Forget Trump’s TV speech about the virus. Here’s what he should, and shouldn’t, do

- Share via

There really is no serious debate about the steps the Trump administration should be taking to address the novel coronavirus crisis, in terms of both public health or economic relief.

President Trump didn’t come close to addressing these imperatives during his televised speech Wednesday night, so we’ll list them here — along with several steps that he definitely should not be taking.

We’ll leave aside the more general concerns about the performance of this White House. These include the overall leadership vacuum, which has been filled by state and local political leaders including California Gov. Gavin Newsom, who on Wednesday called for the cancellation of all gatherings of more than 250 people through the end of the month. Gov. Jay Inslee of Washington, another epicenter of viral infection, went further, banning all events of more than 250 people in the hard-hit counties of King (Seattle), Pierce (Tacoma) and Snohomish.

There’s also the alarming outbreak of sycophancy among federal officials such as Vice President Mike Pence, Centers for Disease Control and Prevention Director Robert Redfield and Surgeon Gen. Jerome Adams, who seem to spend more time telling us what a great leader Trump is than hunkering down and fixing what’s broken about the nationwide response to a crisis.

A payroll tax cut was a bad idea in President Obama’s time, and even worse now.

But never mind. Here are the do’s and don’ts, and some hows, for the crisis.

Pay for sick leave

As we’ve reported, the social Darwinism of the American employment environment leaves millions of workers unable or unwilling to stay home from work even when they’re sick. This undermines calls for “social distancing” and promotes the spread of the novel coronavirus that causes the disease COVID-19.

About a quarter of all American workers have no access to sick leave, according to the Bureau of Labor Statistics. In service industries — where employees must report to their places of employment to work and are most likely to come in contact with the public — more than half have no sick leave.

There are two answers to this problem. In the near term, the government must pay to cover people staying home. In the longer term, it’s long past time for a federal mandate that all workers be entitled to accrue sick leave.

Both are addressed in the crisis measure put forth Wednesday by House Democrats. The bill would pay for two-thirds of a worker’s average monthly earnings, up to a cap of $4,000, covering up to three months in which the worker had to stay home for 14 days or more. The program would be administered through Social Security, but it would be funded separately, with no call on Social Security’s existing revenue or its trust funds.

By limiting sick leave and free healthcare, the U.S. system will promote the spread of coronavirus.

The program would apply to workers who are diagnosed with COVID-19, quarantined or self-quarantined on the advice of a healthcare provider, employer or government official, or caring for others who have the disease or are under quarantine.

The House bill also would require all employers to allow their workers to accrue up to seven days’ sick leave over time, based on their hours worked, plus 14 days during public health emergencies, including the current one. The cost of the 14-day emergency sick leave would be reimbursed for small businesses with fewer than 50 workers. But that provision is opposed by Republicans, and reportedly may be dropped so the emergency bill can be passed with bipartisan support this week.

Expand food stamp and low-income nutrition programs

Amazingly, the U.S. Department of Agriculture says it’s going ahead with a rule change to tighten eligibility for food stamps for adults without dependents. The rule, which goes into effect April 1, is expected to drive 700,000 recipients off the program. The USDA is also going ahead with two other rules expected to end benefits for an additional 3 million people.

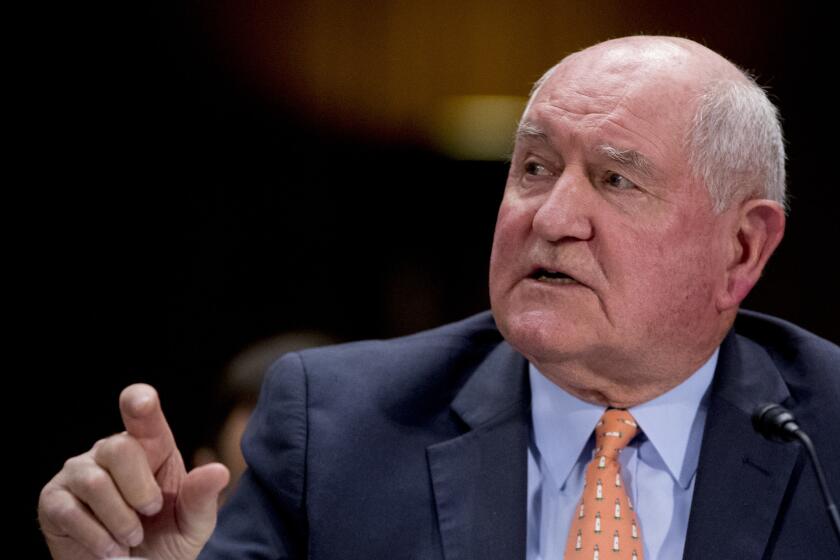

In congressional testimony this week, Agriculture Secretary Sonny Perdue evinced little sympathy for the targeted population. He said the rules were designed to encourage people to go look for employment. Work rules already exist for adult, childless recipients, but the April 1 change would make them more stringent.

The House bill would put the kibosh on these punitive measures, suspending all work requirements for food stamps during the current emergency and giving states more flexibility to provide nutrition help to families.

Trump’s latest attack on food stamp recipients will throw 700,000 off the rolls — and more attacks are coming.

The bill would also loosen regulations governing the delivery of subsidized or free breakfasts and lunches to children already receiving them at school. If schools are closed, authorities would be permitted to deliver meals at other public locations without facing a mountain of paperwork to do so.

The bill also provides $1 billion for food banks and food programs serving low-income pregnant women or households with young children.

Cover Medicaid costs 100%, and declare an emergency already

Some states such as Washington are already facing spending constraints in dealing with the coronavirus. The drain on resources is bound to become more severe as the contagion spreads.

Trump should make clear that coronavirus costs incurred by Medicaid, including not only testing but treatment of infected enrollees, will be covered 100% by the federal government. That may require congressional approval, but it should be on Trump’s agenda. Currently, the federal match of traditional Medicaid expenditures is 50% to 75%, with more going to poorer states. Medicaid expansion costs are 90% covered.

An emergency declaration under the federal Stafford Act would further free up federal funding for states. Washington’s Gov. Inslee has been especially anxious for the declaration to be signed, because it would give his state more flexibility to deploy healthcare resources and bring the Federal Emergency Management Agency in to assist with logistics and funding. White House officials say Trump is considering issuing the declaration as soon as Thursday, but thus far he reportedly has resisted because it would contradict his own efforts to minimize the crisis.

Issue a stimulus check for middle- and low-income households

The economic impact of the virus isn’t yet clear, but it’s a fair bet that it will provoke a slowdown in the economy. Tax cuts won’t help, in part because they’re generally delivered through paychecks and therefore have a diluted effect week by week.

Economists found that in recent slumps, the biggest bang for the buck came from anti-recession programs that delivered sizable checks directly to households. The most recent case involved one-time government checks of up to $1,200 for married couples, including $300 per child in 2008. The payments were phased out starting with household income of $150,000 (for couples), but even low-income households that owed no federal tax were eligible for at least $300, provided they earned at least $3,000 during the year.

Give small businesses a credit guarantee

The lesson of the last recession is that small businesses suffer in economic slumps from a contraction in their access to credit. The Small Business Administration played a modest role at that time in protecting these drivers of employment by issuing loan guarantees covering 50% to 85% of principal.

SBA loans came to only about 1.3% of total small-business loans and 4.1% of total loan amounts. Since then, however, the SBA has been endowed with a $30-billion lending fund to encourage small community banks to lend to small businesses and increased loan limits, from $2 million to $5 million, for two SBA programs. The government should stand ready to increase the funding and liberalize the programs. Small businesses will need them.

Trump, to his credit, announced Wednesday night that the SBA would open a lending window to small businesses in affected areas, and called on Congress to pump $50 billion into the agency.

Federal and state officials have few options to force insurers to cover COVID-19 for free.

A couple of things not to do:

Don’t bail out the cruise ship lines

Cruise ships, as well as hotel companies and airlines, have been mentioned as possible recipients of government bailouts through tax cuts or other help.

One can hardly imagine a less deserving industry.

Cruise ship companies such as Carnival Corp. and Royal Caribbean have been swimming in profits in recent years. Carnival recorded net income of $3.1 billion on revenue of $20.8 billion in 2019, a healthy profit margin of 15%. On this profit, it paid taxes of $71 million, or a mere 2.9%.

What did Carnival do with its take? It repurchased $1 billion of its shares and raised its shareholder dividends.

The cruise lines dodge strict regulations by registering their vessels under “flags of convenience” such as Panama and the Bahamas, which aren’t inclined to ride them too strictly. A Caribbean enforcement official lamented last year that some countries, such as the Bahamas, had only one inspector for all the cruise ships docking at their ports.

Tighter regulations might not have averted the notable spread of coronavirus infections aboard cruise ships in recent weeks, but it’s proper to observe that these aren’t the first cases of mass illness. Royal Caribbean’s Explorer of the Seas set a record in 2014 for the largest mass illness on any cruise ship in two decades, according to the CDC — 700 passengers and crew sickened by a virus.

Airlines are likely to be the companies most heavily affected by the crisis, but whether they need bailouts is also questionable. Since 9/11 and after a wave of mergers, big legacy airlines have been solidly profitable. Delta Air Lines booked more than $16 billion in profits in 2016-19, American Airlines more than $7 billion and United more than $9 billion in the same time span. They’ll take a hit, but once travel recovers so will they.

Keep your hands off the payroll tax

In his Wednesday TV appearance, Trump once again saddled up his hobby horse of a payroll tax cut. As we reported, this would undermine Social Security and Medicare, which are dependent on the payroll tax, without delivering significant help to workers. Not only would the tax cut be regressive, mostly helping better-paid workers, it would do nothing for those thrown out of work by the crisis or its attendant economic slump; those who don’t receive paychecks don’t pay the tax anyway.

Unlinking Social Security from its No. 1 revenue stream would weaken its finances and leave it vulnerable to political tampering, always a danger for programs serving the working class.

In promoting this idea, Trump has once again resorted to outright lying. Referring to the opposition to the payroll tax cut voiced by House Speaker Nancy Pelosi (D-San Francisco), he tweeted that she “all of a sudden doesn’t like the payroll tax cut, but when Obama proposed it she thought it was a brilliant thing.”

This is pure revisionist history. The payroll tax cut was shoved down Obama’s throat in 2011 by a Republican House majority that flatly refused to deliver a working-class stimulus any other way. (The Democrats still controlled the Senate but had lost their filibuster-proof majority.)

The Obama White House found the idea unpalatable, but had no choice. “The Obama administration was desperate to pass any stimulus at all,” recalls Nancy Altman, president of Social Security Works and a long-term Social Security advocate. “They gave in to Republican demands and pushed congressional Democrats to back the reduction in payroll contributions.”

It was a bad idea then, and a bad idea now. If Trump wants to help working families, he should deliver the assistance directly, and in bulk.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.