California lawmakers approve $262.6-billion operating budget. What’s in it?

- Share via

SACRAMENTO — In some ways, the new spending plan approved by the California Legislature on Monday is about going backward: back to a time before the pandemic, when California’s roaring economy fueled budget surpluses.

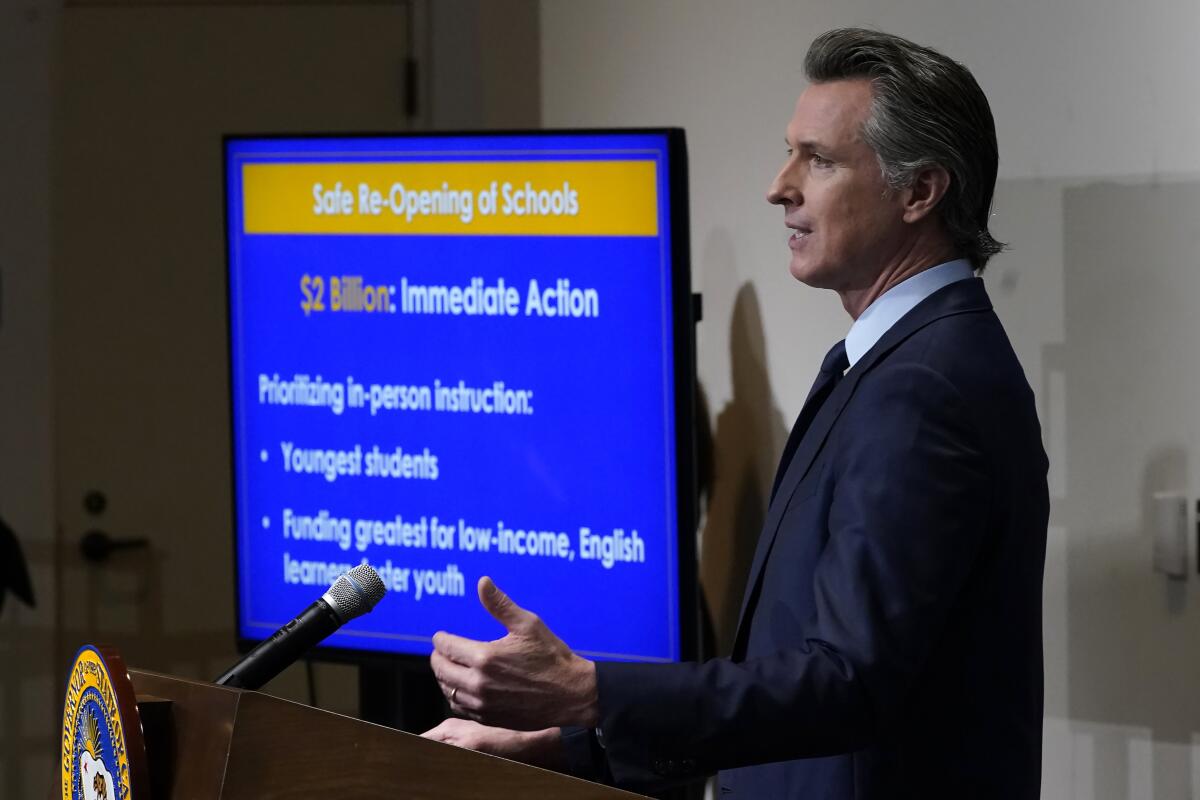

The $262.6-billion proposal on its way to Gov. Gavin Newsom’s desk would restore spending cuts to public schools, colleges and universities, the courts, child support services and state worker salaries — all things that were cut last year when state officials thought they were facing a record budget deficit because of the coronavirus.

Instead, state revenues soared by more than 27%, the biggest year-over-year increase in more than four decades. That includes roughly $100 billion in new money, both from a state surplus and coronavirus aid from the federal government. It’s so much money that the state plans to give rebates of up to $1,100 to more than 15 million households while also pledging to pay for every 4-year-old to go to kindergarten for free and guaranteeing government-funded health coverage for low-income immigrants 50 and older living in the country illegally.

“This budget does not get us back to normal, as that was not our intent,” said state Assemblyman Joaquin Arambula, a Democrat from Fresno. “Instead, it gets us to a better place by making transformative change for Californians.”

Democrats in charge of the state Legislature would have spent even more money over time, but Newsom — who will face a recall election later this year — persuaded them to adopt a more cautious approach that relies more on one-time spending instead of multiyear commitments.

To get shots into arms, California funneled outreach to advertising firms and tech companies, instead of direct interactions with holdouts.

That means the state won’t spend $200 million this year to hire more people in local public health departments in the aftermath of the pandemic. Instead, the Newsom administration committed to spend $300 million next year. It said the money wasn’t needed this year, in part, because the federal government is giving California $1.8 billion for public health, with most of that going for vaccines and coronavirus testing.

Still, there was some grumbling among Democrats about missing the chance to bolster local public health departments, many of which were overwhelmed by the pandemic. State Sen. Richard Pan, a pediatrician and Democrat from Sacramento, said he wanted the Newsom administration to do more than simply “spend the whole year doing planning.”

“We already know from the pandemic some of our weaknesses,” he said.

Republicans, meanwhile, grumbled about a tax increase on businesses with 500 or more employees. The hike would more than double an environmental fee that primarily goes into two funds to pay for cleaning up hazardous waste sites throughout the state.

The budget eliminates the fee for businesses with fewer than 100 employees and keeps it the same for those 100 to 499 workers.

State Sen. Shannon Grove, a Republican from Bakersfield, said the tax increase will discourage companies from hiring more people for fear of growing too large and having to pay a much bigger fee.

“Why do we punish employers for hiring people?” she said.

UCLA, UC Berkeley and UC San Diego would decrease their share of out-of-state and international students and enroll more local residents under an amended state budget bill posted online Friday.

The tax increase required a two-thirds vote from the Legislature, a task made easier by Democrats controlling enough seats that they don’t need Republican votes. Assemblywoman Cristina Garcia, a Democrat from Bell Gardens, said large employers were part of the negotiations on the bill and agreed to pay the higher tax “because they understand that for a long time they have not been paying their fair share.”

“Not paying their fair share means communities like mine get treated like we’re a wasteland and like we’re disposable and it’s OK to let us be sicker,” said Garcia, who represents communities contaminated with lead from a nearby battery plant.

The budget also pledges more than $276 million to help the Employment Development Department more quickly work through its backlog of unemployment claims, currently affecting more than 230,000 people.

In the past year, California has paid $153 billion in unemployment benefits, including billions of fraudulent payments to prison inmates and others who were not eligible. The state quickly ran out of money to pay benefits and had to take out a loan form the federal government to pay the rest.

The state’s debt is approaching $24 billion, all which must be paid back to the federal government with interest. But the budget does not include any money to begin paying off the debt.

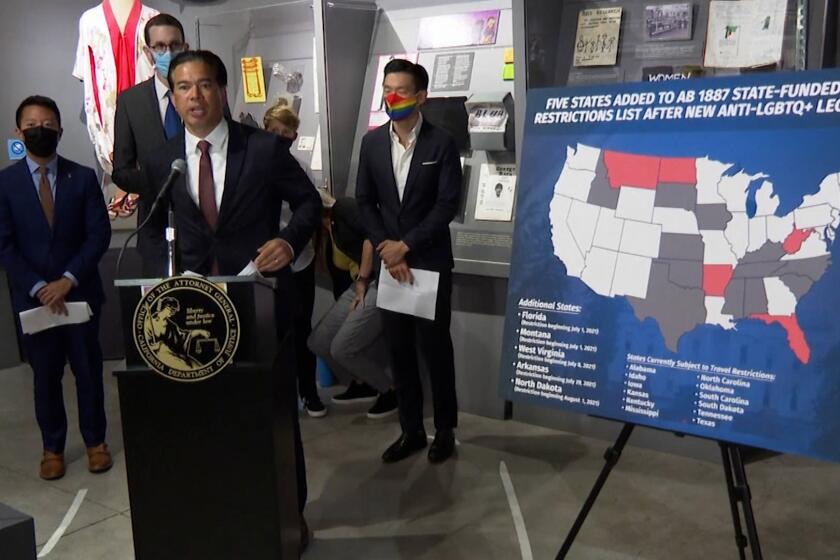

The new states added to the sanctions list are Florida, Montana, West Virginia, Arkansas and North Dakota, according to California Atty. General Rob Bonta.

The federal government has forgiven the state’s interest payments through September, and the Newsom administration hopes it will forgive more in the future. But it took the state seven years to pay off a much smaller loan after the Great Recession more than a decade ago. The Legislative Analyst’s Office estimates interest payments on this current debt could cost the state between $2.5 billion and $5 billion over the next decade.

“I don’t understand how $2.5 to $5 billion isn’t a priority to this administration,” said Assemblywoman Suzette Martinez Valladares, a Republican from Santa Clarita.

Erika Li, chief deputy for the California Department of Finance, said the debt “is a priority for this administration.”

“It is something we are working on and will continue to work on,” she said.

Here’s a look at what’s in the budget:

CASH FOR BUSINESSES AND MOST TAXPAYERS

The budget includes $8.1 billion in rebates for most taxpayers. The amount depends on income, children and how taxes have been filed.

Adults with children who earn $30,000 a year or less will get $500. That’s in addition to the $600 checks they got earlier this year, for a total of $1,100.

Adults who earn between $30,000 and $75,000 will get $600 if they don’t have children and $1,100 if they do.

People who file their taxes using a taxpayer identification number — mostly immigrants — get more. Adults with children earning $30,000 or less will get $1,000. Adults with children who earn between $30,000 and $75,000 will get $1,000. Immigrants who are not citizens get more money because they were excluded from federal pandemic relief checks.

The budget also includes $1.5 billion in grants for small businesses harmed by the pandemic — money they don’t have to pay back.

UNIVERSAL 4-YEAR-OLD KINDERGARTEN

The budget provides ongoing funding to expand the state’s two-year kindergarten program to include all 4-year-olds for free. The program would phase in the expansion to everyone by the 2025-26 school year at a cost of $2.7 billion per year. Right now, about 91,000 4-year-olds are enrolled in “transitional kindergarten.” This proposal would boost that to about 250,000 children.

MORE MONEY FOR HOMELESS SERVICES

The spending plan commits $12 billion for homelessness programs over the next two years. That includes $1 billion for local governments — a rare multi-year commitment from the state to pay for local homelessness programs.

Cox offers few details on how he would accomplish his goal of cutting homelessness in half over the next decade.

ELIMINATING PANDEMIC CUTS

Last year, lawmakers passed a number of spending cuts because they thought they were facing a $54.3-billion budget shortfall caused by the pandemic. That shortfall never happened. This budget restores those cuts. Most state workers will get their salaries restored, plus raises. The court system, public schools, and public colleges and universities all get their funding restored.

EXPANDING MEDICAID

The budget would pay the healthcare costs for low-income immigrants who are 50 and older and living in the country illegally by making them eligible for Medicaid. It would eventually cost $1.3 billion per year when fully implemented. The budget also eliminates a rule that makes more people 65 and older eligible for Medicaid.

MONEY FOR MORE COLLEGE STUDENTS

The budget includes $155 million to make more people eligible for Cal Grants — money to help students pay for college that they don’t have to pay back. This money will help students who are older and have been out of high school longer qualify for these grants.

MORE IN-STATE STUDENTS AT CALIFORNIA COLLEGES

The budget requires three of the state’s most popular public universities to admit more in-state students. Under the plan, UCLA, UC Berkeley and UC San Diego would replace 900 out-of-state students with California students each year. Out-of-state students pay more tuition, so the state would pay those schools $184 million over the next three years.

FREE SCHOOL LUNCH

The budget includes $54 million this year and $650 million in future years to pay for free breakfast and lunch for all public school students.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.