Dr. Patrick Soon-Shiong is postponing IPO of healthcare data company NantHealth

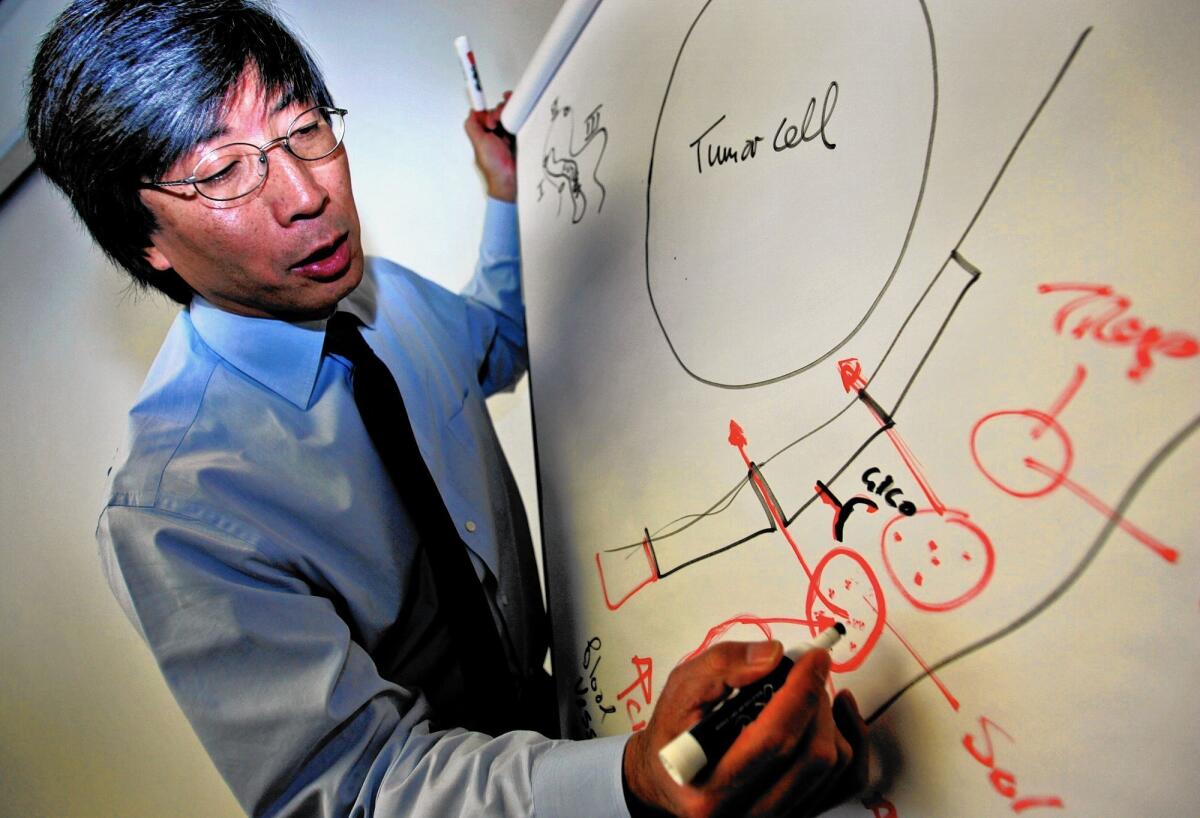

Dr. Patrick Soon-Shiong, who leads healthcare data firm NantHealth and NantKwest, a developer of cancer therapies, draws an illustration about tumor cells and how they react to cancer treatment.

- Share via

Dr. Patrick Soon-Shiong, the billionaire L.A. medical entrepreneur, is postponing the planned initial public offering of his healthcare data company, NantHealth.

The news comes five months after Soon-Shiong told The Times that he planned to take the Culver City company public by the end of this year.

But a lot has changed since then — even for a company that counts itself among the new class of “unicorns,” or tech start-ups valued at more than $1 billion.

Biotech stocks have been hammered in recent months amid calls for governmental regulations of drug pricing. The Nasdaq Biotechnology Index, a collection of biotech and pharmaceutical companies, has fallen 15% from a recent high in July.

And it’s been a rough year for IPOs, with more than half of new public companies trading below their offering price, according to Renaissance Capital, an IPO research firm and fund manager.

Soon-Shiong has already been stung by that downturn. NantKwest Inc., a developer of cancer therapies that he controls and is closely tied to NantHealth, has shed more than $1 billion in market capitalization since its July IPO.

Its stock surged 39% in its first day of trading — valuing his stake at roughly $1.4 billion — but has fallen 53% since then.

“We’re basically ready. The problem is, we don’t want to go out in the current market. There is no reason for us to go out there in a bear market,” said Soon-Shiong, who noted that the company is “well capitalized.”

NantHealth stores medical records in the cloud and analyzes genetic information to help doctors find the best treatment for cancer and other diseases.

Allscripts Healthcare Solutions Inc., an electronic medical records firm, agreed in June to pay $200 million for a 10% stake in NantHealth, valuing the company at $2 billion.

The downturn in biotech stocks began in September when Democratic presidential candidate Hillary Clinton announced a plan to reduce the pricing of prescription drugs.

Things got worse in October after reports that Canadian firm Valeant Pharmaceuticals International Inc. used a network of specialty pharmacies to help drive up the pricing of several of its drugs.

Kathleen Smith, who manages Renaissance Capital’s IPO-focused exchange-traded funds, said Soon-Shiong is probably wise to wait.

“We don’t have an enthusiastic set of public buyers for IPOs,” she said. “Public investors are wanting very low valuations. They won’t come in unless they’re getting a discount, particularly for companies that aren’t earning money.”

Among recent notable tech IPOs, payment company Square saw its shares soar 45% to $13.07 on Nov. 19, their first day of trading. But that came after the offering price was sharply discounted, and the stock has fallen by about $1 since then.

Soon-Shiong, who founded NantHealth, boasts that it can analyze the genetic data from a tumor in 47 seconds and transfer it electronically to a doctor. That information can then be used to develop a course of treatment.

However, that claim has been challenged in court. Two former NantHealth employees sued the company in Florida this year, alleging that they were fired after expressing concern that NantHealth had made fraudulent claims about the effectiveness of its products in marketing materials.

Stephanie and William Lynch said they brought their concerns to the attention of supervisors and were fired as a result.

They sued NantHealth in the Bay County Circuit Court for allegedly violating Florida’s Private Whistleblower Act. The couple were dating while they were employed at NantHealth and they are now married.

“I dug really deeply to vet what was on the website and brochures,” said William Lynch, who had worked as the company’s marketing director out of its offices in Panama City, Fla. “There’s a very big disparity between what the products actually did and what they were saying to clients and investors.”

Soon-Shiong said the claims are “completely without merit,” and the company intends to rigorously defend itself in court.

Meanwhile, Soon-Shiong has taken steps to boost NantKwest, a San Diego-based company with significant operations in Culver City. Soon-Shiong is NantKwest’s chairman and chief executive, and owns a majority of its stock through an investment partnership.

On Nov. 12, the company announced plans to repurchase $50 million worth of its stock. The company’s market capitalization stands at $1.35 billion.

NantKwest is in one of the hottest and most promising fields in cancer therapy: immunotherapy, which boosts the body’s own immune system to seek and destroy cancer cells.

The company is in the early stages of testing its cancer treatments and could be years away from getting a product to market. It reported a loss of $160 million for the first nine months of this year, but significant losses are typical for early-stage biotech companies researching and testing new medications.

ALSO

Have civilian drone pilots become part of the Air Force’s ‘kill chain’?

MLB to investigate Dodgers’ Yasiel Puig for role in reported fight

Colorado Springs’ ‘mass chaos’ ends with shooting suspect in custody, officer and 2 others dead

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.