Is it a car or an SUV? In the EV tax credit debate, it depends on whom you ask

- Share via

General Motors has taken a central role in pushing the Treasury Department to change how the government defines a sport utility vehicle and expand how many buyers can get electric-vehicle tax credits under President Biden’s Inflation Reduction Act.

Billions of dollars in EV incentives over the next decade are at stake as the government and companies hash out final rules, expected in March. At the center of the debate is this question: What’s a car and what’s an SUV? That’s because SUVs costing up to $80,000 can get $7,500 in tax credits, whereas passenger-car buyers get nothing if the vehicle costs more than $55,000.

Adding to the complexity is that the Internal Revenue Service, which is currently writing regulations for the tax credits, has a more narrow SUV definition than the Environmental Protection Agency. GM and other automakers are lobbying for the EPA’s broader definition to dictate who can get tax breaks for buying EVs.

“It’s going to be really important for us and our competitors to get clarity on the car versus truck SUV definition,” said Chris Feuell, head of Stellantis’ Chrysler brand. “There are a lot of very aggressive, low-emission vehicle targets that are in place across the country.”

The definitions are subjective because of a boom in the last couple of decades in crossover vehicles, which have blurred the line between traditional sedans and SUVs.

Democratic Sen. Joe Manchin is trying to delay new tax credits for electric vehicles, a key feature of President Biden’s landmark climate law.

If the EPA designations are used, GM’s new $63,000 Cadillac Lyriq would be considered an SUV and get up to $7,500 in tax credits. But the current IRS interpretation lists the Lyriq as a car, so buyers would get nothing even though the vehicle and its battery are built in the U.S.

GM calls the Lyriq an SUV because it rides higher off the ground than Cadillac sedans and meets the size and weight specs under EPA rules. The Internal Revenue Service sees it differently and listed the vehicle as a car because it doesn’t have a third row of seats.

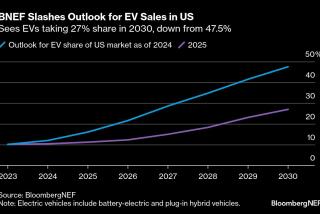

The Treasury Department declined to comment. The administration’s spin on the rules follows a goal set by the Biden administration to have half of the vehicles sold in the U.S. be electric by 2030, a goal the White House has said will help reduce emissions and global warming.

Mustang and Tesla

Ford Motor has a similar issue with its electric Mustang Mach-E. The vehicle is designated as a passenger car, so the base model — starting at $47,000 — would qualify, but other versions can cost more than $70,000 and would not.

Tesla’s Model Y, which the company markets as a midsize SUV, gets a passenger car designation with two rows of seats but gets to be an SUV for versions that have three rows. The company has slashed prices on its vehicles, getting all but its most expensive models under limits to qualify customers for credits.

Elon Musk’s always-changing prices are unique in the auto world, and will be under the microscope like never before.

Other makers such as Volkswagen have models — such as its ID.4 electric wagon — that are caught in the regulations’ complexities because they consider whether a car has all-wheel drive to determine SUV status.

How the rules are finalized has huge consequences for automakers, which plan to build hundreds of different EV models by the end of this decade.

John Bozzella, chief executive of the Alliance for Automotive Innovation, an industry lobbying group, agrees with GM that the IRS should use the existing EPA classifications, which would give more vehicles tax credit eligibility and get more people buying EVs.

“If it looks like an SUV and drives like an SUV, it is an SUV. And it should get the EV tax credit,” Bozzella said in a blog post.

But one of Biden’s strategies going back to his campaign platform was to make EV credits based on income and vehicle price so that government money wouldn’t be used to help wealthy buyers get new vehicles.

Sen. Joe Manchin III (D-W.Va.), who helped craft the law’s EV credits to make sure the vehicles and their batteries are built in the U.S. with materials from free-trade partners, has grown impatient with how long the Treasury Department is taking to finalize rules. He is also critical of how much lobbying is being done to increase spending.

“I had a hard time understanding why the automotive industry needed it so desperately because people were willing to wait a year to get the product,” Manchin said during Senate debate this week.

Bloomberg writer Ari Natter contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.