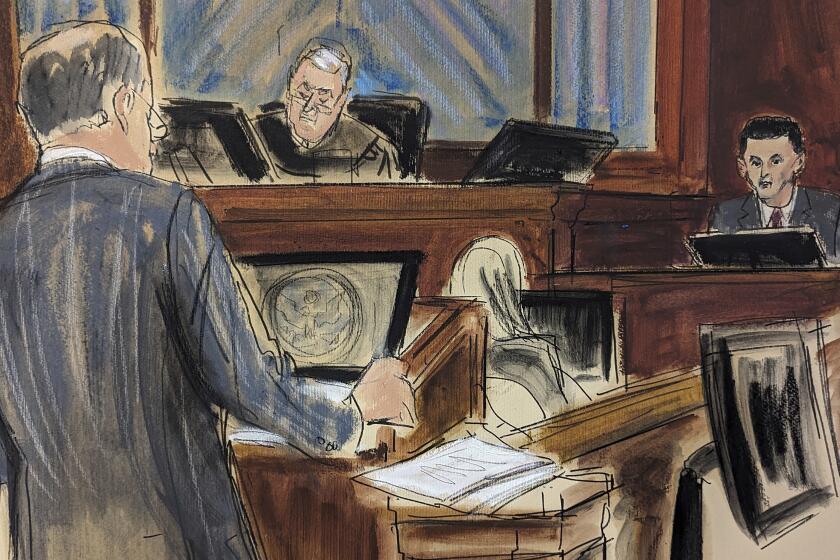

Sam Bankman-Fried struggles on witness stand over questions about FTX’s final days

- Share via

Sam Bankman-Fried, during his last hours on the witness stand, struggled through a withering cross-examination focused on the last days of his FTX crypto exchange.

Assistant U.S. Atty. Danielle Sassoon drilled down on Bankman-Fried’s claims that others were to blame for the failures that led to the collapse of FTX in November 2022 and its affiliated hedge fund, Alameda Research. She pushed the 31-year-old to take responsibility for Alameda’s misuse of customer funds.

“When you claimed you learned in September and October that $8 billion had been spent, what, if anything, did you know about who had spent it?” she asks.

“I don’t remember knowing anything about a particular employee,” he said.

”Did you fire anyone for spending $8 billion of customer deposits?” she asked.

“No,” Bankman-Fried responded.

FTX founder Sam Bankman-Fried has begun testifying at his fraud trial, saying the business he hoped would move cryptocurrency forward did the opposite.

Bankman-Fried concluded his testimony and his defense case shortly before noon Tuesday. Jurors will hear closing arguments Wednesday and probably will begin deliberations this week.

The testimony is crucial to Bankman-Fried’s hopes of avoiding a conviction and decades behind bars. Several former FTX executives, including Caroline Ellison, his former girlfriend and chief executive of Alameda, testified that Bankman-Fried used money that Alameda had borrowed from FTX customer funds to repay lenders and make multibillion-dollar venture investments.

Combative moments

During the more combative moments in cross-examination, when Bankman-Fried danced around questions, jurors appeared to smile and glance at one another.

Sassoon also worked to show that Bankman-Fried hid the risk to customer funds while publicly claiming they were safe.

Bankman-Fried’s lawyer, Mark Cohen, tried to repair the damage from cross-examination, allowing Bankman-Fried to expand on his answers.

“I don’t think there was a clear point or decision at which a person or group of people decided to spend particular dollars,” he said. “There are a lot of things I don’t think I would be able to define about how I would answer that question.”

Prosecutors depict Sam Bankman-Fried as a calculated criminal who used investor deposits at crypto giant FTX as a personal bank account.

Blame was something he “generally deprioritized” as a leader. “I wasn’t particularly interested in trying to dole out blame,” he said.

Sassoon, however, tried to undermine his credibility, seeking to point out that on Monday he said payment processors were not FTX customers, but on Tuesday said they were. The point was important to clarify the special access Alameda had to FTX customer funds.

He replied that he didn’t say it with certainty on Monday.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.