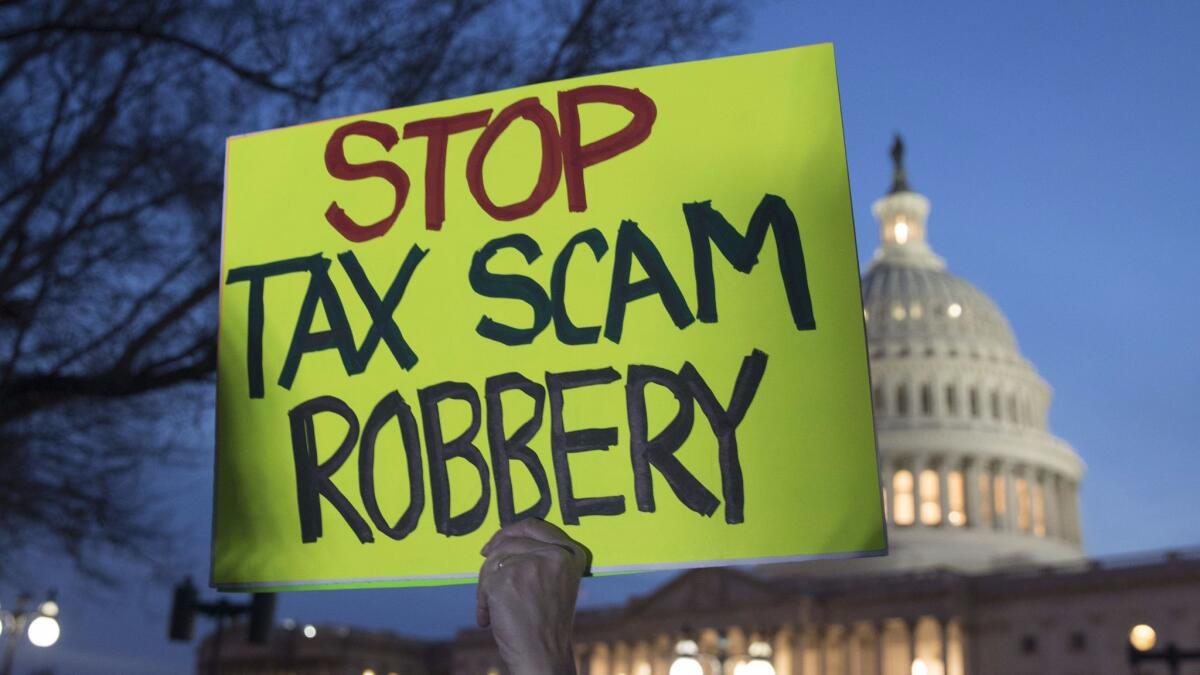

Why failing to pay your taxes is a risky form of protest

- Share via

Dear Liz: I write in earnest hope that you might consider giving advice to those wondering about withholding federal taxes as a form of protest over the enactment of the new tax bill. What are the possible legal ramifications of withholding federal taxes?

If one is willing to accept the possible consequences, how might one go about the nuts and bolts of not paying federal taxes, and are there any measures one might take to mitigate the legal consequences somewhat? For instance, if one spouse withholds taxes but the other pays, does filing separately at year’s end afford any layer of protection to the paying spouse?

Answer: Please find another way to protest.

The Internal Revenue Service has extraordinary powers to collect what it’s owed. The agency can seize your bank accounts, property and a portion of your income. People who willfully fail to pay their taxes can wind up in prison. Filing taxes separately may keep the paying spouse on the other side of iron bars, but it won’t prevent his or her life from being disrupted.

Our duty to pay taxes doesn’t rest on our approval of every single aspect of the tax code. If that were the case, few of us would pony up. Fortunately, in a representative democracy you have plenty of legal options to work for change. The same Constitution that gives Congress “the power to lay and collect taxes” also gives you the right to express your opinion, to assemble in peaceable protest and to vote for new lawmakers at the appropriate times.

If you want to work for change, do so in ways that actually have a chance at success, rather than one that will succeed only in making your life worse.

How to cash savings bonds for children

Dear Liz: My son is trying to cash in his children’s savings bonds, which seems to be difficult. You used to be able to go to a bank to do that. Is that still possible? If not, how can you do it now?

Answer: If the bonds were electronic, they probably would be held in a special minor’s account at TreasuryDirect.gov, the government site that allows investors to buy and redeem Treasury securities. If your son was identified as the person to have authority over the account, it would be relatively easy for him to redeem them.

We’ll assume, then, that your son is dealing with paper bonds. We’ll further assume that your grandchildren are still minors and that your son is cashing these bonds for their benefit, rather than his own. Many banks are leery of cashing children’s bonds precisely because parents (or people posing as parents) may be trying to rip off their kids.

Parents are allowed to redeem a child’s paper saving bond if the child lives with that parent and is too young to sign the request for payment, according to TreasuryDirect. The parent should write the following on the back of the bond:

“I certify that I am the parent of [child’s name]. [Child’s name] resides with me / I have been granted legal custody of [child’s name]. [She / he] is ___ years old and is not of sufficient understanding to make this request.” Your son should find a bank willing to certify or guaranty his signature. Then, in the presence of the bank representative, he must sign the request with his name “on behalf of [child’s name].”

Then he can send them to Treasury Retail Securities Site, PO Box 214, Minneapolis, MN 55480-0214. If the bonds are electronic, he can log into TreasuryDirect.com and follow the instructions there. Your son can contact the U.S. Treasury at (844) 284-2676 for further details.

Credit freezes complicate setting up online Social Security accounts

Dear Liz: You’ve recently written about protecting ourselves by establishing online Social Security accounts. Social Security prevents me (or anyone else) from creating an online account because I have credit freezes in place. As I understand the process, Social Security uses the credit bureaus to verify my identity. With a freeze, there’s no identity verification. In other words, in order to set up a fraudulent online account, someone besides me would have to unfreeze my credit report first. Is that correct?

Answer: Pretty much. Another way to establish an online account is to go into a local Social Security office with proper identification. But most hackers are unlikely to take the trouble to do either.

You may still want to create an online account to monitor your Social Security earnings record and promptly correct any mistakes or spot employment fraud (someone using your number to get work).

You could make a trip to a Social Security office or temporarily lift your freeze with the bureau that’s providing identity verification services. Currently, that bureau is Equifax — and yes, that’s the bureau that suffered the massive database breach that started this discussion.

Liz Weston, certified financial planner, is a personal finance columnist for NerdWallet. Questions may be sent to her at 3940 Laurel Canyon, No. 238, Studio City, CA 91604, or by using the “Contact” form at asklizweston.com. Distributed by No More Red Inc.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.