After two decades, time for couple to stop living day to day

- Share via

When Jerry Tejeda was a teenager, financial stability was just about the last of his concerns.

He was in a gang and was sent to juvenile hall several times for a variety of crimes. At one point, he was homeless. Then, when he was 18, he and his girlfriend, Josephine, had a son.

“The birth of my son changed my life; it was a spiritual and emotional awakening,” Tejeda said. “I didn’t know how to be a husband or a father, but I didn’t want my son to feel the fear and loneliness I had felt. I didn’t want him to see what I had seen.”

Tejeda turned his back on gang life. He and Josephine married, and he got his high school equivalency degree.

Skip ahead about two decades to the present. Jerry, 39, and Josephine, 45, live in a house they rent in Ventura. They have six children, three of them still at home, and four grandchildren.

Jerry works as a graphics coordinator for the Oxnard School District, and he has started a janitorial business. Josephine was laid off from her job as a medical insurance processor and will soon go back to school.

The Tejedas accomplished much as a family, but their finances are still a mess. They never learned how to properly manage money, and it has gotten them into trouble.

Ten years ago, they filed for bankruptcy protection when they couldn’t pay $18,000 in credit card debt. More recently, a creditor has been phoning them to recover an unpaid credit card bill dating back to 2009. With accrued interest, the $325 bill has doubled to $650.

Jerry said he owes the Internal Revenue Service $3,750 and the state of California $1,250 for back taxes from his janitorial business.

And the Tejedas have almost no savings.

“We try to save,” Josephine said. “But every time we do, we end up dipping into savings to pay the bills.”

Recently, Josephine withdrew $5,000 from her 401(k) retirement account to put new tires on her car and meet other expenses. That withdrawal from a tax-sheltered account was rife with penalties.

The Tejedas decided it was time to get their financial lives in order and asked for help.

Brad Hartman, a financial planner in Glendale, reviewed the couple’s situation.

This year the Tejedas will make about $64,000, down $10,400 from last year. Josephine lost her job in November. She currently gets $1,096 a month in unemployment benefits, but that runs out at the end of this year.

They have only about $250 in savings and they owe $14,000 on car loans.

Monthly expenses include $1,500 in rent, an estimated $600 on groceries, $335 on restaurant meals and $50 to groom their dog.

But in large part, they don’t know where their money goes, and because they don’t have credit cards, there is little in the way of a paper trail.

“All these years, they’ve been living day to day without any plan or way to track their spending,” Hartman said.

He suspected that they spend more than they estimated in several areas, including on groceries and eating out. Also, they spend a good deal on gifts for family members, and Jerry spends an undetermined amount on “Star Wars” memorabilia.

Hartman said part of the problem is that the Tejedas don’t have a shared budget and have separate bank accounts. “They have no visibility into what each other is doing with their money,” Hartman said, expressing surprise that after 20 years together they don’t have a joint bank account.

The couple need to change their ways if they want to achieve their goals. One day, they would like to own a home. Jerry wants to go back to school so that he can try for a management position within the school district. He also wants to learn how to run his janitorial business more efficiently.

Last year, the business generated about $15,000 in income for Jerry, though it meant he often spent weekends cleaning office buildings.

Hartman said the good news is that the Tejedas are relatively young and still have time to advance their careers and save for their future. They’re also hard workers.

But to get ahead, they’ll have to start at the financial beginning. Hartman said the couple need to work as a team to create a common budget and meticulously track spending. They also need to boost their earnings.

Based on current family income, Hartman created a budget that allows the couple to save $425 a month. To do this, he cut back the cable and cellphone plans, saving the Tejedas $1,140 a year. He also slashed their monthly restaurant tab to $100 from $335.

“That’s way too high for their income,” Hartman said.

He nixed Jerry’s spending on “Star Wars” memorabilia. And he told Josephine that grooming for the couple’s dog was too pricey.

Hartman did put in the budget the cost of books for courses Josephine will be taking, starting in August, at a local community college. She obtained a financial waiver for the cost of the courses, and taking the classes could increase her hourly wage by 29%, she said, when she goes back to work.

Currently, only one of the children living at home helps with the household expenses: Their 21-year-old (the oldest of the three at home) pays $200 a month toward the rent. Hartman said the situation seemed OK for now, but if any of the three boys reaches his mid-20s and is still in the house, the family should reevaluate how much he should contribute.

Hartman added to the budget an item for vacations. Jerry and Josephine haven’t taken a vacation in 20 years and they deserve a break, he said.

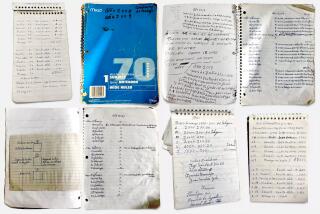

The planner suggested they open a joint checking account from which they would pay bills. But he also put them on an envelope budgeting system, under which they will have one envelope for each of 12 budget categories, such as gasoline and groceries.

The way the system works is that at the beginning of the month, they put enough cash into each envelope to meet that category’s costs. Every time they take money out of an envelope, they have to note what it’s for.

By physically seeing where the money goes, Hartman said, the Tejedas are more likely to stay on budget.

They also have to establish some emergency savings, he said, especially because they don’t have credit cards to use if a vital, unexpected expense arises. Hartman said the couple should as quickly as possible get $1,000 into an emergency savings account.

Next, they should work on eventually putting the equivalent of six months of their expenses into a money market account.

Simultaneously, while saving, they have to work on paying down debts. To deal with their past credit card charge, Hartman suggested they offer $200 to settle the matter. And if that’s accepted, they should get written documentation that they no longer owe the debt.

Any extra money they have at the end of a month should go toward paying down their tax bills and paying more than the minimums on the car loans.

To get these debts out of their lives faster, the Tejedas should be aggressive about bringing in more income. When Josephine finishes her classes by the end of the year, she should look for work right away, Hartman said.

If Jerry continues to work for the school district all the way up to age 67 and then retires, the couple’s retirement could be well funded. He would receive a yearly pension of roughly $66,000. Assuming he and Josephine both work until retirement age, they also would receive a combined $36,000 in Social Security benefits yearly. That would bring their annual retirement income to $102,000.

But that’s an ideal scenario, and they have to first save and get rid of debts in order to meet whatever happens in their lives.

The Tejedas were eager to follow the planner’s recommendations.

“It was a blessing,” Jerry said about Hartman’s advice. “It was eye-opening and educational.”

Jerry said he and Josephine plan to stick to the envelope budgeting system, and he began to look for more business for his janitorial service to increase income. Recently, he landed two more accounts.

The one bit of Hartman’s advice they didn’t have to worry about was saving for a short vacation, at least for this year. Their children are taking them to Disneyland this month for their 20th anniversary.

Do you need a money makeover? Each month the Sunday Business section gives readers a chance to have their financial situations sized up by a professional advisor at no charge. To be considered, send an e-mail to makeover@latimes.com. You also can send a letter to Makeover, Business Section, Los Angeles Times, 202 W. 1st St., Los Angeles, CA 90012. Include a brief description of your financial goals and a daytime phone number. Information you send us will be shared with others.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.