Ports stalemate could hit economic output for $50 billion, study says

- Share via

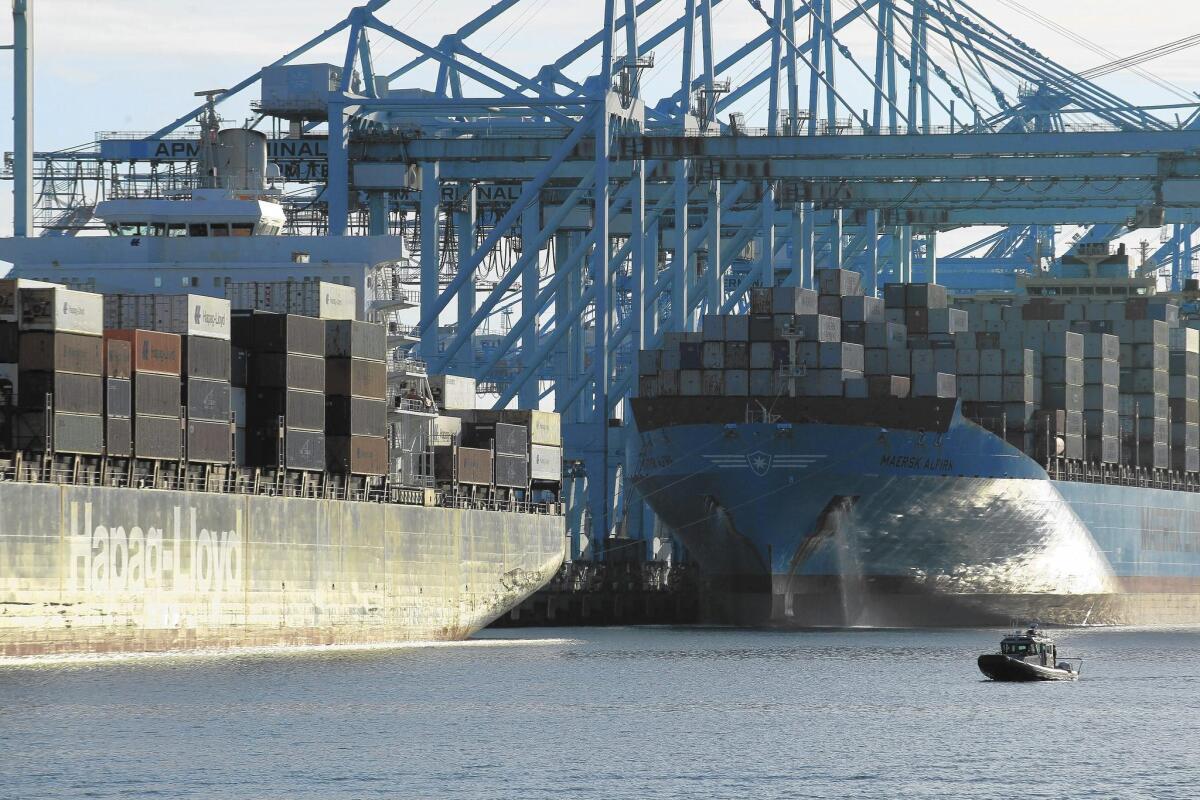

Failure to reach a new labor contract for nearly 20,000 dockworkers at 29 West Coast ports could cause far-reaching disruptions to factory jobs, import prices and even holiday gift-buying habits.

So says a new report from the National Assn. of Manufacturers and the National Retail Federation, two trade groups whose members’ health is closely tied to their ability to move their products in and out of the country.

The six-year contract between the International Longshore and Warehouse Union and the Pacific Maritime Assn., which represents employers operating port terminals and shipping lines, is due to expire on June 30.

Negotiations began in San Francisco in May and are widely expected to extend past the deadline. Businesses are hoping the two sides can reach a consensus without shutting down port activity as a 10-day lockout did in 2002.

The report attempts to measure the potential effects of a complete work stoppage across the entire West Coast port system, disrupting a stream of cargo whose economic value researchers say amounts to 12.5% of U.S. gross domestic product.

The study was conducted by the Interindustry Forecasting Project at the University of Maryland, known as Inforum.

In an already fragile economic recovery, a five-day stalemate could reduce economic output -- measured by loss to gross domestic product in 2014 -- by $9.4 billion. A 10-day pause could result in a $21.2-billion reduction and a 20-day impasse could mean a $49.9-billion hit, according to researchers.

The report, however, notes that in “much of the incoming and outgoing goods that amass around closed ports would ultimately be delivered, albeit at a higher cost and with long delays.”

But researchers also said that perishable commodities or retail goods that miss specific sell dates “will ultimately be lost in a port disruption.” Other trade will reroute via air delivery or through other ports.

The huge volume of Asian trade conducted through the West Coast ports, already threatened by the Panama Canal and competition from Canada and Mexico, could suffer in a strike, according to the report.

Exports could face a $1.5-billion hit, expanding to $3.2 billion and then $6.9 billion as the days pass, according to the report. Imports would see a similar trend.

Across various supply chains, a five-day deadlock would disrupt an annualized 73,000 jobs, the report said. In 10 days, 169,000 jobs would be affected; by 20 days, that would be 405,000 jobs, according to the report.

“Increases in operating and capital costs cascade through the economy to reduce competitiveness, real incomes and, ultimately, final demand,” researchers wrote, though they noted that domestic supply could counteract some of the shock.

Household purchasing power for the year would also take a hit, according to the study: An $81 loss for a five-day halt, then $170 and eventually $366.

Delays and rerouting mean that retailers may have to offer products at a discount by the time they finally reach shelves, ultimately resulting in lower sales revenue, profits and wages, according to researchers.

“Economic effects linger well past the event, including higher supply chain costs, reduced business investment, damage to export relationships and lower consumer income and purchases,” the report concluded.

Follow Tiffany Hsu on Twitter at @tiffhsulatimes

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.