Wall Street ticks closer to record highs to cap its 8th straight winning week

- Share via

Wall Street capped its eighth straight winning week with a quiet finish Friday, following reports showing inflation on the way down and the economy potentially on the way up.

The S&P 500 rose 0.2% to sit less than 1% below its record set nearly two years ago. The Dow Jones industrial average slipped 18 points, or less than 0.1%, and the Nasdaq composite edged 0.2% higher.

Bristol Myers Squibb helped lift the market and rose 2% after it said it will buy Karuna Therapeutics in a cash deal valued at a total of $14 billion. That helped offset an 11.8% slump for Nike, which cut its revenue forecast for its fiscal year and dragged sharply on the Dow. The athletic giant cited weakness in China, the downsides of a stronger U.S. dollar for exporters and other challenges.

But Wall Street’s focus was squarely on a suite of economic reports released Friday, which led to some gyrations in Treasury yields.

Falling yields have been a primary reason the stock market has charged roughly 15% higher since late October. Not only do they boost the economy by encouraging borrowing, they also relax the pressure on the financial system and goose prices for investments. They have been largely dropping on hopes that inflation has cooled enough for the Federal Reserve to cut interest rates in 2024.

The lawsuit is the first of its kind under California’s Fair Chance Act, which went into effect in 2018.

A report on Friday showed the measure of inflation the Federal Reserve prefers to use slowed by more than economists expected, down to 2.6% in November from 2.9% a month earlier. It echoed other inflation reports for November released earlier in the month.

“Inflation has fallen very quickly this year, especially in the last three to five months,” said Niladri “Neel” Mukherjee, chief investment officer of TIAA’s Wealth Management team. Over the next few months, “I think inflation will fade away in terms of top-of-mind items” as risks for financial markets.

Friday’s data also showed that spending by U.S. consumers unexpectedly rose during the month. Although that’s a good sign for growth for an economy driven mainly by consumer spending, it could also indicate underlying pressure remains on inflation.

“People are tightening their belts, but they’re not suffocating their spending,” said Brian Jacobsen, chief economist at Annex Wealth Management.

The Federal Reserve is walking a tightrope, seeking to slow the economy enough through elevated interest rates to cool inflation, but not so much that it tips the nation into recession. Continued strong spending could complicate the balancing act.

Other reports on Friday showed orders for long-lasting manufactured goods strengthened more in November than expected, sales of new homes unexpectedly weakened and sentiment for U.S. consumers improved.

The yield on the 10-year Treasury was at 3.89%, roughly its same level from late Thursday. But it swerved a couple of times following the release of the reports. The 10-year yield is still down comfortably from October, when it was above 5% and putting painful downward pressure on the stock market.

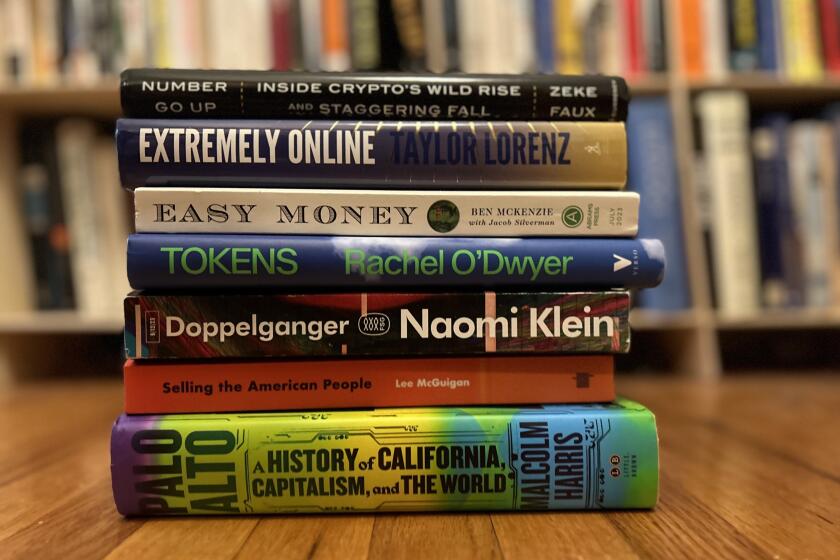

From meditations on AI to investigations of cryptocurrency, this year brought a bumper crop of great books about tech. These are required reading for those who would understand this moment.

Traders are still largely betting the Federal Reserve will cut its main interest rate by at least 1.50 percentage points by the end of next year, according to data from CME Group. The federal funds rate is currently sitting within a range of 5.25% to 5.50% at its highest level in more than two decades.

The Federal Reserve released projections last week showing its typical policymaker expects to cut the federal funds rate several times next year, but probably by only half as much as what Wall Street is expecting.

Critics say Wall Street is too optimistic about how many rate cuts may come in 2024 and when they could begin. They warn the big run for stocks since late October on anticipation of such support may be overdone, or at the least pulling forward returns that would have happened in 2024.

With its eight straight weekly gains, the S&P 500 is in the midst of its longest winning streak since 2017.

Mukherjee of TIAA Wealth Management is relatively optimistic about the U.S. economy in coming years, particularly as artificial-intelligence technology helps reshape the world. But he sees the economy enduring at least a soft patch in the first half of 2024 as the effects of past rate hikes fully make their way through the system.

Plus, he sees the Federal Reserve more hesitant to cut rates than Wall Street expects.

“I think the market has run ahead of itself a little bit in pricing in six rate cuts,” he said. “Inflation is coming down very quickly, but this is a Fed which has been scarred once when they took the view that inflation was transitory back in 2021, and they overstayed their welcome at zero interest rates for longer than anyone thought they would. They want to make sure they’re reasonably comfortable, quite comfortable with inflation somewhere in the vicinity of their target.”

All told, the S&P 500 rose 7.88 points to 4,754.63. The Dow slipped 18.38 to 37,385.97, and the Nasdaq gained 29.11 to 14,992.97.

In stock markets abroad, indexes rose modestly in Europe following a mixed finish in Asia.

Rite Aid has been banned from using facial recognition technology for five years over allegations that its surveillance system incorrectly identified potential shoplifters, especially Black, Latino, Asian or female shoppers.

Hong Kong’s Hang Seng dropped 1.7% after China released new regulations for online gaming. That sent stocks of Tencent, China’s largest gaming company, and rival NetEase down sharply.

AP writer Elaine Kurtenbach contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.