L.A. County wants to buy — and forgive — your medical debt. Here’s how that would work

- Share via

Saddled with medical debt? L.A. County is looking to take it off your hands.

The county government on Tuesday became the latest municipality to consider wiping out residents’ long-lingering medical bills by buying up the debt at a steep discount. The Board of Supervisors unanimously voted to ask county executives to explore purchasing and forgiving the more than $2 billion constituents owe in unpaid medical expenses.

Supervisor Janice Hahn, who brought the motion along with Supervisor Holly Mitchell, said she believed the county could erase the debt for pennies on the dollar.

“If L.A. County stepped in and bought out our residents’ medical debt for them, we could eliminate their debt for millions of dollars, not billions,” Hahn said.

About 20% of U.S. households are grappling with some form of medical debt. Federal officials are fashioning a rule to keep it out of credit reports.

The vote follows a county report released in June that found 810,000 county residents — roughly 1 in 10 adults— have outstanding medical debt. A disproportionate percentage were Black and Latino.

The bills were often incurred during some unexpected, unbudgeted-for event — emergency room trips or an overnight hospital stay. Residents with these unpaid bills were more likely to go hungry, struggle to keep their housing and skip their medication, according to the report. Nearly half of those surveyed said the bills stopped them from buying basic necessities.

According to the report, county residents had racked up more than $2.6 billion in medical debt as of 2021, the most recent year for which data were available. To buy $2 billion of it, the Department of Public Health estimates officials would need to spend $24 million.

When hospitals can’t collect on unpaid bills, they will sometimes bundle the debt and sell it at a steep discount to a collection agency. (The older the debt, the greater the discount.) These agencies will then try and collect the face-value amount from the debtor and pocket the profit.

A growing number of local governments are trying to subvert that model. They buy the debt. And rather than try and claw back the payment for profit, they forgive it.

In the last year, residents in a handful of cities across the U.S. have opened the mailbox to find a letter informing them their debt has been erased.

Cook County, Ill., started the trend in the summer of 2022, announcing a plan to wipe out $1 billion in medical bills. Since then, at least 30 cities, counties and states have expressed interest in doing the same, according to RIP Medical Debt, a nonprofit that has contracted with governments including Cook County to help them find and forgive mass amounts of debt.

Daniel Lempert, a spokesperson for the organization, said Cook County and the cities of Toledo, New Orleans and Cleveland are the farthest along.

L.A. County residents are still a long way off from seeing their unpaid medical bills disappear. The county has asked for a report in three months, looking at how debt forgiveness would work in the region and exploring what funding streams they can tap.

The motion also asks for new rules that would require local hospitals share information about their debt-collection policies and available financial assistance.

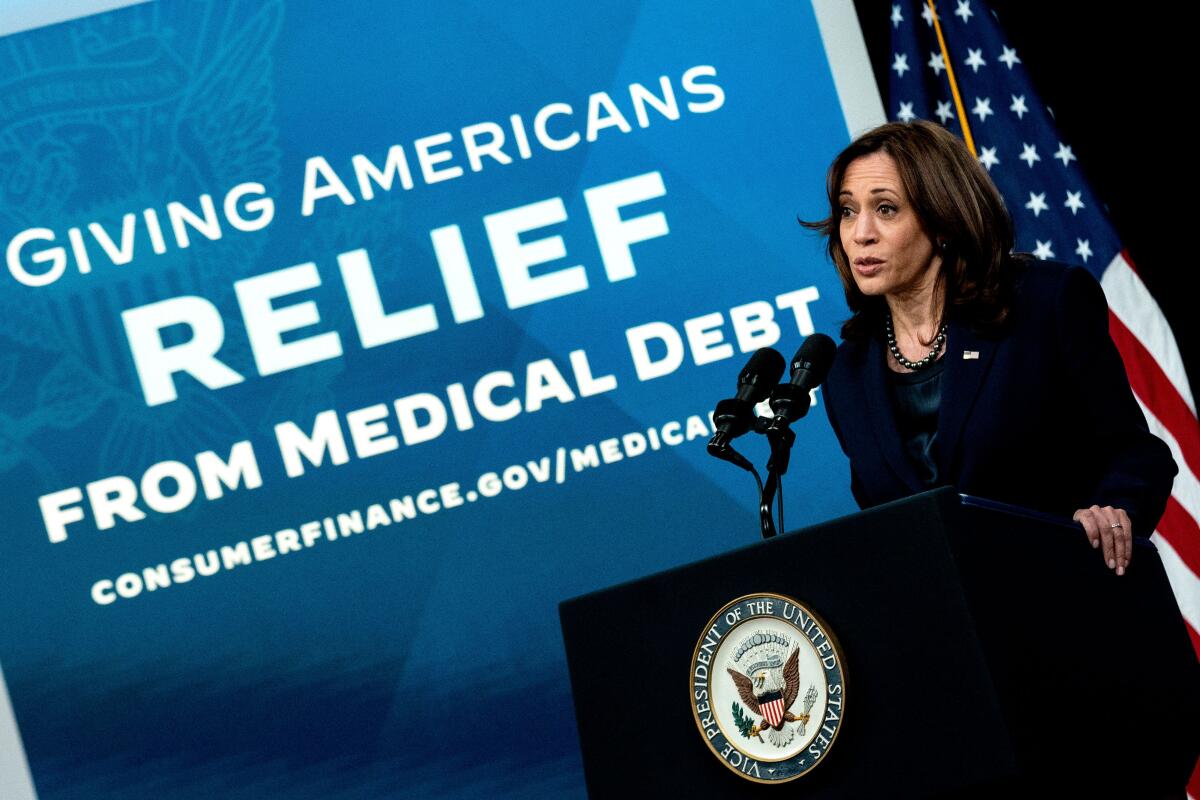

Other municipalities looking at forgiving medical debt have used federal money from the American Rescue Plan. As of February this year, $16 million in these funds has wiped $1.5 billion in medical debt, according to a release from the White House.

Lempert, with RIP Medical Debt, said the organization typically buys debt from a wide variety of places — hospitals, physician groups, ambulance groups, debt collectors. On average, he said, $1 can wipe roughly $100 of medical debt.

That’s roughly the rate the county appears to have in mind in estimating it will cost roughly $24 million to erase $2 billion.

Three U.S. agencies are looking into whether medical credit cards can harm consumers with features such as exorbitant deferred interest fees.

It may sound like an obvious bargain.

But Wesley Yin, professor of public policy and management at the UCLA Luskin School of Public Affairs, said such a low price suggests the government would be focusing on the cheapest debt — the kind of years-old medical bills that most people have long-forgotten about.

“It might not impact people’s financial situations that much anymore at this point,” said Yin, who has studied the impact of wiping out medical debt. “And so there’s reasons to think that abolishing really old medical debt may not be as consequential as we would think.”

Yin said patients would see a greater benefit to their bottom lines if governments bought the debt directly from the hospital early on when patients are still working to pay it off — though this would be a much more expensive undertaking for the county.

He said solutions that would get the bills paid quicker, such as hospital financial assistance programs and health insurance expansions, may be more effective.

“I’m not saying that abolishment isn’t good,” he said. “I’m saying that it can’t be what we’re doing alone.”

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.