Newspaper publishers may merge with regional rivals to survive

- Share via

The possible sale of the Orange County Register’s parent company could mark the start of a cost-cutting wave of consolidation of rival newspapers within regional markets.

It once was rare for newspapers to team up with nearby competitors, in part because of antitrust concerns. But after several years of aggressively slashing expenses, many publishers see such consolidation as the response to a slide in advertising revenue, which has continued this year despite a firming of the overall U.S. economy, experts say.

Although the newspapers would retain their separate identities, acquirers could save millions of dollars by consolidating administrative operations. And because of the troubled state of the industry, antitrust objections are seen as less likely than they might have been before.

Companies such as MediaNews Group long have chased operating efficiencies by owning multiple papers within geographic regions.

But the latest moves go further, with the potential to leave only a single company owning every newspaper in a broad region such as Southern California, said Ken Doctor, an analyst at research firm Outsell Inc.

“This is all about geographic clustering,” said Doctor, who writes a blog about the media industry at Newsonomics.com. “Any opportunity to combine companies, they’re going to take advantage of.”

There is plenty of room for consolidation because the newspaper business is far less concentrated than many other industries, Doctor said. Newspaper giant Gannett Co., the U.S. market share leader, has just more than 10% of total newspaper circulation nationwide, he said.

The lure of slashing expenses appears to be a central element in the auction being conducted by Freedom Communications Inc., which publishes 100 newspapers including the Register and operates eight TV stations.

The Irvine-based firm, which emerged from Chapter 11 bankruptcy protection last year, has sought bids for all or part of the company. A Freedom spokesman declined to say whether any offers were made before the Thursday deadline set by the company.

A number of suitors, however, are believed to have interest in various parts of Freedom, including Tribune Co. — which owns the Los Angeles Times, KTLA-TV Channel 5 and other media properties — and MediaNews, a Denver publisher whose holdings that include the Daily News in Woodland Hills and the Press-Telegram in Long Beach.

Two Los Angeles private equity firms, Gores Group and Platinum Equity, also were reportedly contemplating offers. Platinum owns the San Diego Union-Tribune.

It isn’t clear whether any of the prospective suitors would be interested in swallowing all of Freedom. Representatives of all of the companies either declined to comment on the auction or couldn’t be reached.

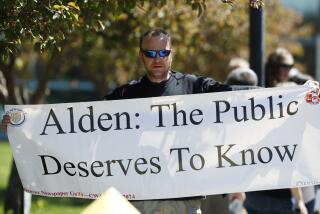

Some investors holding stakes in multiple newspaper firms may seek consolidation to lift their combined value. These financial players typically bought the companies’ debt at depressed prices, expecting it to be converted into stock under Chapter 11. New York private equity firm Alden Global Capital, for example, owns about 40% of both Freedom and MediaNews, Doctor said. Alden also is a creditor of Chicago-based Tribune, which still is in Chapter 11.

Although consolidation may be a good way to cut expenses without further chopping news staffs, newspapers in the longer run must figure out how to stop the exodus of advertisers, said Edward Atorino, an analyst who follows the industry at investment bank Benchmark Co. in New York.

Combining operations is “a short-term, stopgap measure,” he said. “The real answer is advertising has got to stop going down.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.