Paying more for gas and food? Here’s what the Federal Reserve can do

- Share via

After two decades of little or no inflation, Americans have seen prices jump for gasoline, fuel oil, electricity and cars, while also creeping up for apparel, food and other commodities. Overall, consumer prices were 7.5% higher in January than they were a year ago, the biggest increase in 40 years, easily outpacing the 4.4% growth in average wages.

The pinch is widely felt, particularly among low- and moderate-income Americans. That helps explain why polls show inflation to be a top concern among U.S. adults in recent months.

Many of those polled say President Biden isn’t doing enough to rein in prices, and it’s certainly true that the White House has a role to play. So does Congress. But the primary responsibility for fighting inflation rests with the Federal Reserve, the central bank of the United States. The Fed regulates some parts of the financial industry and conducts U.S. monetary policy, raising or lowering the tide of credit and money flowing through the economy.

On Wednesday, the Federal Open Market Committee — a group of officials from the Fed board and its regional reserve banks that sets monetary policy — announced new and more vigorous efforts to fight inflation, including a quarter-percentage-point increase in its interest rate target. Here’s a guide to what the Fed can do and how its tools relate to the forces currently driving up prices.

The root causes of inflation

Prices go up and down all the time for certain goods, most notably gasoline and food. Inflation happens when prices increase broadly and steadily across the economy, forcing you to spend more and more to maintain the status quo.

In theory, market forces will eventually lower overall demand as prices rise, bringing inflation to heel. But economists blame COVID-19 for knocking supply and demand out of balance, then keeping them that way.

The pandemic and the public health response caused both supply and demand to plummet in 2020, leading to millions of layoffs. In response, the federal government pumped enormous sums of money into the economy — loans to keep businesses afloat, larger benefits for unemployed workers, cash to shore up local governments’ budgets and stimulus checks for just about everybody.

“As the economy recovered in 2021,” said economist Paul Sheard, a research fellow at Harvard University’s Kennedy School, “demand was able to come back much, much faster than supply was able to meet it.” Among other issues, the surge in demand triggered breakdowns in the global supply chain, making some goods harder to get and raising prices.

The economy has improved rapidly, yet notable issues remain. One major one: Despite an extended hiring binge, many employers have struggled to fill openings and retain workers even as they’ve raised wages. Those struggles have persisted long after states stopped providing more generous unemployment benefits, in part because of child-care shortages, earlier retirements and more opportunities for workers to shop around for better job offers. The share of adults working was about 1% lower in January than it was pre-pandemic; that translates to about 3 million fewer people employed.

The cumulative result is that demand has remained strong and supply has remained constrained, sustaining the upward pressure on prices.

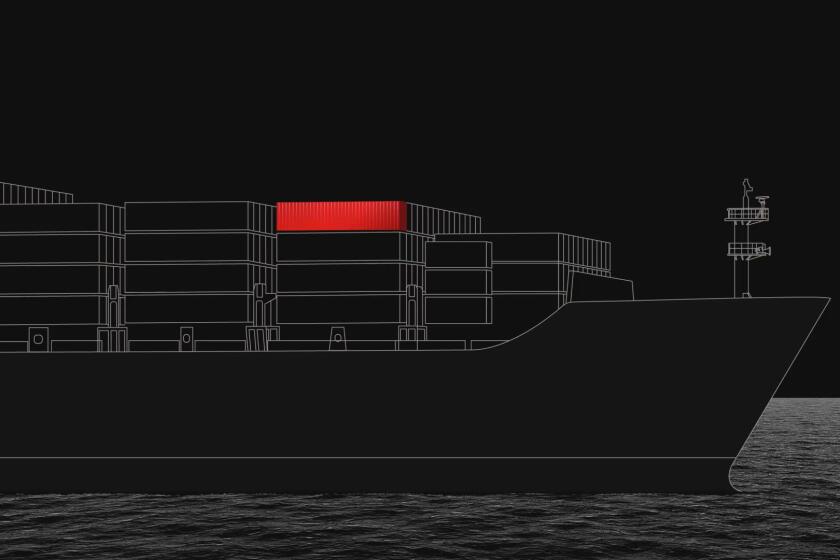

Follow a container of board games from China to St. Louis to see all the delays it encounters along the way.

What tools the Fed has

Sadly, the Fed can’t unclog the ports or persuade a larger percentage of Americans to work. What it can do is stoke the economy or cool it by making banks more or less able to lend money.

The central bank has a variety of ways to affect the availability of credit and the stability of the financial system, many of which can help banks recover from a shock along the lines of the subprime mortgage collapse. Now, though, the central bank is expected to use its tools to counteract inflation.

“What the Fed aims to do when the economy is running too hot is to tighten financial conditions on a gradual and predictable basis,” said David Wilcox, an economist at the Peterson Institute for International Economics and Bloomberg Economics. It does so, he said, through its ability to control the federal funds rate — the interest rate that banks pay one another on overnight loans of bank reserves. “That rate, which hardly anyone comes into contact with in their daily life, radiates out from the market for bank reserves and affects many other financial markets.”

Since April 2020, the Fed has kept the federal funds rate close to 0%, a “loose money” approach that sought to encourage lending and buttress the economy. It was one of a number of efforts by the central bank to pull the U.S. out of a COVID-related recession.

Now the Fed is turning the spigot in the other direction. The Federal Open Market Committee raised its target for the federal funds rate by a quarter of a percentage point (in bank parlance, “25 basis points”). Economists expect the increase to be the first in a series as the Fed pushes the federal funds rate back to a level that neither boosts nor brakes the economy.

Sheard said he was dismayed that the Fed has waited as long as it has to act, given how entrenched the supply problems were.

“The slower they are to get this train moving, the more possible it becomes that the situation gets away from them and they have to scramble to catch up,” Sheard said. Although the central bank can change policies overnight, he added, “a lot can happen before that monetary policy can have a tangible effect.”

And while the Fed has leapt into action with lower rates when the economy was struggling, it has been slow to take its pedal off the gas — a hesitation that also contributed to the housing bubble in the early 2000s. One reason, Sheard said, is that the Fed doesn’t have to worry about destabilizing the economy when it cuts rates, but it does when it raises them. “Rather than rushing to the entrance, you’re starting to tiptoe to the exit,” he said.

Primarily driven by supply chain bottlenecks, inflation is a threat to the health of the economy, but the rise in prices has been good for some.

What will that mean to me?

An increase in the federal funds rate doesn’t affect consumers directly, Wilcox said. But it does ripple through the banking system, tending to raise lots of other interest rates because the rates for longer-term loans are based on expectations for where short-term interest rates will be in the coming months and years.

“When the Fed tightens financial conditions, that reduces demand for everything by a little bit, or potentially a lot if the Fed moves by a big amount,” Wilcox said. “When interest rates are higher, the cost of borrowing is greater, and therefore households at the margin are a little less likely to purchase that new vehicle, and a little less likely to bid aggressively on that new house, a little less likely to borrow to take that vacation.”

Higher rates of return in the U.S. also tend to make investing here more attractive, which pushes up the value of the dollar. That, in turn, makes U.S. goods and services more expensive for foreigners, and makes their goods and services cheaper for us, Wilcox said.

“As a result, they buy less of our products, and we buy more of theirs,” he said. “The net result is that demand for the goods and services made in the U.S. cools down a little, in line with what the Fed is trying to do when the economy is running too hot.”

As demand for goods and services eases, Wilcox said, “that’s going to translate into a reduction in price.” But that’s not enough to tame inflation; another important factor is whether the public expects prices to keep rising in the future. That expectation becomes something of a self-fulfilling prophecy; economists say that if workers expect the dollar’s buying power to diminish, they will demand higher wages, employers will seek higher prices, and the cycle will continue.

That’s why the Fed, in addition to cooling demand, needs to send a clear message that “it will be the cop on the inflation beat ... and it will do what’s necessary to control inflation,” Wilcox said. “That in itself will help condition expectations in a helpful way.”

The signals about the public’s expectations are mixed at this point. A survey released by the Federal Reserve Bank of New York shows that consumers expect food and gas prices to continue to rise over the coming year at roughly their current pace. But they also expect inflation three years from now to be down to 3.5% — significantly lower than today, although higher than the Fed’s long-standing target of 2%.

The data suggest that inflation expectations “have moved up a little bit,” Sheard said, “but they’re not flashing red.”

Already-high gas prices are headed higher because of the Russia-Ukraine conflict, a painful blow for L.A.’s lower earners who must drive to survive.

The war in Ukraine

Many economists had been predicting that inflation would be significantly reduced by the end of the year. One major complication, however, is the Russian invasion of Ukraine. The war and the U.S. sanctions on the Putin regime have raised the cost of key materials, further damaged supply chains and exacerbated problems for some manufacturers.

The effects will be more pronounced if the U.S. and its allies bar imports of Russian oil and natural gas. But even with Russian energy sales continuing unabated, crude oil prices have jumped based on fears of shortages to come.

Richard Pontius, head foreign exchange trader at City National Bank, wrote in a newsletter Tuesday that the current sanctions “make it likely that pressures will remain on already tight supplies of energy and commodities,” which in turn “makes for a longer duration of the sharp escalation in inflation.” He added, “Fears that the conflict could extend and lead to a global economic slowdown are rising and could alter expected tightening moves by central banks around the world.”

If we can make significant headway in resolving the supply chain problems, Pontius said in an interview, the inflationary pressures would ease in the latter part of 2022. But if the conflict in Europe lingers and sanctions continue, he said, those pressures would extend much longer than most economists have been projecting.

Jerome H. Powell, chairman of the Federal Reserve Board, told a congressional committee this month that the Ukraine war’s potential effects on the U.S. economy “are highly uncertain” and that the Fed “will need to be nimble.” Yet in response to members’ questions, he also said, “We’re going to avoid adding uncertainty to what is already an extraordinarily challenging, uncertain moment.”

Russia’s invasion is yet another reason to switch from fossil fuels to clean energy, experts say.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.