The Wide Shot: The producer taking TikTok storytelling to Hollywood

- Share via

One can easily picture every short-form streaming video entrepreneur going into investor meetings with essentially the same pitch: “We are so not Quibi.”

The reasons for Quibi’s spectacular flame-out last year have been thoroughly analyzed. It overspent; it misread what people wanted from short video; it asked users to pay too much for what they could get for free on YouTube and TikTok; it didn’t listen to the audience.

Thirty-nine-year-old entrepreneur Prerna Gupta is trying to avoid those mistakes with her mobile reading and short-form video app company Hooked, which has an unusual and intriguing strategy for catering to the Gen Z audience.

The former Oklahoman and her husband, Parag Chordia, launched Hooked in 2015 with a mission to discover the next “Harry Potter” by testing stories with millions of users on its reading platform. Now they’re taking their best material and adapting it into short-form series and films tailored to a generation that has grown up bingeing videos on TikTok and Snapchat.

Last year, the company launched an app called Hooked TV to showcase video pilots based on scripts it managed to test and develop before and during the COVID-19 pandemic. A full Hooked streaming platform is expected to debut in the second half of this year with 12 original series, culled from 50 pilots tested through the app and on social media. Many of the videos are just a few minutes long, but others go up to 20 minutes.

“Our goal was always to be able to test scripts,” Gupta said. “The premise was that if we can build an audience for a script in written form, then by the time we’re investing money to produce it, we’ll have a much better idea if it will be a hit.”

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

An illustrative example is Hooked’s sci-fi short “Starling,” which the company released in October on TikTok in 10 snippets of about a minute each. The series centers on a teen girl who mysteriously starts to lose her teeth and eventually discovers special powers; the filmmaking style matches the medium: Much of the first episode is told through a video-chat conversation between the main character and her mom. “Starling” went viral, garnering 27 million views on TikTok.

The pacing of the series is fitting for TikTok. Which is to say, dizzying. Some might say frantic. That’s by design. To build an audience on TikTok amid infinite online distractions, creators have to seize their viewers’ attention, 15 gripping seconds at a time, Gupta said.

“A minute is an eternity in TikTok land,” she said. “You have two seconds to grab their attention. You have another eight to keep their attention.... They’ll stick around for the 20-minute episode. It’s not that they won’t give you their time, it’s just that you have to keep fighting for their time during that entire 20 minutes.”

When I spoke with Gupta in 2016, her company had just started to test its core idea: evaluating film scripts by letting users read them in an experimental teen-friendly texting format.

In Hooked’s reading app, readers witnessed the action of the story play out as if they were privy to an I.M. conversation between the characters (e.g., a reader follows a story about a kidnapping by reading texts between a young woman locked in the trunk of a car and a friend). The company analyzed data including completion rates to see whether the stories’ cliffhangers were working.

Anyone who says they have a data-driven method of predicting hits should prepare to get eye rolls from creators and dealmakers in traditional entertainment. But Hooked counts some major investors from the traditional media space, including the Chernin Group, WME Ventures, Charles D. King’s Macro, Ashton Kutcher’s Sound Ventures and Greg Silverman, founder of Stampede Ventures. The company has raised $15 million to date from investors, including VC funds and celebrities like Steph Curry, LeBron James and Jamie Foxx.

“Hooked is a testament to the success that comes when you really listen to your audience,” said Silverman, a former top Warner Bros. executive.

TikTok, with 100 million reported users in the U.S., has inspired new forms of videomaking from creators who now have an opportunity to reach a massive audience with just their phones. Multiple copycats have sprung up. Snap Inc. and Instagram have launched their own TikTok competitors, following on the explosion in popularity for the Chinese-owned social media company. Aspiring filmmakers have used the platform to hone their techniques and build large followings. Users such as @lastmanstanley are among those who have become viral sensations with cinematic videos on the platform.

But few companies have tried to do professional-looking narrative productions for TikTok, because the monetization just isn’t there. Success in super short-form video has been elusive for Hollywood beyond the realm of branded content. The medium doesn’t naturally lend itself to traditional business models like subscriptions. Putting unskippable ads on five-minute Snap Original episodes makes for an awkward viewing experience, as a Vulture article noted last year.

Gupta says that’s not a problem for her company, which sees TikTok as part of a broader plan to build an audience while it develops the business model for Hooked TV. That could be a subscription, said Gupta, though she added that after the Quibi debacle, it’s not clear that that’s the right path. In its testing phase, Hooked TV has been charging $4.99 a week after a seven-day trial, prompting some confusion in the app stores from users looking for the reading platform.

For now, the company plans to continue licensing series to platforms like Snapchat. The series “First Time’s a Charm,” based on the Hooked text story “Trevor and the Virgin,” was recently picked up and ran as a Snap Original.

Besides, the content Gupta is making is low-budget and usually filmed by folks just starting out in the business. Hooked found the lead actress for “Starling,” influencer Tatyana Joseph, by scouring TikTok profiles, for example.

“It’s out of necessity,” Gupta said. “No one’s going to give me $2 billion to launch my own streaming service.”

Ari strikes again?

Penske-owned sports business publication Sportico scooped that UFC and WME parent Endeavor Holdings is going back to the IPO ring, reporting that the Beverly Hills company had filed confidential paperwork to go public.

As Stacy Perman noted in her story, Chief Executive Ari Emanuel and Executive Chairman Patrick Whitesell tried to take their talent-sports-content conglomerate public in 2019, but pulled back because the IPO market had basically become a woodchipper for new listings.

Round 2 comes after the pandemic fueled speculation that Endeavor was coming under increasing financial pressure. Also during the COVID-19 crisis, the Writers Guild extracted an agreement from Endeavor to divest its stake in production company Endeavor Content to 20% or less and to end packaging fees — it will be interesting to see how those developments factor into investors’ appetite.

L.A. box office returns

How important is the return of movie theaters in Los Angeles? Over the weekend, the L.A. metropolitan area accounted for 9% of U.S. ticket sales as indoor cinemas came to life for the first time in a year at 25% capacity. Twelve of the nation’s top 20 theaters by grosses were in the Los Angeles area, led by AMC in Burbank (where “Tenet” director Christopher Nolan was among the first in line). Distributors are hoping that capacity restrictions will relax by the time big Hollywood movies are supposed to start hitting theaters. “Black Widow” is still planned for May 7.

Production tracker

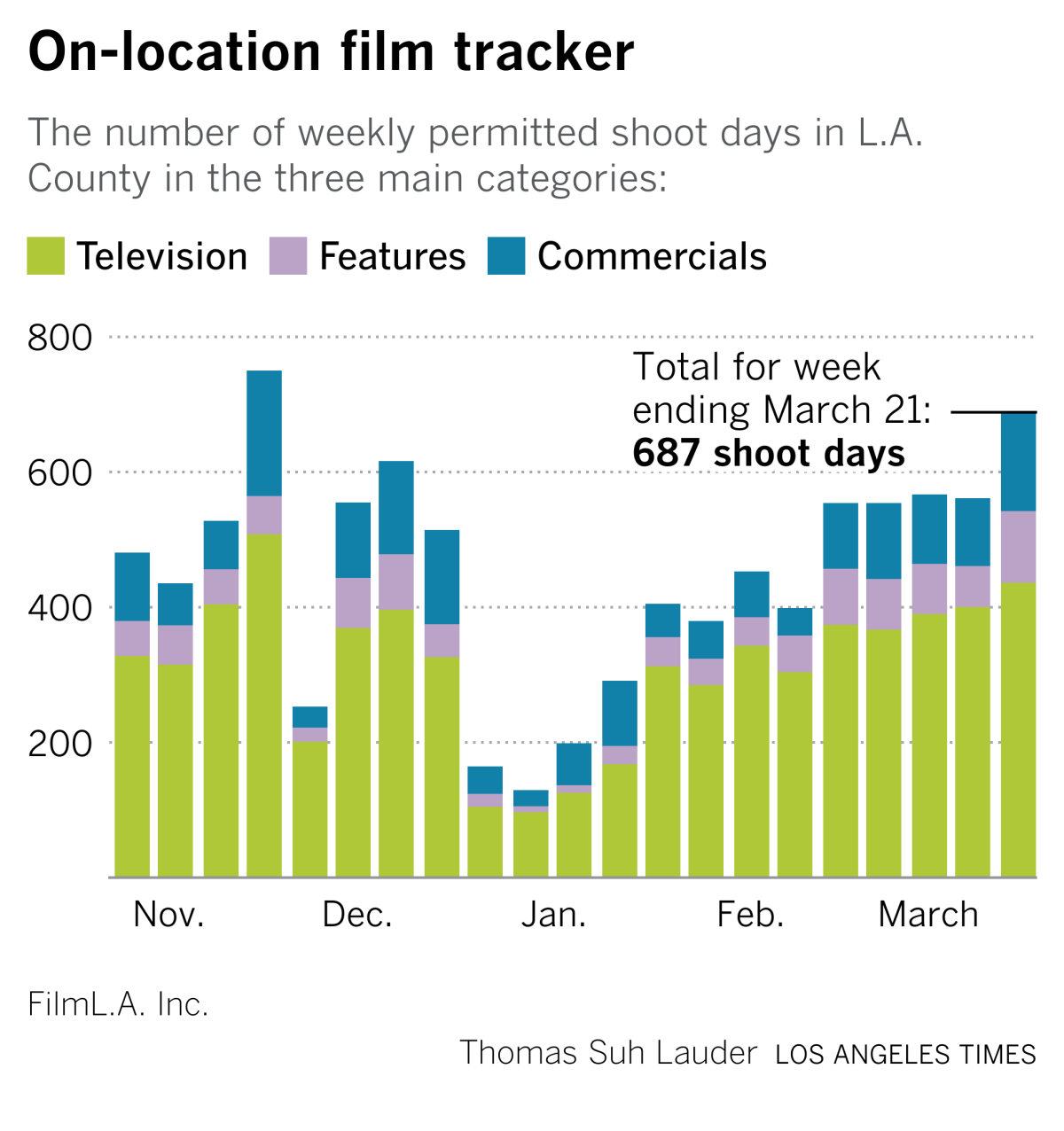

Shoot days in Los Angeles jumped 22% last week as Hollywood continued to reopen amid the rollout of COVID-19 vaccines, according to data from FilmLA. Gains were seen in all three main categories — film, television and commercials.

Number of the week

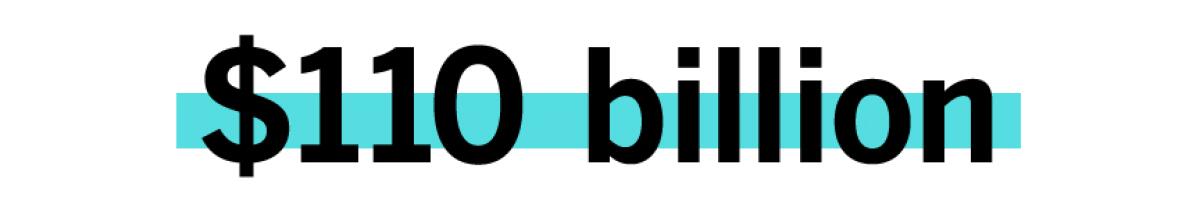

Reading about the NFL television rights last week was arguably more interesting than actually watching last month’s Super Bowl. In the end, the league secured TV rights deals with multiple media companies worth roughly $10 billion a year over 11 years.

The broadcast nets and ESPN will see their payments nearly double to around $9 billion a year, wrote Stephen Battaglio. Amazon will pay around $1.5 billion a year to stream Thursday night games exclusively. Notably, the NFL’s Sunday Ticket package of out-of-market games, currently held by DirecTV, is still up for grabs, and it could land at streaming service ESPN+.

There are various winners and losers here. One clear victor is the NFL, which holds the biggest bargaining chip in television because of football’s persistent popularity in a world of declining linear ratings. Other winners are Disney and ESPN, which will pay $2.7 billion a year but will also get two Super Bowls.

The main loser is the cable bundle (again), because the deals allow the media companies to stream more games on their streaming platforms, including Fox Corp.’s Tubi, NBCUniversal’s Peacock, ViacomCBS’ Paramount+ and Disney’s ESPN+. Amazon’s Thursday night games were money losers for the networks, but it’s probably a win for growing Prime Video.

So that snipping sound you’re hearing? It’s more people cutting the cable cord.

Non-number of the week: Disney said Monday that “The Falcon and the Winter Soldier” was the “most watched series for its opening weekend on Disney+,” without disclosing real figures. That’s not real data, per se, but if “Falcon” was bigger than the premieres of “The Mandalorian” and “WandaVision,” it must have been pretty big, and it also reflects the growth of Disney+.

Stuff we wrote

— Josh Rottenberg and Stacy Perman’s latest follow-up on the Golden Globes: “As HFPA struggles to respond to mounting PR crisis, Hollywood keeps the pressure on.” It was a busy week for the Hollywood Foreign Press Assn.’s damage control efforts, after more than 100 Hollywood publicists warned the 87-member group that they would cut the embattled organization off if it does not take significant steps toward reform. The nonprofit committed to expand membership by adding at least 13 Black members by next year.

— L.A. goth nightclub Cloak & Dagger, known for its rituals and secrecy, has closed amid sexual misconduct claims, reports August Brown.

— Remember when Warner Bros. offered to fund a $100-million aerial tramway from Burbank to the Hollywood sign? Well, never mind about that.

— A gender pay lawsuit against Walt Disney has been expanded to include pay secrecy claims, reports Anousha Sakoui.

— A streaming milestone! Global subscriptions passed 1 billion for the first time in 2020, according to the Motion Picture Assn. Look at this chart showing the share of consumer entertainment spending that was taken up by digital last year.

#ReleasetheWiderCut

I’m not really the intended audience for the four-hour Zack Snyder-directed “Justice League” that debuted on HBO Max last week, but a lot of people got a kick out of this:

The boxier format looks a little weird on a wide-screen TV, but “whatever Snyder wants” was kind of the point of the fan movement to make this happen in the first place.

More important, it looks like the fans generally got what they wanted from their #ReleasetheSnyderCut campaign. Now, of course, they want more. Variety asked WarnerMedia studios and networks chief Ann Sarnoff whether the company will go further into the Snyder-verse with more movies. TL;DR version: doesn’t look like it.

More top stories

— Everyone has a Substack, or at least a Substack competitor. Axios reports that Facebook “will soon begin testing partnerships with a small group of independent writers for its new publishing platform.” This follows Twitter’s move to allow users to charge followers for bonus content.

— CBS looks for growth abroad with the help of David Hasselhoff. The broadcaster’s production arm is venturing into foreign-language programming with German spy show “Ze Network.” (WSJ)

— How Epic Games is creating a new medium of storytelling through Fortnite. (The Verge)

— New DAZN Chair Kevin Mayer gets honest with CNBC about being passed over for the Disney CEO job and leaving TikTok.

— Wow, the internet loves talking about the NFTs (nonfungible tokens) that have taken over the art world. Now Ja Rule, of Fyre Festival fame, is getting into the mix. (The Art Newspaper)

Finally ... a classical outro

Vice Media’s music vertical Noisey posits a positive cultural side effect of our work-from-home lifestyle: Classical music isn’t just for stuffy snobs anymore. Hey, we all need to chill out somehow. It also published some solid introductory playlists distinguishing the Baroque period, Classical period and the somewhat more emo Romantic era. For a deep dive, read Times classical music critic Mark Swed’s “How to Listen” series, designed for newbies and aficionados alike.

BONUS TRACK: Los Angeles-based guitarist Mateus Asato shreds over Daft Punk.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.