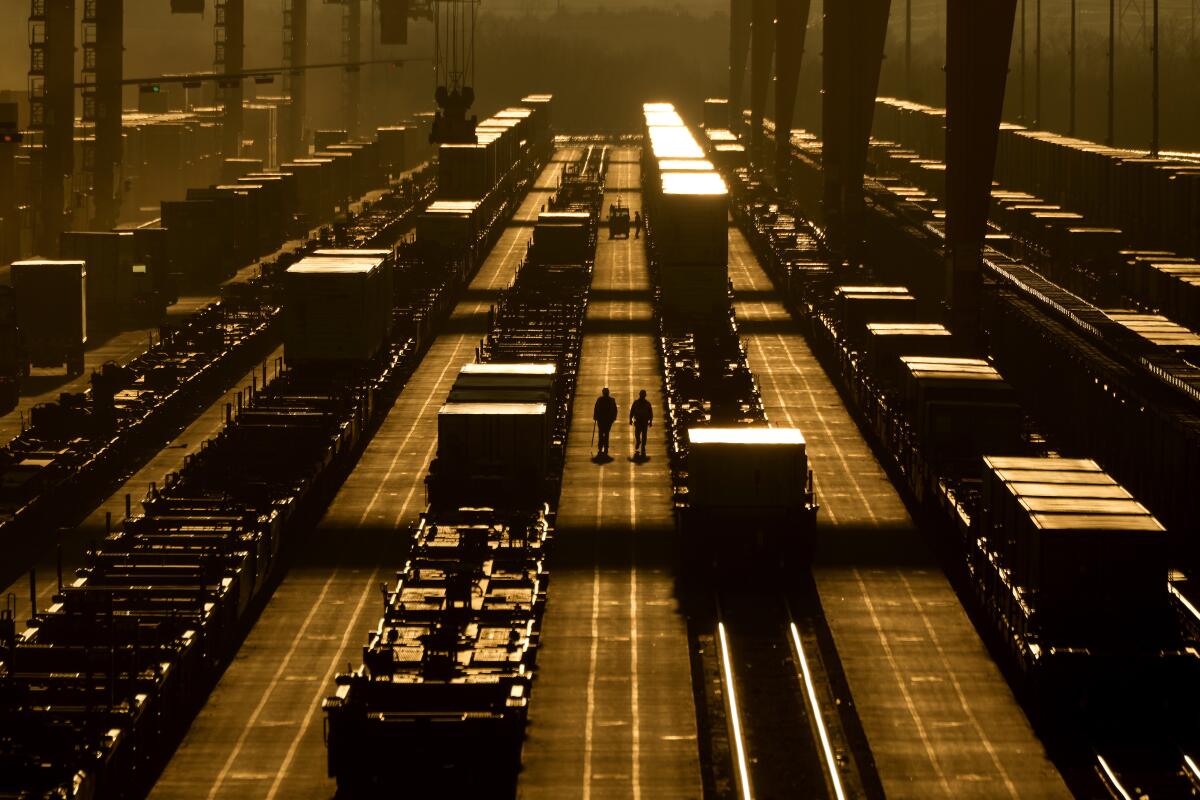

U.S. employers add a surprisingly strong 216,000 jobs in a sign of continued economic strength

- Share via

The nation’s employers added a robust 216,000 jobs last month, the latest sign that the American job market remains resilient even in the face of sharply higher interest rates.

Friday’s report from the Labor Department showed that December’s job gain exceeded the 173,000 that were added in November. The unemployment rate was unchanged at 3.7% — the 23rd straight month that joblessness has remained below 4%.

Some details of the report, though, may disappoint the inflation fighters at the Federal Reserve, who might now be inclined to delay any cuts in their benchmark interest rate. Average hourly wages rose 4.1% from a year earlier, up from a 4% gain in November, which could make it harder for the Fed to slow inflation back to its 2% target.

And the proportion of people who either have a job or are looking for one fell to 62.5%, the lowest level since February. The Fed prefers having more people in the labor force to help ease pressure on companies to sharply boost pay to attract or retain workers and to then pass those high labor costs on to consumers by raising prices.

Despite the low unemployment and cooling inflation, polls show that many Americans are dissatisfied with the economy. That disconnect, which will likely be an issue in the 2024 elections, has puzzled economists and political analysts.

New research seems to support the idea that working from home leads to less productivity. But are employers measuring remote work results by the right metrics?

A key factor, though, is the public’s exasperation with higher prices. Though inflation has been falling more or less steadily for a year and a half, prices are still 17% higher than they were before the inflation surge began.

Friday’s jobs report, while reflecting steady hiring gains, did include some cautionary notes. Paul Ashworth, chief North America economist at Capital Economics, suggested that it “was not quite as good as it looks at first glance.’’

Ashworth noted that the government revised down its previous estimate of job gains for October and November by a combined 71,000. And he noted that, just as in November, December’s job growth was concentrated in just a few industries: Leisure and hospitality companies added 40,000, healthcare 38,000 and governments 52,000. Ashworth also noted that temporary jobs, which are often seen as a sign of where hiring is headed, dropped by 33,000.

Fed Chair Jerome Powell warned of hard times ahead after the central bank began jacking up interest rates in the spring of 2022 to attack high inflation. Most economists predicted that the much higher borrowing costs that resulted would cause a recession, with layoffs and rising unemployment, in 2023.

Yet the recession never arrived, and none appears to be on the horizon. The nation’s labor market is still cranking out enough jobs to keep the unemployment rate near historic lows. For all of 2023, employers added 2.7 million jobs, a healthy gain but down from 4.8 million jobs added in 2022.

A surprising study shows most workers like working remotely some days but would prefer to be in the office more often than they are.

The resilience of the job market has been matched by the durability of the overall economy. Far from collapsing into a recession, the U.S. gross domestic product — the total output of goods and services — grew at a vigorous 4.9% annual pace from July through September. Strong consumer spending and business investment drove much of the expansion.

At the same time, average hourly pay has outpaced inflation over the last year, leaving Americans with more money to spend. Indeed, as they did for much of 2023, consumers, a huge engine for U.S. economic growth, hit the stores in November, shopped online, went out to restaurants or traveled.

Since March 2022, the Fed has raised its benchmark interest rate 11 times, lifting it to a 22-year high of about 5.4%. Those higher rates have made borrowing costlier for companies and households, but they are on their way toward achieving their goal: conquering inflation.

Consumer prices were up 3.1% in November from a year earlier, down drastically from a four-decade high 9.1% in June 2022. The Fed is satisfied enough with the progress so far that it hasn’t raised rates since July and has signaled that it expects to make three rate cuts this year.

But Friday’s robust jobs and wage figures could lead the Fed to push back the start of any interest rate cuts if it decides that inflation will take longer to tame.

Many people of color found remote work lessens the racism they face on the job. Now they must decide: Is it worth trying to never return to the office again?

“Today’s report speaks to the bumpy road ahead for the Fed’s journey back to 2% inflation,″ said Andrew Patterson, senior international economist at Vanguard.

Patterson suggested that the Fed might have to wait for the second half of the year to start cutting rates. Many investors had anticipated cuts sooner than that.

Beyond a hard hit to the housing market, higher rates haven’t exerted much damage across the broader economy. Many industry sectors, including healthcare and government, have proved relatively resistant to higher interest rates.

The labor market’s cool-down has been nowhere near enough to signal that a recession is on the way. Normally, slowing job growth might be a cause for concern. But under the current circumstances, with inflation still above the Fed’s 2% annual target, a more moderate pace of hiring is seen as just what the economy needs.

Lower demand for workers tends to ease the pressure on employers to raise pay to keep or attract workers and to pass on their higher labor costs to customers by raising prices.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.