Biden’s green push gives Detroit the cover to go electric

- Share via

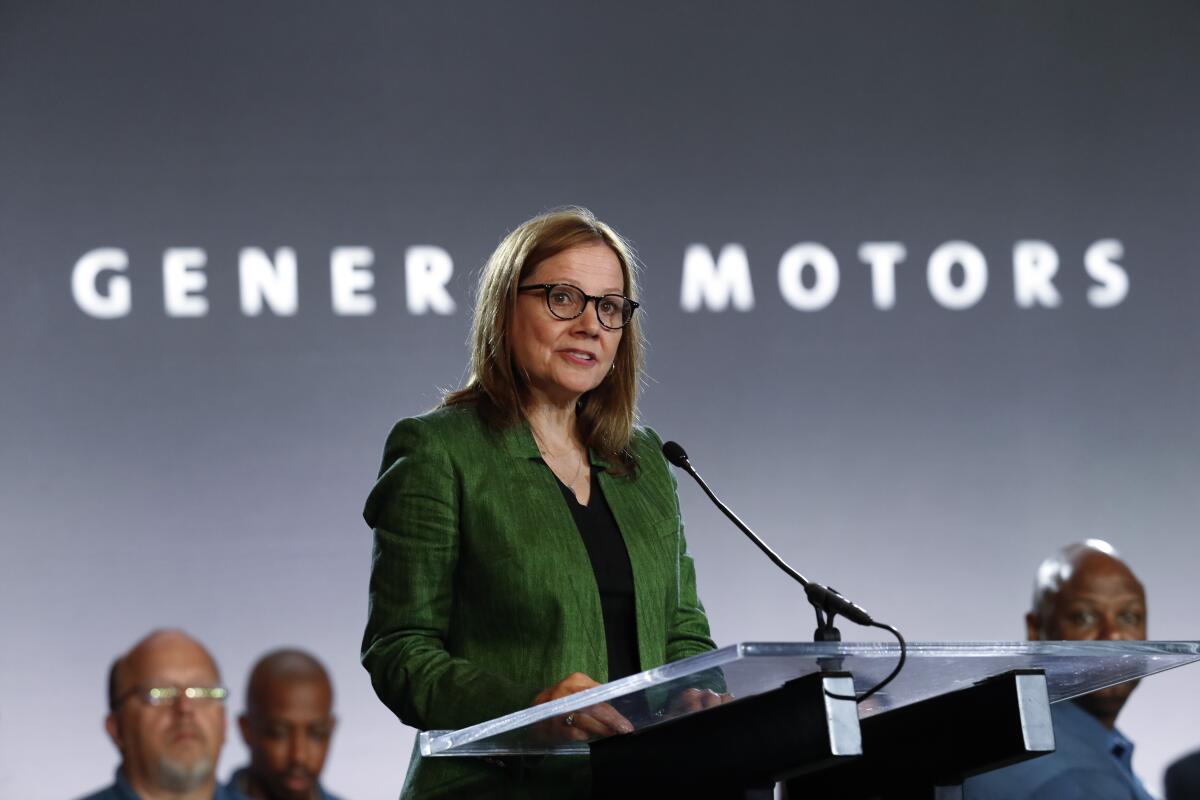

General Motors Co. Chief Executive Mary Barra just stomped on the electric-vehicle accelerator pedal. Call it the Biden effect.

Six months ago, the automaker backed the Trump administration in a legal battle that could have neutered California’s longstanding right to set its own tougher carbon emission rules.

About two weeks after Trump lost, GM withdrew from that fight. Two weeks after he left office, it pledged to match the state’s mandate to sell only electric vehicles starting in 2035 — and do that all across the U.S.

Why the 180? Barra is getting a jump on President Biden’s policies, which are expected to help GM and its rivals build and sell more EVs in the U.S. He wants to restore the $7,500 tax incentives that companies including GM and Tesla Inc. exhausted under Trump’s watch, and Biden plans to build 500,000 charging stations across the country. That could make EVs more affordable and ease concerns of would-be buyers about battery-powered cars’ driving range.

Some see GM’s about-face on the politics of clean cars as less a calculated policy move than a recognition of longer-term global forces at work.

“They would not make an announcement this substantial just for political purposes,” said Joe Britton, executive director of the Zero Emission Transportation Assn., a Washington-based lobbying group pushing for full adoption of EVs by 2030. “This is a clear sign that electric vehicles are going to be the future and that we’re in a bull market for innovation right now.”

Believe it or not, Biden’s position has been met with a collective sigh of relief in some quarters of Detroit. The rest of the world is moving toward electric vehicles, and the Trump administration had no interest in easing that transition in the U.S.

Behind China, EU

While Trump was trying to prolong the era of the gas guzzler by watering down clean-air rules and resisting efforts to expand the EV tax credit, China’s government has adopted rules and incentives that boosted EV sales in the world’s largest car market. Almost all of the European Union’s 27 member states have purchase or tax incentives for consumers who buy electric vehicles, and the EU is rapidly ratcheting up emission restrictions to penalize automakers that don’t sell enough EVs in Europe.

As a result, China and the EU have jumped way ahead of the U.S. in EV adoption rates. Last year, of the 3.2 million EVs sold globally, 1.3 million were in China and 1.2 million were in the European Union and U.K. The U.S. accounted for just 328,000 sales, according to Swedish researcher EV Volumes.com.

That put Detroit’s carmakers in a spot. They get most of their revenue and profits at home in the U.S., where EV sales have been minimal. And they need help with economies of scale sufficient to drive down battery costs and create profit margins.

Barra had been heading in this direction since 2017, when GM announced plans to build 20 different EVs by 2023, but most of them were bound for the Chinese market. GM accelerated that shift in November, promising 30 models by 2025 and an investment of $27 billion in electric and self-driving cars, with more models planned for the U.S. Ford Motor Co. has been stepping up its efforts as well, budgeting $11 billion for EVs and more fuel-efficient vehicles.

Biden’s victory put some wind at the auto industry’s back and makes the commitment to electric powertrains more palatable for their risk-averse corporate cultures.

Political convenience

Even so, there also is a hefty dose of political convenience involved in the decision to go all-in on EVs. GM, Toyota Motor Corp. and Fiat Chrysler Automobiles — now a part of Stellantis — went along with Trump in his legal fight with California, throwing a bone to a temperamental president and thereby extending their ability to churn out cash-cow gas guzzlers.

Officially, GM said it always wanted one national standard instead of different rules from Washington and Sacramento. It just so happens that the company picked Trump’s watered-down option.

Critics of government subsidies were quick to see GM’s move as a sign the market for EVs is maturing fast enough that no additional incentives are needed.

“GM is a publicly traded business and is making a strategic, calculated market decision,” Tom Pyle, a former Trump advisor and current president of American Energy Alliance, a free-market advocacy group, said in a statement. “In no way should any taxpayer be responsible for GM’s ability to achieve — or fail to achieve — their corporate goal of an all-electric light duty fleet by 2035.”

Big companies have long sought to position themselves in the most favorable light in Washington, regardless of which party’s candidate is in the Oval Office. Carmakers are no exception. Former Ford CEO Mark Fields warned then-President Trump that overly tough mileage rules would put a million jobs at risk, a prelude to Trump’s rollback. And GM broadly touted its Chevrolet Volt plug-in after its 2009 rescue by the Obama administration, which later set a goal of putting a million electric vehicles on the road by 2015.

Carrot and stick

Trump and his Twitter account are now silenced. With Democrats running the White House and having a majority in both chambers of Congress, the prevailing wind is blowing against Detroit’s status quo dependency on big sport-utility vehicles and trucks.

Biden’s plan also comes with a stick. Earlier this week, he vowed to reinstate vehicle emissions standards gutted by the Trump administration and set “new, ambitious ones that our workers are ready to meet.”

Doing so would aid GM’s electrification push and could encourage competitors to follow suit, said Joshua Linn, a senior fellow at Resources for the Future, a Washington think tank that focuses on environmental policy and economics.

“Companies don’t want to get out too far ahead of the market,” he said. “Having more ambitious policies, greenhouse-gas standards and maybe a national zero-emission vehicle program will help support the entire market moving in that direction.”

GM’s worst nightmare is a scenario in which its commitment to EVs isn’t met with higher consumer demand, allowing rivals with less ambitious electrification plans to steal away business. Biden may be giving GM some of the cover it needs to proceed.

Welch and Beene write for Bloomberg. William Mathis and Jennifer A. Dlouhy contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.