Big drug makers are whining about having to negotiate with Medicare, but they can’t afford not to

- Share via

Given the pharmaceutical industry’s conviction that the government’s Medicare drug negotiation program will “deal a fatal blow” to its innovative research, “coerce” it into sacrificing its rightful profits, kill innocent patients and was also unconstitutional, naturally the companies would decline to participate.

Just kidding.

A few days ago, the White House announced that the manufacturers of all 10 of the first drugs selected for the negotiation process have agreed to participate.

Eight of the manufacturers have challenged the negotiation program in federal lawsuits, in which the above assertions can be found.

AbbVie, the parent of a ninth company with a drug on the negotiation list, is specifically named by the U.S. Chamber of Commerce in its lawsuit as a member with a direct interest in the outcome. So far, cases have been filed by Merck, Johnson & Johnson, AstraZeneca, Novo Nordisk, Bristol Myers Squibb, Novartis, and Boehringer Ingelheim (a partner of Eli Lilly in marketing one of the 10 drugs). The industry’s lobbying arm, Phrma, filed a separate lawsuit.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

That the drug makers are joining the negotiation process even as they engage in judicial whining and mewling about it may be taken as a testament to the cleverness of the program’s design.

Knowing that Medicare can’t walk away from the negotiating table, the key leverage tool in any negotiation — it’s legally bound to cover all drugs approved by the Food and Drug Administration — they made it exceptionally difficult for the drug makers to walk away: They can only do so by withdrawing all their drugs from Medicare, which is the largest drug buyer in the country. They also face an immense excise tax if they fail to negotiate in good faith.

The drug companies say these rules are coercive, trample on their rights to free speech, and are unconstitutional and bad in other ways. But they know their only real option is to hedge their interest by participating in the program and also suing to overturn it, on the chance that at least one judge will see it their way and that the issue will land in our generally business-friendly Supreme Court. Or to put it the other way, to sue to overturn it but also to participate, in case they lose in court.

Merck says that being forced to negotiate its drug prices with Medicare is unconstitutional. But it’s not forced to do anything.

Before going any further into this conflict, a few words about how the negotiation process works.

Medicare’s right to negotiate drug prices with their manufacturers was enacted as part of the Inflation Reduction Act, which President Biden signed in August 2022. The act aims to reduce prescription drug prices in several ways.

It requires drug companies to pay a rebate to Medicare if they raise prices faster than inflation on drugs used by Medicare members. Starting next year, it eliminates the “donut hole” in the Medicare drug benefit, which imposes co-pays on enrollees after their spending reaches a certain level; it also caps their out-of-pocket spending at $2,000 a year starting in 2025. It caps cost-sharing on insulin for Medicare patients at $35 a month.

These provisions are likely to cut spending on prescription drugs for millions of seniors on Medicare.

As for the negotiation program, Medicare was required this year to select 10 branded, non-generic drugs from those on which it spends the most; 30 more drugs will be added to the list in 2025 and 2026, and more in subsequent years.

The companies had until Oct. 1 to signal their participation, with negotiations continuing through next July, with prices to take effect in 2026. The negotiated price will have to be at least a 25% to 60% discount from a drug’s average price on the non-federal market.

The 10 drugs selected in the first round included the blockbuster blood clot drugs Xarelto and Eliquis, which are taken by a total of more than 5 million Medicare enrollees, and diabetes, autoimmune, cancer and cardiac drugs taken by about 4.7 million enrollees. The manufacturers are largely the same names as those appearing as plaintiffs in federal court — very much a Big Pharma aristocracy.

Some of the lawsuits give the impression of throwing everything at the wall in the hopes that something will stick, no matter how implausible. My favorite in this vein is a passage in AstraZeneca’s lawsuit shedding crocodile tears over the impact of the negotiation program on the development of “orphan” drugs. These are drugs aimed at conditions affecting fewer than 200,000 U.S. patients.

Because the markets for these drugs are so small, the company says, drug companies “take on enormous risks in developing new drug products and new indications for existing products” for them. The negotiation program’s regulations “undermine the incentives for manufacturers to take on that risk.”

Izzatso? In the first place, the negotiation program covers a few score drugs costing Medicare the most; almost by definition, orphan drugs probably will never fall into that category.

In the second place, AstraZeneca doesn’t happen to mention the special treatment that orphan drugs receive from the federal government. They get fast-tracked through the Food and Drugs Administration review process, enhanced tax credits for clinical trials, and lengthier exclusivity rights than other drugs. None of those benefits is affected by the Medicare negotiation process.

Then there’s the lawsuit filed Sept. 29 by Novo Nordisk, maker of a family of diabetes drugs on the Medicare negotiation roster. According to its lawsuit, “In recent decades, the federal government has taken control over large segments of the nation’s healthcare markets.”

A prostate cancer drug developed at UCLA with federal funds costs more than three times as much in the U.S. as anywhere else. President Biden could have forced a price cut but didn’t.

The sheer nerviness of this assertion is astounding. All we can say is: Would that it were so, then healthcare in America would be changed infinitely for the better. If Novo Nordisk really wants to know what it’s like in a land where the government takes control of healthcare, it need only look to its home country, Denmark, which provides universal healthcare to citizens and residents for free.

That brings us to the other claims the industry makes in its lawsuits and its PR. In an earlier column, I disposed of the idea that the companies are being coerced into participating in the negotiations. The truth is that manufacturers have every right to refuse. The penalty of a punitive tax only applies to drug companies that sell any drugs to Medicare or Medicaid.

That’s their choice: No one forces Merck to participate in Medicare and Medicaid, as Nicholas Bagley of the University of Michigan law school told me, alluding to Merck’s lawsuit over the program: “Merck doesn’t have a constitutional right to sell its drugs to the government at the price that Merck would prefer.”

The companies uniformly characterize the program in their legal filings as government price-setting, as if the companies are powerless victims of an industrial dictatorship.

The truth is that in the lengthy negotiations, they’ll have every opportunity to make their case for a higher price, by citing their research and development costs, the exceptional value of their product, its uniqueness as a treatment, and so on.

One common claim in the lawsuits is that the negotiations, by reducing the manufacturers’ profits, will sap their interest in innovative research and development, in part because the returns from R&D will become so meager.

This argument is based on the industry’s own estimate that bringing a new drug to market costs more than $1 billion, in part because most drug development projects fail.

That estimate has been challenged for years as immensely inflated. But it remains a key element in the industry’s pushback against the negotiation program.

Eli Lilly’s price cuts on insulin will increase its profits, thanks to America’s bizarre drug pricing system. Don’t mistake its move for philanthropy.

The drug makers got academic support from economist Tomas Philipson of the University of Chicago, a former top economic advisor to President Trump.

Philipson estimated in 2021 that the negotiation proposal and other features of the Inflation Reduction Act would lead to 135 fewer new drugs through 2039 and the loss of more than 330 million life-years for Americans — an average of one year for every man, woman and child, or “about 31 times larger than from COVID-19 to date” (that is, through November 2021).

If that sounds unduly alarmist to you, then you’re on the same page as the Congressional Budget Office, which calculated that the drug-pricing provisions in the Inflation Reduction Act would reduce the number of new drugs brought to market by one in the first decade, four more in the decade after that, and five more in the third decade. Meanwhile, 1,300 new drugs would be introduced over that 30-year span.

Nor does that cover the question of which new drugs might fall by the wayside. The likelihood is that drug makers, if they’re truly feeling pinched by lower profits, would be more discerning about drugs with the least prospects for success and the smallest potential markets. Those with truly superior potential would still make it through the R&D gauntlet.

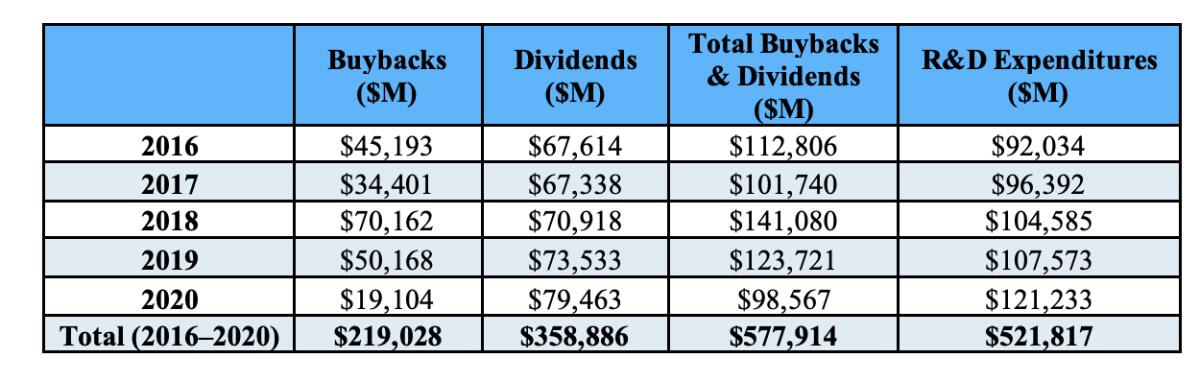

Another issue raised by the drug-pricing initiatives is how drug companies spend the money they have. It doesn’t go mostly, or even largely, to R&D. As the Democratic staff of the House Oversight and Reform Committee reported in December 2021, the largest drug companies spent more on dividends and stock buybacks ($578 billion) than R&D ($522 billion) from 2016 through 2020.

“A significant portion” of the R&D spending, the staff determined, went not to the development of new drugs, but toward efforts to “extend market monopolies, support the companies’ marketing strategies, and suppress competition,” including insignificant “enhancements” of existing drugs aimed at getting a few years more protection against competition from biosimilar products.

In a sense, nothing the drug industry is saying by parading conjectures about the downside of lower drug prices before judges or the public is new. As I reported earlier, industry always claims that every regulatory initiative will hamper innovation and raise consumer costs and harm millions of innocent civilians.

In this case, the public remains fully in favor of lower drug prices, however they come about. Maybe that shows that they’ve finally gotten wise to the PR persiflage of Big Pharma.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.