WeWork IPO turns contentious at SoftBank’s Vision Fund

- Share via

As WeWork contemplates listing on the public markets at a far lower valuation than previously expected, its biggest backer — Japan’s SoftBank Group Corp. — is bracing for a potentially staggering loss, a stark reminder of the risks of an investing strategy that inflated startup valuations across Silicon Valley.

SoftBank has a roughly 29% stake in We Co., WeWork’s parent, one executive said in an analyst call Wednesday, after the company plowed a total of $10.65 billion into the startup. The Tokyo conglomerate’s massive stake is a vote of confidence in the unprofitable company, which lost about $1.61 billion last year.

Perhaps more than any other startup, WeWork, which provides shared workspaces for businesses as well as individuals, has come to symbolize the brash investment style of SoftBank and its $100-billion Vision Fund, known for making huge bets on promising but unproven companies, and spurring others in the industry to follow suit to compete. The success or failure of WeWork’s initial public offering is likely to be read as a statement on the overall standing of SoftBank, the judgment of its executives and its ability to raise cash for future ventures.

Now, SoftBank’s big bet may already be turning sour as WeWork mulls an IPO that would peg its worth at less than half the $47-billion valuation it had when SoftBank invested earlier this year. New York-based WeWork is now said to be considering a market debut at just $20 billion to $30 billion, fueling tensions among SoftBank employees.

The WeWork IPO comes at a critical time for SoftBank, which is trying to persuade investors to bankroll a second, $108-billion iteration of its Vision Fund. The company is already mopping up the fallout from another poorly performing IPO. SoftBank put $7.7 billion into Uber, whose market value promptly fell after shares listed publicly at $45 in May. That price has since fallen to about $35, well below the price SoftBank paid for part of its stake.

Some staffers at the Vision Fund are now concerned that WeWork’s valuation could fall further, to even below $20 billion — the valuation of SoftBank’s original investment made by the Vision Fund, according to people familiar with the company who asked not to be identified discussing private matters.

Because the Vision Fund is so exposed to WeWork, it will play a substantial role in compensation for employees of the fund. People at the Vision Fund are not paid on a deal-by-deal basis, as with some other venture firms. Vision Fund employees, including high-profile bankers and investors, receive base salaries and bonuses, but they get payouts only when profits are booked. They are also on the hook for potential losses, facing clawbacks of 20% and above for some senior staff, and 7% for more junior employees.

There is also a possibility that WeWork could delay its IPO. Adam Neumann, WeWork’s larger-than-life chief executive and co-founder, pledged to SoftBank Chief Executive Masayoshi Son this year that WeWork would have a valuation of at least $47 billion when it goes public, people familiar with the matter said. A SoftBank spokeswoman declined to comment for this article. Neumann also met with Son in Tokyo last week to discuss a potential capital infusion, the Wall Street Journal reported, citing unnamed people familiar with the matter. The possibility of SoftBank investing money to enable WeWork to delay the IPO until 2020 was also raised in the discussions, the Journal said.

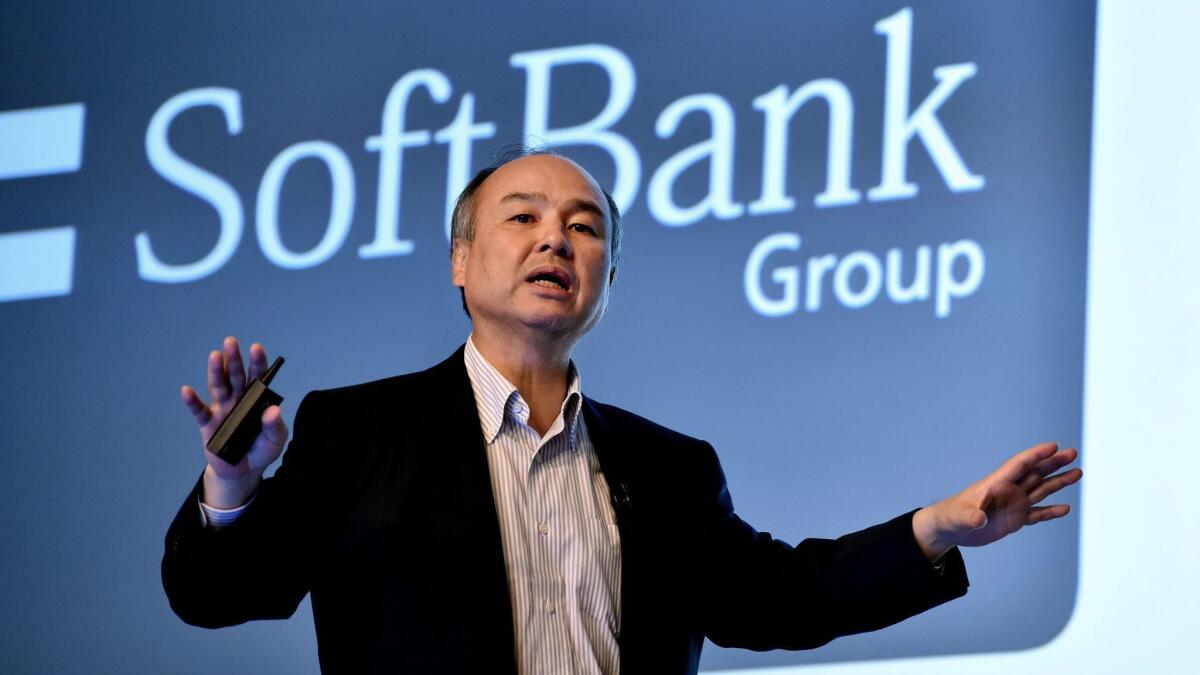

SoftBank’s massive bet in WeWork is emblematic of Son’s overall approach. “Why don’t we go big bang?” he told Bloomberg in an interview last year when asked about his investing style, and added that other venture capitalists tend to think too small. His goal of swaying the course of history by backing potentially world-changing companies requires that those companies make large outlays in areas such as customer acquisition; hiring talent; and research and development — a spending tactic that he acknowledged sometimes brings him into conflict with other investors.

“The other shareholders, they try to create clean, polished little companies,” Son said. “And I say: ‘Let’s go rough. We don’t need to polish. We don’t need efficiency right now. Let’s make a big fight. Let’s make a big, successful — a big win.’”

Sometimes, though, the investors he comes into conflict with are his own. The Vision Fund’s backers, particularly Saudi Arabia’s Public Investment Fund and Abu Dhabi’s Mubadala Investment Co., early this year scuttled a $16-billion investment in WeWork that Son had championed — something Son alluded to in an interview with CNBC in March. SoftBank ended up making only a $2-billion investment separately from the Vision Fund.

SoftBank’s huge bet on WeWork has also caused friction between members of the Tokyo company itself. Although Son has the final say on investments, WeWork is seen internally as the bet of Ron Fisher, the Boston-based SoftBank executive and a longtime aide to Son, the people said. Fisher, who grew up in South Africa, was SoftBank’s highest-paid executive, with $31 million in compensation, in the last fiscal year — 62% more than a year earlier.

Before SoftBank first invested in WeWork in 2017, Fisher met with executives at IWG, a European competitor with a much lower valuation and — at the time — 10 times as many sites, people with direct knowledge of the matter said. Some Vision Fund employees were surprised when instead of persuading Fisher not to invest in WeWork, the unfavorable metrics seemed to encourage him, leaving him convinced that tremendous growth lay ahead for the fledgling company. Son agreed. A month later, the Vision Fund led a $4.4-billion investment round into WeWork at a $20-billion valuation. Fisher and Mark Schwartz, the former Asia Pacific chairman at Goldman Sachs Group Inc. who was appointed to SoftBank’s board that year, joined WeWork’s board.

WeWork, by far the largest in the grouping of SoftBank’s real estate investments, serves as the linchpin of Son’s broader strategy around real estate. In all the sectors where SoftBank makes big bets, including financial services, transportation and health, it believes that too many small companies with outdated technology drag down the industry, creating opportunities for bigger, updated iterations. SoftBank has also backed startups such as brokerage-services provider Compass, mortgage lender Social Finance Inc. and construction-tech firm Katerra Inc., with the belief that these companies could funnel business to one another and boost growth in the sector overall.

But Fisher and Son’s plans weren’t wholeheartedly shared by investors in the Vision Fund. That’s part of the reason SoftBank’s WeWork stake is split between SoftBank itself and its giant tech fund. Of SoftBank’s 114 million WeWork shares, about 64 million are owned by the Vision Fund and the rest by SoftBank Group, according to financial filings. Once SoftBank completes a contract that will result in it buying more shares next year, SoftBank Group’s stake will increase to roughly the same as the Vision Fund’s, the filings said. A spokeswoman for SoftBank declined to comment on the reasons behind splitting the stake.

In its results for the quarter that ended in June, SoftBank said the Vision Fund’s fair value was $82.2 billion. The cost of the investments in the most recent results was $66.3 billion, up from $60.1 billion the prior quarter, and the fair value doesn’t reflect the Vision Fund’s handful of exited investments such as the money the Vision Fund made when it sold its stake in the Indian retailer Flipkart to Walmart last year.

For the most part, the fair value includes the portfolio companies that have held IPOs, because the Vision Fund typically holds on to most of its shares rather than selling them in the IPO, as was the case with Uber. That means as the price of those listed shares declines, the drop will hit the Vision Fund’s fair value in the next reported results. The Vision Fund will be able to book some increases due to successes such as Guardant Health, a portfolio company that listed last year with a steadily rising stock price, but that still falls far short of offsetting the expected declines in other holdings. Similarly, any decline in that valuation at WeWork’s listing will hit the Vision Fund’s fair value.

Son, a famously long-term thinker who has outlined 30- and 300-year plans for humanity, could conceivably brush off a poor showing for WeWork as a bump along the long road toward changing the world. It’s not clear the Vision Fund will be able to do the same.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.