Enterprise zone bill passes state Senate

- Share via

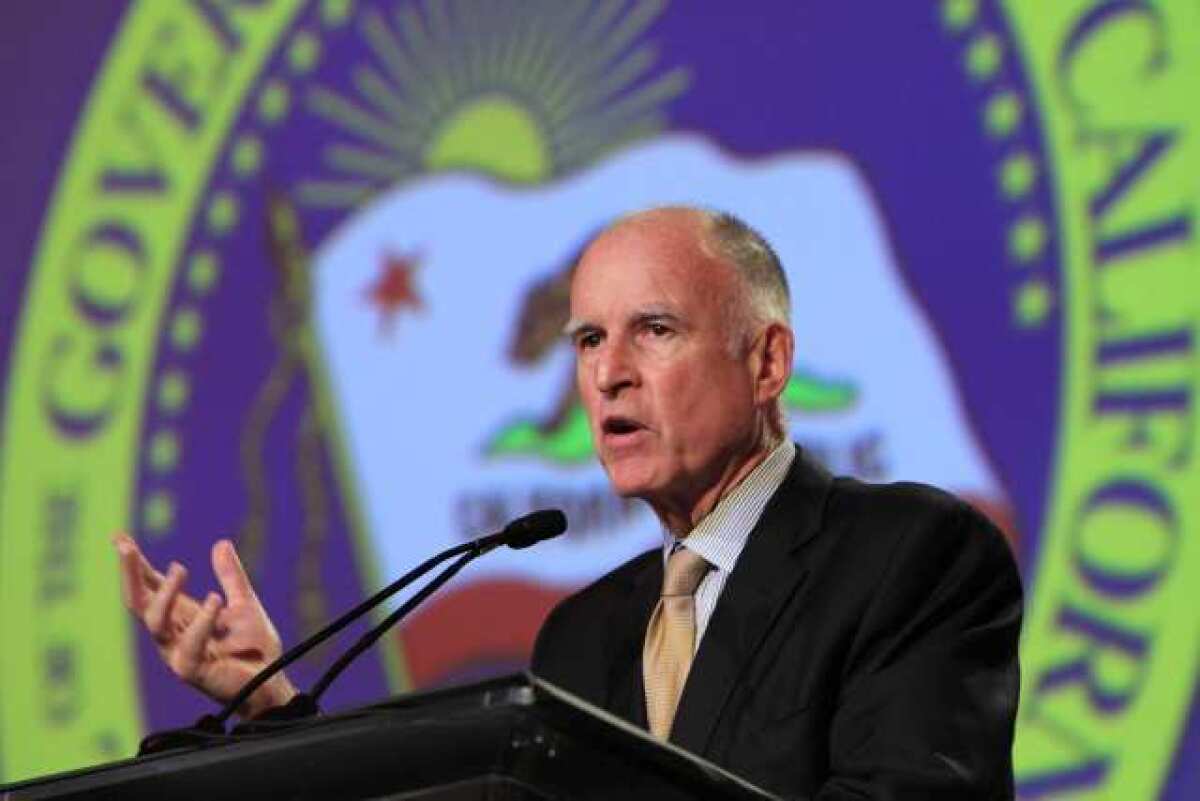

SACRAMENTO -- After a lengthy debate, Gov. Jerry Brown’s drive to revamp a nearly 3-decade-old business tax break passed the state Senate with bipartisan votes to spare.

The bill, which now faces potentially strong opposition in the Assembly, was approved on a 30-9 tally at 10:23 p.m. Tuesday. It all but eliminates the $750-million-a-year, locally controlled enterprise zones and replaces them with a broader, statewide series of business incentives.

The program “is wasteful. It’s inefficient and not giving taxpayers the biggest bang for their buck,” Brown said recently. “There’s a better way and it will help encourage manufacturing in California.” In the hours before the vote, Brown personally lobbied a number of Democratic and Republican senators to get commitments to give him the minimum of 27 votes needed.

The California Assn. of Enterprise Zones countered that its members are fulfilling the program’s promise of persuading companies to invest in hard-to-hire workers, including the chronically unemployed, veterans and ex-convicts. The zones collectively created 25,000 new jobs and saved 110,000 others from disappearing in 2012, the association said, though its numbers are difficult to corroborate.

Brown’s proposal, contained in AB 93 by the Assembly Budget Committee, would redirect existing economic development funds, spending $400 million on a sales tax credit to boost manufacturing and biotech research and development, $200 million on updated enterprise zones that provide incentives for hiring the poor and unemployed, and as much as $100 million to reward specific businesses that relocate to California.

The bill is backed by a coalition of labor unions, Silicon Valley tech companies and pharmaceutical firms and opposed by local enterprise zones, city and county governments and chambers of commerce.

They accused Brown of attempting to shove his bill through the Legislature without giving lawmakers and the public enough time to analyze the new incentive plan. Indeed, a handful of key amendments were still being drafted until just before the Senate vote.

The amendments, which spread out the transition from the old enterprise system to the new version, were aimed at persuading wavering senators to vote for the bill.

Critics of the current system point to a number of academic studies that say enterprise zones don’t create new jobs that wouldn’t have happened otherwise. They also complain that most of the benefits go to large companies that don’t need the tax breaks. According to the Franchise Tax Board, 65% of the credits issued in 2010 went to corporations with more than $1 billion in assets, 15% to companies with $100 million to $1 billion in assets and only 6% to employers with less than $10 million in assets.

Additionally, the entire program is cloaked in secrecy, they complain, because most enterprise zone officials cite taxpayer confidentiality laws to deny state Public Records Act requests for information about which companies receive tax breaks and how much they get. Those credits can be claimed up to four years after hiring a worker, who may no longer be on the payroll. What’s more, excess credits can be carried forward for up to five years to be used as needed to lower future state corporate and personal income tax bills.

Sacramento, one of the few enterprise zones willing to release data, revealed that many of the claims of up to $37,400 per hire in tax credits went to giant companies, including Wal-Mart Stores Inc. and FedEx Corp. The Sacramento documents also showed the incentives had been paid to two local strip clubs, Gold Club Inc. and Deja Vu Showgirls.

Enterprise zone supporters, including the city of Los Angeles, argue that they’re eager to mend their system but are loath to give up what they consider their last remaining economic development tool under California law. The governor successfully eliminated locally controlled redevelopment agencies in 2011.

ALSO:

Editorial: End California’s enterprise zones

Voters may get final say on enterprise zones

Gov. Brown targets enterprise zone tax credits

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.