The economy has been strong. Why are economists so eager to predict it will tank?

- Share via

Mohammed El-Erian is one of the most respected economic sages in the business world, the holder of a prestigious academic post at Cambridge University and an advisory position at the international financial firm Allianz.

But the timing of his latest economic commentary in the pages of Britain’s Financial Times last Wednesday was a bit, er, unfortunate.

El-Erian warned that the Federal Reserve’s commitment to keeping interest rates high to quell inflation will sap the likelihood of a “soft landing” for the U.S. economy — that is, one that escapes a recession, or at least a serious recession.

This is not an overheated labor market.

— Economist Mike Konczal, Roosevelt Institute

The Fed’s policy, he wrote, “compounds the erosion in financial, human and institutional resilience.”

Two days later, the government announced that the U.S. economy had gained 336,000 jobs in September, a figure that confounded virtually the entire economist community, which expected much less.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

That points to the question: Why do economists get these things so consistently wrong? And to a corollary: Why pay any attention to their forecasts?

El-Erian alluded in his column to the chronic unreliability of economic projections. “By my count,” he wrote, “this will be the sixth time in the past 15 months that conventional wisdom shifts for the world’s most influential economy.”

Why anyone would lend credence to economic projections that get revised on average nearly every other month is a mystery.

But El-Erian himself ignored the lesson of that dreary record. The latest pivot, he wrote, “is likely to stick for longer this time around, threatening what has been an impressively strong US economy, undermining genuine financial stability and exporting volatility to the rest of the world.”

This underscores the pitfalls of making short- or even medium-term forecasts of economic trends. It evokes the line of screenwriter William Goldman about Hollywood: “Nobody knows anything.”

Projecting the future of economic growth is, unfortunately, more than a parlor game. Economists’ consensus often guides economic policymaking, including at the Federal Reserve.

The Fed’s policy of driving interest rates higher over the last year or so has been based at least partially on economic received wisdom about the relationship between inflation and unemployment — that is, that lower unemployment leads to higher inflation and vice versa — and reinforced by economic commentators, who view every bit of economic news through the prism of how that will translate into Fed action.

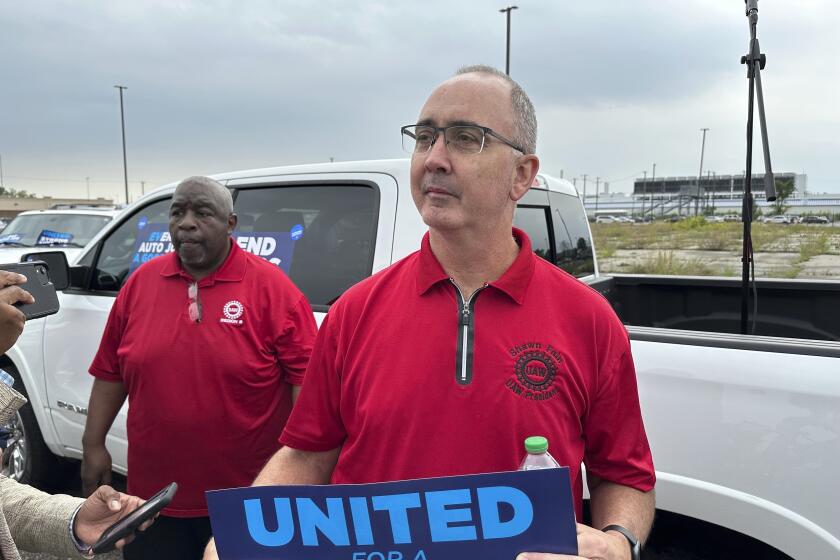

As usual, the media and politicians are blaming the possibility of an auto strike on the auto workers union, but company managements are the guilty parties.

It’s an eternal feedback loop. Last week’s job number, for instance, was widely reported largely in terms of how it would affect the Fed’s coming decisions on whether to raise interest rates again or leave them alone, and when the central bank might start to bring them back down.

“Surprisingly strong hiring,” declared the Wall Street Journal, “keeps the door open to another rate increase this year.” CNN initially introduced the statistic with a headline reading, “Why the shockingly good jobs report is going to cost you.” (Its argument was that more hiring would stoke inflation and prompt an interest rate increase, which means higher rates on mortgages, car loans, etc., etc.)

Bond yields spiked and bond prices, which move in the opposite direction from yields, fell. This was based on the expectation, solidified by some public comments from Fed governors, that the central bank would keep interest rates higher for longer.

Almost lost in the hand-wringing about the jobs report was that it showed the U.S. economy to be far more resilient than economists expected. That should have been treated as good news for anyone in the job market. Instead, the economic commentary focused on the reaction of the financial markets, specifically the bond market.

This amounts to mistaking the scoreboard for the game. The scoreboard — the instant reaction of the financial markets — is a snapshot; the game is the creation of financial health for American workers over the long term, not the short-term portfolio returns of bondholders.

Coming back to the utility of economic projections: To be fair, long-range projections can be reasonably instructive, viewed with the proper horizon. But economists and their followers in the financial press are addicted to the shorter range, which often tells us nothing or is flagrantly misleading.

Consider the projections of gross domestic product issued in real time by two separate Federal Reserve Banks, based in Atlanta and New York.

The Atlanta Fed’s GDPNow estimate projects a reading of annualized growth for the third quarter of 2023 that ended Sept. 30 of 4.9%. The New York Fed’s Nowcast is for 2.5%. (The Atlanta Fed’s forecast was dated Oct. 10, and the New York Fed’s, Oct. 6.)

Fitch says the U.S. deserves a credit-rating downgrade. Its own analysis shows it’s wrong, but that didn’t stop Republicans from seizing it as a political bludgeon.

That’s a hopelessly large differential, but both come with protective caveats: Atlanta’s is accompanied by a reading of the range of projections from a private survey of prominent economists — currently from about 1.5% to 4.0%. New York provides a range of standard deviation, specifying a 68% probability that the GDP figure will fall between 1.07% and 3.99%.

The actual GDP reading from the Bureau of Economic Analysis won’t be issued until Oct. 26, but even that isn’t the final word. It’s the “advance estimate, which is based, like all the others, on incomplete information, as statistical indicators come dribbling in over time. The advance estimate will be revised on Nov. 29, and again — probably for the last time — on Dec. 21.

In other words, quarterly GDP is a moving target until all the data are in, months after the quarter’s end. The issue of what use the interim numbers are to anyone is raised by the checkered record for accuracy of the interim projections, especially those issued even before a quarter’s end.

Atlanta, graciously, documents its own errors over the years. For the first quarter of 2022, its final projection before the quarter’s end was for annualized growth of 0.37%; the BEA’s advance estimate came in at -1.41% and its final reading was -1.6%.

So what’s the right way to view the latest job numbers? To liberal economist Mike Konczal of the Roosevelt Institute — one of the most consistently informative economists writing today — it’s proper to take them as a picture of the economy as it is today.

He notes that the September employment report showed that the monthly average hourly earnings of all private employees has been decelerating — in other words, job growth doesn’t have the power to drive inflation higher, as the Fed has feared. “This is not an overheated labor market,” he wrote.

Konczal also pointed out that the government data showed that the ranks of the unemployed are being filled with new entrants and reentrants into the job market, not job-losers. “That’s who we want in [the] unemployed, people pulled into the labor market,” expanding the supply of workers.

More people working for longer, wages holding steady: That should be a recipe for growth, not recession. You might not detect that if you’re watching the bond market and conjecturing about what the Federal Reserve Board will do when its open Market Committee next meets to ponder interest rate policy on Oct. 31 and Nov. 1.

To paraphrase what Goldman wrote of Hollywood, no one knows anything about what will happen over the horizon. Those who have tried to predict the future are, more often than not, doomed to get it wrong. All we can say for sure is what’s happening today, and from that perspective, the employment news was good.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.