Trump’s budget proposal shreds Social Security and Medicaid benefits

- Share via

In accordance with the old adage that budgets are political documents, President Trump’s budgets are windows into his political id.

Trump’s proposed $4.8-trillion budget for the 2021 fiscal year makes his intentions crystal clear: He means to shred the federal safety net for the poor and the sick.

The budget proposal released Monday calls for drastic cuts in Social Security and Medicaid benefits, as well as in a program protecting defrauded student loan borrowers.

Calling his $844-billion healthcare cut over 10 years the “President’s health reform vision allowance” is hands down winner for the make-the-Soviet-propagandists-blush award.

— Jared Bernstein, Center on Budget and Policy Priorities

Medicare spending will also be cut, although the extent to which the reductions would affect benefits is unclear.

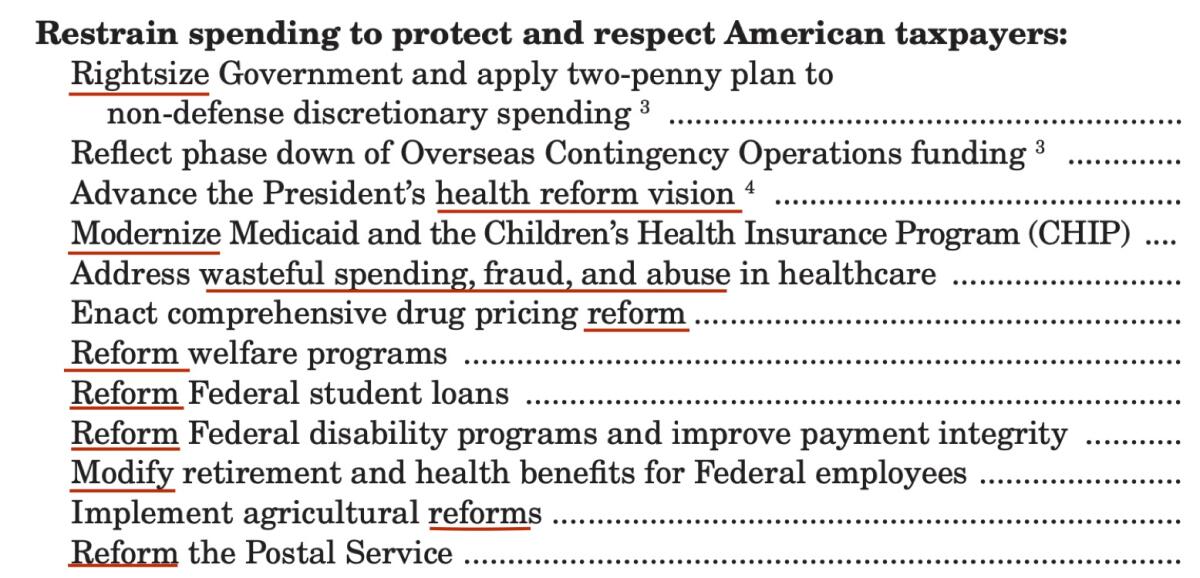

These cuts all are presented under the heading, “Restrain spending to protect and respect American taxpayers.” Who are the taxpayers Trump is talking about? The wealthy, whose take from the 2017 tax cuts won’t be affected one whit.

Trump’s budget proposal was depicted in some media coverage as a walk-back of his promises to protect social insurance programs from cuts. (“We will not be touching your Social Security or Medicare in Fiscal 2021 Budget,” he tweeted Monday.)

This is the wrong reporting approach for two reasons.

First, no one in his or her right mind should ever have taken Trump at his word. He has lied about pretty much everything else about his administration, so why should his treatment of programs for the poor, disabled and elderly be any different?

More important, however, this depiction places a merely political spin on what is fundamentally a catastrophe for tens of millions of Americans.

If there’s a saving grace in this year’s budget proposal, it’s that many of its most draconian provisions will be dead on arrival. To the extent they require congressional approval, they won’t get it from the Democrat-controlled House. Indeed, some of Trump’s proposals couldn’t even make it through Congress when Republicans controlled both chambers. Among other proposals, some cuts to the Supplemental Nutrition Assistance Program and Medicaid have failed to win much favor from the GOP.

The latest effort to gut Medicaid is Trump at his most dangerous.

Other proposals, however, may be amenable to administrative action that circumvents Congress. These include efforts to impose work rules on Medicaid and tighten eligibility for disability coverage. Advocates of Americans needing the safety net will have to remain vigilant against such end-runs.

As one would expect of a political manifesto masquerading as an administrative spending plan, Trump’s budget is lathered with weasel words aiming to distract and conceal his intentions.

The term for a 10-year, $193-billion cut in Medicaid and the Children’s Health Insurance Program is “modernize.” Cuts in welfare, student loan forgiveness and disability benefits are described as “reforms,” as is a cut in postal service support. “Modify” is the word for cuts in federal employee retirement and health benefits.

These words all mean the same thing: “cut.”

“Calling his $844-billion healthcare cut over 10 years the ‘President’s health reform vision allowance,’” says Jared Bernstein, who was chief economist for former Vice President Joe Biden, and is now a senior fellow at the Center on Budget and Policy Priorities, “is hands down winner for the make-the-Soviet-propagandists-blush award.”

Let’s make no mistake about the flow of federal funds in this budget proposal: It’s all about making the poor, sick, children and elderly pay for the tax cuts for the rich. Trump projects that his spending cuts would reduce the federal deficit to $966 billion rather than the previously projected $1.1 trillion.

Either way, the deficits produced by the tax cuts — formally, the Tax Cuts and Jobs Act of 2017 — are the largest since the stimulus-driven deficits of Barack Obama’s first term, which came down sharply starting in fiscal 2012.

Unlike the earlier phase of deficit spending, the Trump deficit has done virtually nothing for middle-class and low-income families, since the tax cuts have gone overwhelmingly to corporations and the wealthy. According to calculations by the Tax Policy Center of the Urban Institute and Brookings Institution, 36.5% of the total benefits of the tax cut went to the top 5% of households, with the top 1% collecting 24.1% of the benefits.

Forget about any trickle-down effect. “Despite the Trump Administration’s rosy promises that the post-TCJA economy would boom,” Tax Policy Center experts have found, “it has instead grown on many dimensions at roughly the same steady, unspectacular pace as it did prior to passage of the tax law.”

Not only are Trump’s proposed cuts devastating, but the administration appears to have taken steps to conceal the extent of the healthcare cuts. As the Center on Budget and Policy Priorities observes, the budget tables calculate the 10-year reduction in healthcare spending — that’s gains from “the President’s health reform vision” — at $597 billion.

‘60 Minutes’’ shameful attack on the disabled

In fact, it’s $844 billion. The budget document nets out $247 billion from the elimination of three Affordable Care Act taxes, but those taxes were eliminated by Congress and already reflected in the budget baseline, so they’re being double-counted here.

Combine the cuts to Medicaid and the cuts to opioid and mental health spending, and they come to $1 trillion over 10 years.

Notwithstanding his claim to protect Social Security, Trump’s budget proposal takes an ax to Social Security’s disability program, tightening eligibility and subjecting some beneficiaries to stringent new oversight. The purported savings would be $60 billion over a decade.

Disability advocates are up in arms about these proposed changes, which were telegraphed in advance. Disability eligibility rules are already stringent, and those who have been denied benefits or prematurely deemed to have recovered tend to do poorly when returned to the workforce. The disability program has a popular image of being a haven for malingerers, but it’s nothing of the kind. Trust the Trump administration to pick up on an inaccurate and harmful notion.

As is characteristic of the Trump approach to Medicaid, the program takes the brunt of safety net cuts. Trump would allow states to impose co-pays on enrollees for “improper use of the emergency department,” for instance.

This is a “reform” pioneered by profit-seeking commercial insurers that places the onus of determining whether an emergency visit is necessary on patients who are ill-equipped to make a medical judgment. It’s designed to discourage ER visits, whether they’re proper or not. This idea should be eradicated, not expanded.

Seema Verma, the federal official in charge of Medicare, Medicaid and the Affordable Care Act, has blasted into the limelight. And not in a good way.

Trump projects savings of $152.4 billion over 10 years from implementing work requirements on Medicaid nationwide. Never mind that the experience of the states that have tried to do this shows that the savings are virtually nonexistent, and that a federal judge has overturned one state’s program and blocked others. Although the Trump administration has approved work requirements for 10 states, even red states are backing away from these useless regulations.

The budget proposal hints at , though doesn’t specify, a further attack on the Medicaid expansion included in the Affordable Care Act, which extended Medicaid coverage to adults without children rather than merely families with children. The budget aims at “ending the financial bias that currently favors able-bodied working-age adults over the truly vulnerable.”

One needs a code book to decipher this line, so here goes: The federal government pays 90% of the cost of treating Medicaid expansion enrollees, compared with the 50% to 80% share covered for traditional Medicaid patients (poorer states get the higher contributions).

The reference to “financial bias” plainly means that Trump proposes cutting the federal share of expansion costs to the reimbursement for traditional Medicaid. That means more spending by states, which might be inclined to cut back their Medicaid programs to save money. A further clue is the reference to “able-bodied” adults — this is standard conservative code for Medicaid expansion enrollees.

Trump signals he’s open to Social Security and Medicare cuts, despite promising during the last presidential campaign to leave the programs alone.

Trump also proposes shutting the courthouse door to patients who have been injured by malpracticing doctors. He would cap non-economic damage awards (usually known as “pain and suffering awards”) at $250,000 (indexed to inflation) and impose a three-year statute of limitations on malpractice claims.

This is an idea pioneered by California, to its everlasting shame, through its Medical Injury Compensation Reform Act of 1975, or MICRA. The California cap of $250,000 isn’t indexed to inflation, so it’s worth less than $58,000 in 1975 terms today. As we’ve reported, the cap falls most severely on women and infants, whose families find it hard, if not impossible, to find lawyers to take cases with stringent limitations.

There are cuts to other safety net programs. The food stamp program, formally known as the Supplemental Nutrition Assistance Program, would be cut by $181.9 billion over 10 years.

Trump is again pushing his ridiculous food box program, which would deliver boxes of preselected foods to households instead of coupons. As we reported in 2018 when the idea first surfaced, it would be less efficient, more expensive and largely unworkable.

The fiscal effects of Trump’s proposals are shrouded behind a scrim of magic asterisks. He projects sustained economic growth — attributed naturally to his budgeting — of roughly 3% a year. Never mind that he hasn’t come close to that growth level in his first term, despite having projected even better than 3%, and that economic consensus points to closer to 2% in the future.

The budget says it will “reform the Postal Service” to extract $91.4 billion in savings over 10 years. The document doesn’t go into much detail, but Trump’s earlier proposals have included eliminating Saturday deliveries, outsourcing some postal operations to private companies, and eliminating cost-of-living pension increases for some postal retirees.

Then there’s the budget’s attack on students who need financial aid or have been defrauded by unscrupulous for-profit colleges. Trump would scrap all subsidized student loans, which allow for deferred repayment of interest for students while they’re in school or suffering financial hardship. This would save the government $18.3 billion over 10 years, according to the budget proposal.

Trump would also eliminate the public service loan forgiveness program, which forgives student loans after 10 years of monthly repayments for borrowers employed by governments or nonprofit organizations. This would save $52.2 billion over 10 years but eliminate an incentive for college graduates to enter public service.

Over the next few days, experts will be poring over the Trump proposal and probably dredging up more nastiness. Trump’s messaging is all about enhancing services to the poor and sick. The budget document’s actual words are very different.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.